Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Minneapolis Fed: Chapter 12 Bankruptcies on the Rise

In addition to the melancholy agricultural outlook contained in recent Federal Reserve District agricultural surveys, an update last week from the Federal Reserve Bank of Minneapolis pointed to troubling data regarding Chapter 12 Bankruptcies in the District. In addition, recent news articles have also discussed some variables that could impact the state of the U.S. agricultural economy as the 2018 harvest draws to an end.

Federal Reserve Bank of Minneapolis Article- Chapter 12 Bankruptcies

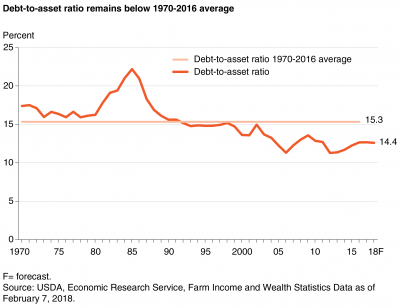

A recent update from the Federal Reserve Bank of Minneapolis (“Chapter 12 Bankruptcies on the Rise in the Ninth District“), by Ronald A. Wirtz, stated that, “It’s no longer a news story that crop and livestock prices are depressed, given their current multiyear persistence. Feedback from farmers, agricultural lenders, suppliers, and other interests in the ag sector, gathered informally by the Minneapolis Fed over the past year or so in meetings and other venues, has suggested that farm balance sheets are increasingly stressed.

“And that nagging economic strain of low commodity prices on farmers and ranchers—compounded for some by recent tariffs—is starting to show up not just in bottom-line profitability, but in simple viability.

Over the 12 months ending in June 2018, 84 farm operations in Ninth District states had filed for chapter 12 bankruptcy protection—more than twice the level seen in June 2014.

Mr. Wirtz explained that, “The trend is both simple and complex. For example, current numbers are not unprecedented, even in the recent past, having reached 70 bankruptcies in 2010. However, current price levels and the trajectory of the current trends suggest that this trend has not yet seen a peak.”

The Fed update pointed out that, “Not surprisingly, bankruptcy numbers inversely follow the rise and fall of commodity prices. After a comparatively steep spike in chapter 12 filings during the Great Recession—that 2010 peak—ag prices started rising across the board, and bankruptcies logically pivoted and started to decline. Farm bankruptcies bottomed out in 2014, but again pivoted as high prices reversed and have remained low.”

The Minneapolis Fed noted that, “Bankruptcies are but one measure of the difficulty in agriculture. Many are leaving the business altogether. The number of licensed dairies in Wisconsin, for example, has fallen by about 1,200—or 13 percent—from 2016 through October of this year, according to federal and state data.”

Agricultural Economy: Recent News Articles

In other news regarding the current state of the U.S. agricultural economy, Katie Dehlinger and Elizabeth Williams reported last week at DTN that, “Cash flow is a growing problem in farm country, and nearly all of the bankers that spoke with DTN at a recent conference said there’s some part of their portfolio that’s under significant financial stress. However, that portion is small, and bankers say they’re being more proactive in helping customers head off problems.

“Moody Analytics director of sales management Doug Johnson started a presentation at the National Agricultural Bankers Conference with a number of quotes from ag lenders, the themes of which echoed through the workshops, coffee breaks and keynote sessions.

“He said one lender told him: ‘The valley is as deep as it was in the 1980s, both financially and emotionally for some producers, but it’s not as wide.'”

The DTN article noted that, “Lenders say they’re more proactive in working with troubled clients to refinance, restructure or rethink their operations to stay in business. They’re preparing for a tough renewal season by taking a deep look at their customers’ numbers to generate financial metrics that help take the emotion out of tough business conversations.

“‘We may see a few more necessitated sales in weather-stressed areas or operations without strong equity,’ said Mike Hein, vice president at Liberty Trust and Savings Bank in Durant, Iowa. ‘But for most borrowers, they are hanging on, especially those who took advantage of higher prices earlier in the year.'”

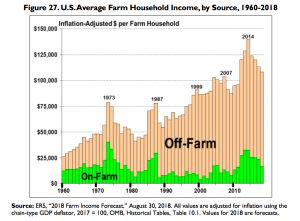

Dehlinger and Williams added, “Joe Kessie, senior vice president and regional manager of commercial banking at Lake City Bank in Warsaw, Indiana, said that, overall, balance sheets are strong and there are a lot of off-farm employment opportunities in his part of north-central Indiana.

“‘What’s helping is a lot of operations had equity going into this tough period. And if we can help them by stretching out terms and reducing minimum payments, we’ll do that.

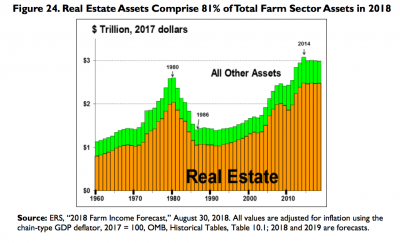

“Much of that equity is tied to farmers’ largest asset, their land.

Jason Henderson, associate dean of Purdue University’s College of Agriculture and director of Purdue Extension, said he thinks a combination of slightly higher interest rates, uncertainty about yields after years of above-trendline production and lower commodity prices will probably result in a slight decline in land values.

And Dan Looker reported last week at Successful Farmer Online that, “[Virginia Tech emeritus ag economist David Kohl] compares the current ag lending environment to the smoke that preceded the Mt. St. Helens eruption in Washington state. Some of the threats rumbling under the ag economy include continued uncertainty in international trade, the size of farm loans, rising interest rates, and the possibility of declining farmland values.”

Meanwhile, Sarah Zimmerman reported last week at Politico that, “Market volatility caused by President Donald Trump’s trade disputes, extreme weather and the potential spread of African Swine Fever could threaten the stability of global food commodity prices next year, the agricultural banking company Rabobank warned Thursday in a new report.

“‘The agri-commodity price environment may be relatively stable currently, but it’s difficult to remember a time [when] there were so many threats to food commodity prices on so many fronts,’ Stefan Vogel, Rabobank’s head of agricultural commodity markets and a co-author of the report, said in a statement.”

The Politico article noted that,

In Rabobank’s annual Outlook report, the Holland-based company predicted that trade uncertainty remains the largest threat facing U.S. farmers next year.

“The downward trend of U.S. farmers’ profitability will only get worse if China continues to ignore American agricultural imports, the report said. Fiscal 2018 marked the second-worst profitability year for American farmers in nearly the last decade, the report said, despite record-smashing corn and soybean yields and the fact that Chinese retaliatory tariffs only directly affected one-quarter of the 12-month period.

“Rabobank anticipates that American soybean farmers will continue to take the biggest hit if Beijing keeps its tariffs in place — and that U.S. soybean stocks ‘will easily double’ under that scenario. USDA Secretary Sonny Perdue has said that farmers will not receive additional trade aid for 2019 production, reasoning that Trump’s tariff policies have already altered markets and that farmers must now react accordingly.”