The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

U.S. and China Plan Talks in November, While Soybean Trade Flows Adjust

News reports indicate that President Trump and Chinese Leader Xi Jinping plan to meet in November, in what could be an opportunity for the two leaders to discuss trade issues. Meanwhile, a recent USDA report, and current news articles, continue to highlight how the ongoing Chinese trade tariffs are impacting the international trade flow of soybeans.

Background- President Trump and Chinese Leader Xi Jinping Plan to Meet in November

Wall Street Journal writers Lingling Wei and Bob Davis reported late last week that, “With U.S. markets tanking and the trade battle with China intensifying, the White House decided to move ahead with plans for President Trump to meet with Chinese leader Xi Jinping at a multilateral summit in November to see if the two leaders can find a way out of the mess, according to officials in both nations.

“The White House has in recent days informed Beijing that it would proceed with the summit meeting, an encounter China has been hoping could provide an opportunity for both sides to ease the escalating trade tensions. The meeting is scheduled to take place at the Group of 20 leaders’ summit in Buenos Aires at the end of November.”

.@WhiteHouseCEA's Kevin Hassett on China trade: "Don't underestimate the president. Don't underestimate him. You put President Trump in a room, he's a great negotiator." pic.twitter.com/pGNrfbzuMD

— FOX Business (@FoxBusiness) October 12, 2018

Also last week, a Reuters News article noted that, “A Chinese finance ministry official said on Wednesday he felt ‘a little bit more optimistic‘ on the prospect of breaking an impasse in trade negotiations with Washington, saying both sides are too economically integrated to tolerate a fallout.”

Soybean Exports- USDA Monthly Update

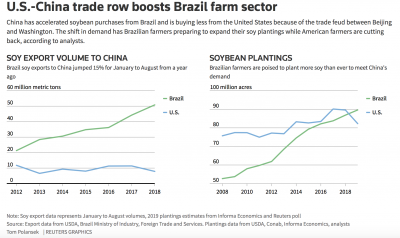

A report last week from USDA’s Foreign Agricultural Service (FAS) stated that, “As of the October 4 U.S. Exports Sales, U.S. soybean outstanding sales are below last year owing to fewer sales to China, which are currently 85 percent below last season. Anemic weekly sales and significantly lower outstanding sales indicate that there is not much interest in purchasing U.S. soybeans by China, primarily due to its decision to include soybeans on the list of key U.S. commodities that are subject to retaliatory tariffs. U.S. soybean exports to China typically reach their lowest levels in summer and then build strength as harvest progresses.

However, a large pullback in Chinese demand for U.S. soybeans appears likely to continue well into 2018/19.

“U.S. accumulated soybean exports were a little over 3.0 million tons or 23 percent below last year. Accumulated exports to China were only 67,000 tons, which is 2.5 million tons less compared to last year. Weekly shipments to the rest of the world were 1.6 million tons above last year; however, they did not fully offset reductions for China.”

The FAS update indicated that, “U.S. soybean sales to the rest of the world (including unknown) are 42 percent above last year, though the ability for the rest of the world to make up for typical exports to China will be tested. The export sales are a good forward indicator of shipments; however, unlike China, many markets such as the European Union, the Middle East, and North Africa do not purchase soybeans in advance, so the report’s usefulness as a predictor of future shipments is limited.”

Top 10 U.S. export markets for #soybeans by volume https://t.co/nU3EGSESGT @USDA_ERS pic.twitter.com/rPVlkwEE4d

— Farm Policy (@FarmPolicy) October 10, 2018

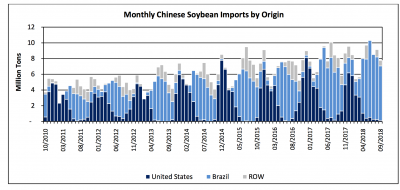

FAS also pointed out that, “Based on available trade data, USDA estimates that 2017/18 U.S. soybean market share in China has fallen to 29 percent from 39 percent last year, while Brazil surged to 66 percent from 48 percent. According to U.S. Census Bureau trade data, U.S. soybean exports to China (Sep-Aug) were the lowest in volume since 2013/14 and the lowest in value since 2009/10.”

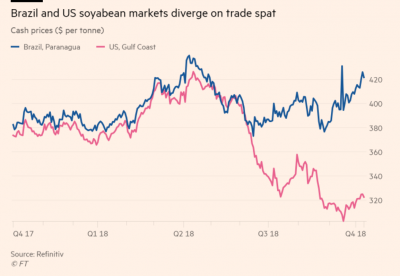

The FAS update added, “The implementation of retaliatory tariffs led to an adjustment of trade flows in global soybean markets. An export price gap that opened between the United States and Brazil continued to widen towards the end of the marketing year, leading to fewer Brazilian sales outside of China and greater U.S. exports to other-than-China markets. Trade tensions between the United States and China will continue to affect soybean and soybean products trade in 2018/19.”

