A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

FSA Administrator Highlights Market Facilitation Program; Chinese Ag Imports Projected to Decrease

The Administrator of USDA’s Farm Service Agency (FSA), Richard Fordyce, was a guest on Friday’s “Adams on Agriculture” radio program with Mike Adams, where he discussed details of the new Market Facilitation Program. Meanwhile, USDA released its quarterly Outlook for U.S. Agricultural Trade last week, which noted that agricultural exports to China are projected to decrease.

Market Facilitation Program

Recall that back in July, USDA indicated that the Department would “take several actions to assist farmers in response to trade damage from unjustified retaliation.” After waiting for additional details, USDA released an outline of the program in late August, which has subsequently been analyzed by members of the farmdoc team.

During the “Adams on Agriculture” interview on Friday (audio replay here (MP3- 7:00); unofficial FarmPolicyNews transcript here) Mr. Adams queried: “So this ag assistance package, which FSA, your agency, is going to administer, how will it work? What do producers need to do?”

Mr. Fordyce explained, “Well, signup will begin and can begin on September 4th. However, a producer doesn’t need to immediately come in. In order for us to be able to calculate the payment, we’ll need to know production numbers. So, for example, in the Midwest if you’re a corn or soybean producer, we will have to have your production numbers, so we’ll have to wait till after harvest.

“On the other hand, however, if you’re a dairy producer or a pork producer, you could come into the office around September 4th to come in and give production. On the pig part of the program it’s number of head, and on the dairy part of the program it is production, so historical production from numbers that we have through the Margin Protection Program, and dairy producers will be very aware of that. But the other grain commodities, again, we’ll need production.”

The FSA Administrator pointed out, “So how this will work is we’ve set rates on five crop commodities and two livestock commodities, dairy and pork, and the numbers will go toward 50% of your production. So a producer doesn’t have to come in and elect that payment. They don’t have to make a decision. If they decide to participate in the program, they are covered under those first payment numbers for 50% of their production.

And then on or about December 3rd the Secretary will make a decision based on what we’ve seen happen on the global trade front and run the model again. The chief economist for USDA has a model that they run to determine what these payment levels are and what the impact of trade disruptions are on each individual commodity.

“So on or about December 3rd we’ll run the model again and that will determine what the second 50% of the payment will be. There may be a payment on some commodities, there may not. Those payment rates may change, depending on what we know and what the model tells us is the trade impact on those individual specific commodities.”

Mr. Fordyce added, “And so Mike, there’s another part of this, I think, that I’ve been asked a lot of questions about, and that is do you need to come in—and so let’s say you’re a pork producer and a corn and soybean producer—do you need to come in multiple times. Well, you do. If you want that initial payment on your number of head of pigs, you would want to come in fairly early. But on the corn and soybean part of that you could come in after harvest, bring your numbers in, and then we would be able to calculate the first 50% of that payment.”

Also on Friday’s program, Mr. Fordyce pointed out that, “And so the model literally takes a look at what is the impact of retaliatory tariffs that were levied against certain commodities and then what is the market share or what is the volume of that export going to the country that issued those tariffs.

And so in the case of corn, for example, we just don’t ship a lot of corn to China. China’s the one that really has the largest tariff impact on U.S. production, and not a lot of bushels are going to China, and so the tariff doesn’t affect corn nearly like it does soybeans.

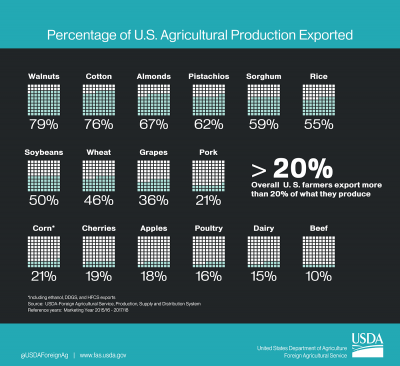

“Obviously we export, in this country, over 50% of our soybean production, and of that 50% volume that’s exported, China has been about a 50% buyer of our exports.”

