A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Overview: China Purchases U.S. Soybeans

Reuters writer Karl Plume reported last week that, “China on Wednesday made its first major purchases of U.S. soybeans since President Donald Trump and his Chinese counterpart Xi Jinping struck a trade war truce earlier this month, providing some relief to U.S. farmers who have struggled to find buyers for their record-large harvest.

The purchase of over 1.5 million tonnes of beans is the most concrete evidence yet that China is making good on pledges the U.S. government said Xi made when the two leaders met on Dec. 1 and agreed to a 90-day detente to negotiate a trade deal

The article noted that, “Commodities traders and analysts said soybean prices may struggle to build on Wednesday’s gains unless China buys considerably more soybeans.”

Gregory Meyer reported last week at The Financial Times Online that, “More than 1.1m tonnes of sales were confirmed by the US Department of Agriculture on Thursday, in a report that recorded large transactions made before 3pm Washington time on Wednesday.”

Private exporters reported to @USDA #export sales of 1,130,000 MT of #soybeans for delivery to #China during the 2018/2019 MY. https://t.co/rBMHzbscAa

— Foreign Ag Service (@USDAForeignAg) December 13, 2018

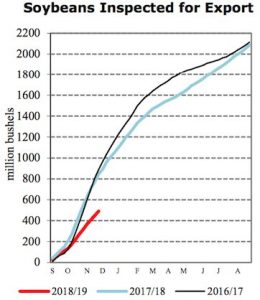

For perspective, the FT article pointed out that, “The purchases reported by the council represented a fraction of the more than 30m tonnes of soyabeans the US was annually exporting to China before the new tariff. In December 2017 the US was exporting nearly 1m tonnes of soyabeans to China every week, according to the US Department of Agriculture.”

And on Friday, USDA announced additional “export sales of 300,000 metric tons of soybeans for delivery to China during the 2018/2019 marketing year, as well as, “Export sales of 130,000 metric tons of soybeans for delivery to unknown destinations during the 2018/2019 marketing year.”

Private exporters report the following export sales for MY 2018/19: 300,000 MT of #soybeans for delivery to China , 130,000 MT of soybeans for delivery to unknown destinations, and 125,000 MT of #corn for delivery to Japan. https://t.co/bHOLX6jkIy

— Foreign Ag Service (@USDAForeignAg) December 14, 2018

Meanwhile, Bloomberg writer Mario Parker reported Thursday that, “China’s return to the U.S. soybean market this week comes too little, too late for many Iowa farming families to put more Christmas presents under the tree this year, according to third-generation grower Brent Renner.

“Renner said he’s cautiously optimistic after reports of the first U.S. purchases by China since Donald Trump and Xi Jinping agreed to a 90-day trade war ceasefire. But volume so far is ‘a drop in the bucket.'”

Mr. Parker explained that, “Even before the trade war, farmers had been doing it tough. Net farm income has fallen four out of the last five years and is projected to be $66.3 billion in 2018, or 46 percent of 2013 levels, according to USDA.”

In a big win for Trump, China has resumed buying U.S. soybeans, bringing relief to farmers in heartland, and more purchases could be on the way pic.twitter.com/S5xGE5X85p

— TicToc by Bloomberg (@tictoc) December 13, 2018

Reuters writers Julie Ingwersen and Karl Plume reported last week that, “China’s meager first purchase of U.S. soybeans since its trade war with the United States began in July disappointed farmers, grain traders and a U.S. government official hoping for larger sales to lift slumping prices and absorb a huge surplus across the U.S. farm belt, they said on Thursday.”

‘Having a million, million-and-a-half tonnes is great, it’s wonderful, it’s a great step,’ USDA Deputy Secretary Steve Censky said at an Iowa Soybean Association annual meeting on Thursday. ‘But there needs to be a lot more as well, especially if you consider it in a normal, typical year, we’ll be selling 30 to 35 million metric tonnes to China.’

The Weekly National Grain Market Review (USDA- Agricultural Marketing Service) on Friday pointed out that, “Last week’s export sales and shipments of soybeans totaled 29.1 million and 42.1 million bushels, respectively, still a bearish pace despite China’s purchase earlier this week.”

On Thursday, Bloomberg writers Shruti Singh and Jeremy Hill reported that, “A huge stockpile of soybeans helps explain why the market remains unimpressed with China’s resumption of U.S. purchases.”

The Bloomberg writers noted that, “The soybean market is looking for much higher sales to China to put a dent in the mountain of beans stockpiled in the U.S. Inventories are set to double to a record 25.99 million tons, according to the U.S. Department of Agriculture. On Thursday, the USDA reported sales of 1.1 million tons to China.”

FrtPg @OWHmoney section in today's @OWHnews: "#Trade Dispute Seeds Doubt for #Farmers," https://t.co/kG3fr8F0tO pic.twitter.com/FeudpwRa48

— Farm Policy (@FarmPolicy) December 16, 2018

Also, a separate Bloomberg News article from Friday reported that, “Corn futures gained on Friday after Chinese officials were said to be preparing to restart purchases of American supplies as soon as January in another sign that China is working on a lasting detente with the U.S.”

The article pointed out that, “Unlike soybeans, where China has historically purchased about a third of the U.S. harvest, the Asian nation hasn’t been a significant buyer of American corn for several seasons. China is the world’s second-largest producer of the grain, and the last time it bought more than 3 million tons of U.S. corn in a calendar year was 2013, U.S. Department of Agriculture data show.”

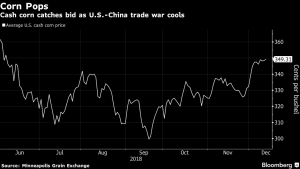

Nonetheless, Bloomberg writers Jen Skerritt and Shruti Singh reported late last week that, “While reaction in the soy futures market has been muted so far as traders hold out for bigger purchases, U.S. cash prices have climbed. There’s also been a lot of action in the corn options market, while premiums for Brazilian crops have dropped.”

The article stated that, “The trend is reversing for American and Brazilian soy prices. When the Asian country snubbed U.S. supplies earlier this year, premiums for crops from Brazil started surging as trade flows changed. Now, cash prices for U.S. beans are recovering, and the Brazilian market is cooling off.”

The Bloomberg article added that, “The average U.S. cash corn price climbed to the highest since early June, according to an index compiled by the Minneapolis Grain Exchange. As China resumes its soy purchases, some traders have said that corn may be a surprise beneficiary of the easing trade relations.”

Lastly today, Reuters writer Humeyra Pamuk reported last week that, “U.S. Agriculture Secretary Sonny Perdue said on Thursday he expects the White House to approve a second tranche of aid payments to farmers hurt by ongoing trade disputes, despite new Chinese purchases of soybeans.

“Perdue told reporters he expected to meet with the White House Office of Management and Budget on the issue on Friday. He added that he hoped China would continue buying U.S. soybeans after the recent purchases, but said he had no knowledge of new agreements for China to do so.”

Many thanks to General Kelly for decades of exemplary and honorable service to his country, in uniform and in this @WhiteHouse. And congratulations to @MickMulvaneyOMB. We already have a strong relationship and I know we’ll continue to work together well.

— Sec. Sonny Perdue (@SecretarySonny) December 15, 2018

On Friday, President Trump tweeted that, “I am pleased to announce that Mick Mulvaney, Director of the Office of Management & Budget, will be named Acting White House Chief of Staff, replacing General John Kelly…”