Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Trade War May Be More Than “a Short-Term Hiccup” for Agriculture

Recent news articles continue to highlight the impact that the ongoing trade war between the U.S. and China is having on the agricultural economy. Today’s update looks at news items that discuss trade repercussions for pork and soybean farmers.

China Tariffs and U.S. Pork Production

Jacob Bunge and Lucy Craymer reported on the front page of Friday’s Wall Street Journal that, “China has the world’s biggest appetite for pork. It’s such a beloved staple that the written Chinese character for ‘home’ depicts a pig inside a house. U.S. producers banked on that business being around for years.

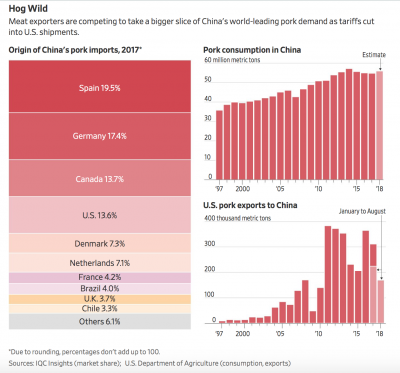

“That’s changed. As a result of the Trump administration’s clash with Beijing over trade, China’s tariffs on U.S. pork have climbed as high as 70%, making U.S. imports more expensive. At the same time, an outbreak of African swine fever in China has increased demand for imported pork.

To fill the void, Chinese customers are increasingly looking to companies in Europe and South America to fill their orders—and those companies aim to turn that opportunity into long-term business. The shift raises the prospect of not just a short-term hiccup for American hog farmers, but a fundamental realignment in the global supply chain in one of the world’s hungriest markets.

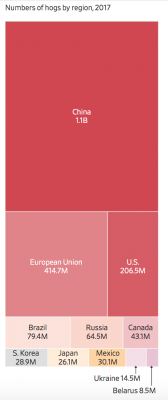

Bunge and Craymer explained that, “Farmers in China will rear about 708 million hogs this year, the U.S. Department of Agriculture estimates—more than half the pigs on the planet. That won’t be enough to sate China’s appetite.

“Chinese consumers eat 123 billion pounds of pork annually in everything from dumplings to fiery mapo tofu. In a nation of 1.41 billion people, that works out to about 87 pounds a person this year, up around 30% since 1998, according to the U.S. Department of Agriculture. Per capita pork consumption in the U.S. is expected to be 51 pounds this year, little changed from two decades ago.”

The Journal article noted that, “China’s pork imports swelled to 3.6 billion pounds last year, nearly 10 times more than a decade ago, the USDA says. The surge has encouraged producers in other countries, including the $200 billion U.S. meat industry, to spend hundreds of millions of dollars on gigantic, state-of-the-art slaughterhouses to help fill that demand.”

The Journal writers pointed out that, “A boom in China’s domestic hog production, fueled by government efforts to consolidate smaller, family-owned farms into giant commercial operations, helped push pork prices to a four-year low in May. Outbreaks of African swine fever have since driven domestic pork prices in September near their highest level in a year.”

“China’s tariffs on U.S. pork—a 25% duty in April, followed by a second duty in July, on top of existing import charges—have called the future of the U.S.-China pork trade into question.

Competition is already tight: The European Union has been China’s top overseas pork supplier since 2009, according to Rabobank, one of the world’s largest agricultural lenders. The U.S. currently ranks third, behind Canada.

Bunge and Craymer added: “China’s efforts to buy low-cost pork from other countries suggest that the U.S. may have to cut prices to keep its sales there, [Costa Brava export manager Ernest Xargayo] said. ‘Only the most competitive will survive.'”

Also on Friday, Jeff DeYoung reported at Iowa Farmer Today that, “[Iowa Pork Producers Association president Gregg Hora] says the opportunity for growth [in the pork industry] is there due to several factors, including increased packing capacity in Iowa and the Midwest, as well as strong export demand.

“There are concerns over retaliatory tariffs imposed by Canada and Mexico after the Trump administration imposed tariffs on several items those countries export into the U.S., Hora says. But the announcement of the reworked NAFTA agreement, now known as USMCA (U.S.-Mexico-Canada Agreement), has commodity groups hoping the tariffs will be eliminated.”