Also last week, Berkeley Lovelace Jr. reported at CNBC Online that, “American farmers would rather have trade deals from President Donald Trump than need government tariff relief, Agriculture Secretary Sonny Perdue told CNBC on Wednesday.

‘Everybody wants trade, not aid,’ Perdue said in a ‘Squawk Box’ interview.

“Soybean producers, in particular, have been hard hit by Chinese retaliatory tariffs and stand to get up to $3.6 billion in assistance under the Market Facilitation Program,” the article said.

DTN Ag Policy Editor Chris Clayton reported last week that, “Noting the mantra of farmers that they want ‘trade, not aid,’ Perdue said another payment tranche could come later on depending on how trade issues are resolved. ‘If we’re able to resolve all these trade disputes right away prior to harvest then that’s the best thing that can happen. This will be calculated on an ongoing basis.’

“Perdue defended the payment methodology that groups criticized, including dairy, wheat and corn growers. ‘The methodology we used is the same we would used if we went to the WTO and had to litigate the tariff damages,’ Perdue said. He added, ‘We have to demonstrate what the tariff damage is. I wish I could control corn prices and bean prices.'”

And Des Moines Register writer Donnelle Eller pointed out last week that, “The trade impact could be significant in Iowa, the nation’s leading producer of corn, pork and eggs, and second in soybean production.

“Iowa farmers could lose an estimated $2 billion over the next year if the tariffs remain in place. That includes the impact of falling prices for pork hit by Chinese and Mexican tariffs.”

USDA Trade Outlook

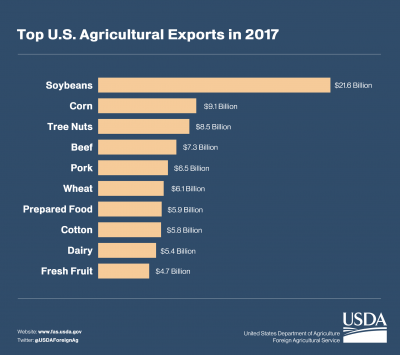

In its Outlook for U.S. Agricultural Trade last week, USDA stated that, “Fiscal 2019 agricultural exports are projected at $144.5 billion, up $500 million from the revised forecast for fiscal 2018. This increase is primarily due to higher exports of wheat and horticultural products, which offset expected declines in oilseeds, livestock, and dairy product exports.”

More narrowly, the Trade Outlook noted that, “Oilseeds and products are projected down $1.4 billion; soybean exports are forecast to fall $800 million to $21.0 billion as both volumes and unit values decline, in large part due to weakening demand from China.

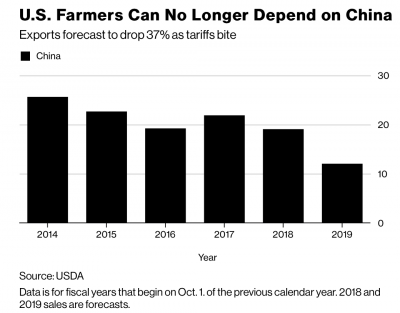

Agricultural exports to China are forecast down $7.0 billion from fiscal 2018 to $12.0 billion as soybean sales are expected to be sharply lower due to retaliatory tariffs, which also curb demand for other products.

“Agricultural exports to Canada and Mexico are forecast at $21.5 billion and $19.7 billion, respectively.”

The USDA update added, “The fiscal 2018 grains and feeds export estimate for the United States is forecast at $31.6 billion, up $400 million from May due to higher corn exports. The estimate for corn is raised $900 million to $11.2 billion on larger export volumes, a record if realized. Strong exports reflect robust global demand and reduced competition from Argentina and Brazil.”

While discussing the USDA trade update in an article last week, Bloomberg writer Alan Bjerga reported that, “China, the largest buyer of U.S. farm goods in 2017, is expected to fall to third place this year, after Canada and Mexico, and then to fifth place behind the European Union and Japan, the USDA said. That follows Chinese tariffs imposed on soybeans and pork earlier this year, a move that has depressed prices for both commodities.”

Mr. Bjerga noted, “‘The greatest unknown is China’s demand for U.S. soybeans,’ USDA economists wrote in the report.”