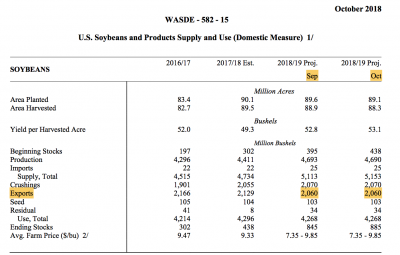

Also with respect to soybean trade flows, a recent USDA Radio update by Rod Bain (MP3- 1 minute) noted that USDA’s soybean export forecast for this marketing year remained unchanged in October.

In the radio report, Mr. Bain noted that, “Working in U.S. soybean’s favor is low prices, currently significantly lower than main export competitor Brazil, which is now selling their crop primarily to the Chinese.”

World Outlook Board Chair Seth Meyer stated, “Given the wide spread between our prices and the Brazilian prices, the Chinese are buying from the Brazilians and everyone else is buying from us, because of that price spread.”

“And an uptick of those non-Chinese market sales of U.S. soybeans are expected to take place in the second half of the 2018/19 marketing year, based on those markets’ traditional purchasing season,” Mr. Bain said.

U.S., Brazil, China and Soybeans- Other News

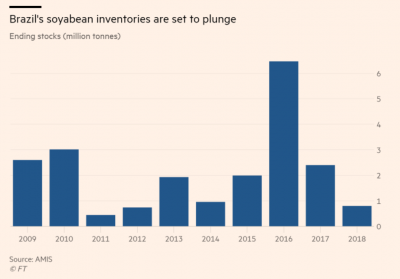

In other news, Financial Times writer Emiko Terazono reported last week that, “The ravenous [Brazilian soybean] demand from China, which has become the world’s largest importer of the commodity, has sent the price for Brazilian soyabeans surging more than 30 per cent this year but left domestic supplies run dangerously low.”

The FT article explained that, “One question is whether Brazil now turns to the US, where soyabean prices have declined, to replenish its own supplies. ‘Prices are so low at the ports in the US Gulf that the economics might work,’ said [Andrew Allan, analyst at AgriCensus], although he noted that many of the Brazilian crushers were inland, which would push up the cost.”

Reuters writers Ana Mano and Jake Spring reported Thursday that, “Brazilian farmers are expected to harvest up to 238.54 million tonnes of grain in the 2018/19 season, the government said on Thursday, with the South American country potentially breaking its production record thanks to expected corn and soy bumper crops.”

The article stated that, “Brazil’s soybean output could total 119.42 million tonnes in 2019, roughly in line with this year’s record of 119.28 million tonnes, Conab said. Brazil is the world’s largest exporter of soy.”

Also, Reuters writers Jake Spring and Tom Polansek reported last week that, “Brazilian producers are not only selling more grain, their soy is fetching $2.83 more per bushel than beans from the United States, up from a premium of just $0.60 a year ago, thanks to stepped up Chinese purchases.

“Prices for U.S. soybeans, meanwhile, recently sunk to decade lows that farmers say are below the cost of production. The slump has made the agricultural sector a drag on an otherwise healthy U.S. economy.”

And Financial Times writer Lucy Hornby reported earlier this month that, “Donald Trump’s trade battle against China, which has seen Washington impose tariffs on almost half of all US imports from the country, has sparked a renewed emphasis on self-reliance in food and technology that was a common theme during Mao Zedong’s era. That is ‘not a bad thing,’ President Xi Jinping said last week during a tour of state farms in the northern province of Heilongjiang, which produce an outsized portion of China’s grain supply.

“Mr Xi’s choice of venue was no accident. Along with the Liaoyang refining complex, a subsidiary of China National Petroleum Corp that processes crude oil from Russia, the state farms represent the value of China’s state-owned enterprises: politically reliable institutions that promise security of supply, even if that comes at the cost of commercially competitive operations.”

Also with respect to China, Bloomberg writer Alfred Cang reported last week that, “China’s 400 million pigs may have to get used to a new diet in the name of national interest.

“The country is considering whether to cut the amount of protein required in food for pigs, according to the state-run China Feed Industry Association, to reduce soybean purchases from abroad. The nation’s facing soaring prices of meal made from the oilseed — a principal source of animal protein — after imposing a 25 percent duty on soybean imports from the U.S., its biggest supplier.”