As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

European Drought Impacting Production, Potential Opportunities for U.S. Farmers

Reuters writer Gus Trompiz reported on Wednesday that, “European farmers are counting the cost of a summer heatwave that has shrunk cereal harvests and shriveled pastures, leaving some farms struggling to survive and shutting the EU out of lucrative export markets.

“The severe weather in Europe has coincided with adverse growing conditions in other major grain producing zones such as Russia and Australia, raising the risk that supplies in exporting countries will be eroded to their smallest in years.

“The latest harvest estimates have underlined the impact of drought and heatwaves in northern Europe.

Germany’s farmers’ association DBV on Wednesday forecast a 22 percent plunge in grain production this year in the European Union’s second-largest cereal grower.

Mr. Trompiz explained, “A sharp drop in the EU’s wheat harvest will also limit exports from the bloc, adding to nervousness about global supply given weather issues elsewhere, including in top wheat exporter Russia.

“Consultancy Agritel on Wednesday said it projected EU wheat exports, including durum, to fall to a seven-year low of around 21 million tonnes in 2018/19 as the bloc was set to see all-wheat production drop by some 15 million tonnes from last year.”

The Reuters article added, “Analysts see the onus on the United States to make up for reduced availabilities in other exporting countries, given relatively high U.S. stocks, and to a lesser extent Argentina after a successful sowing campaign there.”

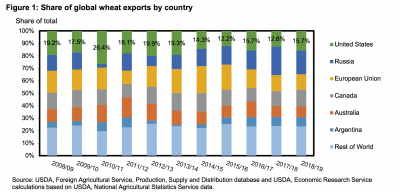

And this month’s Wheat Outlook report from USDA’s Economic Research Service stated that, “Global 2018/19 wheat production is cut 6.6 million metric tons this month on a sharp decline in production in the European Union (EU). This opens further opportunities for U.S. exports, especially in the second half of the marketing year. The U.S. 2018/19 export forecast is lifted 50 million bushels from the July forecast to 1,025 million. Based on the revised export forecast, the U.S. share of global wheat exports is forecast at nearly 16 percent in 2018/19, compared to 12.6 percent for the 2017/18 marketing year.”

More broadly, Reuters writer Nigel Hunt reported on Wednesday that, “A scorching hot, dry summer has ended five years of plenty in many wheat producing countries and drawn down the reserves of major exporters to their lowest level since 2007/08, when low grain stocks contributed to food riots across Africa and Asia.

“Although global stocks are expected to hit an all-time high of 273 million tonnes at the start of the 2018/19 grain marketing season, according to U.S. Department of Agriculture estimates, the problem is nearly half of it is in China, which is not likely to release any onto global markets.

“Experts predict that by the end of the season, the eight major exporters will be left with 20 percent of world stocks – just 26 days of cover – down from one-third a decade ago.”

The article stated,

The USDA estimates that China, which consumes 16 percent of the world’s wheat, will hold 46 percent of its stocks at the beginning of the season, which starts around now, and more than half by the end.

Wednesday’s article added, “The United States is best placed to capitalize on a shortfall in global supply, with much higher stocks than rival exporters and rising production.

“The outlook provides a much-needed boost for U.S. farmers caught in the crossfire of a trade war with China, a huge importer of U.S. soybeans and corn, as well as Mexico and Japan, two of the top buyers of U.S. wheat.”

High #Harvest18 yields in Central Montana. Here's an overflow #wheat pile at @GAVILON_ Moore. #agchat pic.twitter.com/5YefBwuOFK

— Riley Slivka (@rwslivka) August 19, 2018

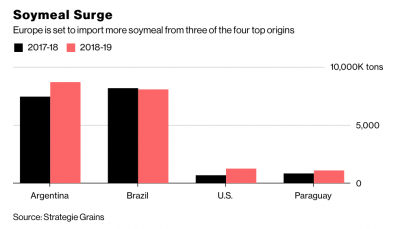

Meanwhile, Bloomberg writer Manisha Jha reported Tuesday that, “More European cows and pigs will get fat on American feed this season.

“European Union imports of soymeal — crushed soybeans used to make food for livestock — are set to surge to a seven-year high of 20.2 million tons this season as heat and drought ravage pastures, boosting the price of locally grown wheat and corn, according to French consultancy Strategie Grains. While Brazil and Argentina will still dominate supply, shipments from the U.S. will post the biggest gains as America-China trade tensions roil the market, it said.”

The Bloomberg article noted that, “U.S. soymeal shipments to the EU are projected to climb by about 80 percent to 1.2 million tons as Brazil sells more feed to China, according to Moret-sur-Loing, France-based Strategie Grains.”

Tuesday’s article explained, “The appeal of U.S. soymeal in Europe has increased as prices fell by almost a fifth since May after China imposed a 25 percent levy on American soybean shipments in a tit-for-tat response to tariffs imposed by Donald Trump’s administration. European wheat prices also rose to a five-year high earlier this month, widening the spread between the two.”