The article noted that, “Trade with China has also been affected by tariffs.

‘We encourage the Trump administration and the U.S. Trade Representative’s office to meet with Chinese negotiators, to give us the opportunity to sell into China and Hong Kong,’ Hora says.

“A new agreement with South Korea should also help pork exports, he says.”

China Tariffs and U.S. Soybeans

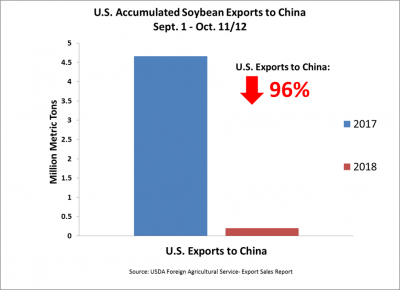

Reuters writers Naveen Thukral and Dominique Patton reported Wednesday that, “China’s soybean imports are set to drop by a quarter in the last three months of 2018, their biggest fall in at least 12 years as buyers curb purchases amid the Sino-U.S. trade war and high domestic stockpiles.”

The article noted that, “Soybean imports by China, which buys 60 percent of the oilseed traded worldwide, will likely decline to around 18-20 million tonnes in the fourth quarter, compared with 24.1 million tonnes in the same period last year, traders said.”

“‘Purchases are going to be mainly from Brazil and some from Argentina and Canada. Buyers are not willing to take chances by bringing in U.S. beans,’ the trader added, declining to be identified as he was not authorized to speak with media,” the Reuters article said.

Despite rapid depletion of stocks, #soybean shipments from #Brazil could reach a record level in Oct, with 2.1m t already shipped as at 12 Oct based on the shipping data, incl. 2.0m t to #China. pic.twitter.com/oebJTtyW1u

— International Grains Council (@IGCgrains) October 17, 2018

Thukral and Patton added, “China, which largely uses soy in feed for the world’s biggest pig herd, is unlikely to face a shortfall in supplies despite the drop in imports as it has abundant domestic reserves after a strong pace of imports.”

And a separate Reuters article from late last week reported that, “China has ample supplies of soybeans and significant price fluctuations are unlikely, a senior agriculture ministry official said on Friday.

“Domestic soybean planting acreage has increased and China is set for a bumper harvest, supported by government subsidies and crop rotation policies, Tang Ke of the Ministry of Agriculture and Rural Affairs told a press briefing.”

However, Bloomberg News writers Shruti Singh, Megan Durisin, and Kevin Varley reported last week that, “Two more vessels loaded with U.S. soybeans have departed for China, signaling that buyers may be getting more desperate for supplies amid the prolonged trade war between the nations.

“Star Laura and Golden Empress were loaded during the week ended Oct. 11. Star, which left the Gulf of Mexico, is destined to arrive at China’s Qingdao port at the end of the month, and Golden Empress, which left from the Pacific Northwest, is expected to arrive in December, according to vessel data compiled by Bloomberg.”

Meanwhile, a news release from Sen. Heidi Heitkamp (D., N.D.) on Thursday stated that, “[Sen. Heitkamp] today released the following statement after new USDA data show a nearly 96 percent drop in the pace of U.S. soybean exports to China this marketing year, which began September 1. About 70 percent of North Dakota’s soybeans have typically been exported to Asia, primarily China, but the administration’s trade war has crippled this important market for North Dakota farmers.

“‘North Dakota farmers are not at fault for China’s unfair trade practices, yet they’re being asked to bear the brunt of the pain caused by the administration’s trade war. That’s not fair to our farmers or to our rural communities who rely on agriculture to keep them strong,’ Heitkamp said.”

Latest data show US export commitments for #soybeans in 2018/19 at 20.8m t as at 11 Oct, a drop of 21% y/y, explained by plunge in sales to #China. China commitments down by about 90% y/y, but those to all other key markets, including the #EU, #Mexico and #Argentina are higher. pic.twitter.com/NOQN2i8BtO

— International Grains Council (@IGCgrains) October 18, 2018

And Reuters writer Julie Ingwersen reported on Friday that, “U.S. soybean futures fell to a one-week low on Friday and recorded a second straight weekly decline, pressured by fresh cancellations of U.S. soybean sales, traders said.”