Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Government Shutdown: Impact on Soybean Exports and Trade Mitigation Payments

On the night of Friday, December 21st, the U.S. government began a partial government shutdown. Today’s update points to recent news items that highlight how the shutdown may impact information related to U.S. soybean exports, as well as USDA trade mitigation program payments.

Soybean Export Issues- Background

After a meeting early last month between President Donald Trump and Chinese President Xi Jinping in Buenos Aires, trade tensions between the U.S. and China began to ease, and China agreed, “to start purchasing agricultural product from our farmers immediately.”

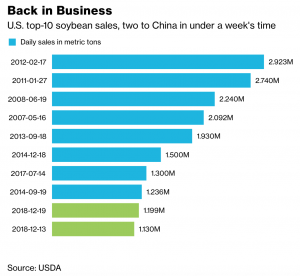

And in mid-December, China began to purchase some U.S. soybeans.

Soybean Export Issues- Additional Purchases, Government Trade Data

On December 19th, Bloomberg writers Shruti Singh and Isis Almeida reported that, “China, the world’s largest consumer of soybeans, bought American-grown oilseed for a second week after largely shunning U.S. supplies earlier this year in a trade war between the two countries.

Private exporters report sales of 1,199,000 MT of #soybeans for delivery to China during MY 2018/2019. https://t.co/IAleldhvfN

— Foreign Ag Service (@USDAForeignAg) December 19, 2018

“On Wednesday, the U.S. Department of Agriculture said in a statement that exporters sold 1.199 million metric tons to China for delivery by Aug. 31.”

And on December 20th, USDA’s Foreign Agricultural Service documented additional U.S. soybean sales of 204,000 metric tons to China.

Private exporters report the following sales for MY 2018/2019: 204,000 MT of #soybeans to China, 257,000 MT of soybeans to unknown destinations, & 100,000 MT of soybean meal to Colombia. https://t.co/AnN2yfDfkf

— Foreign Ag Service (@USDAForeignAg) December 20, 2018

On Friday, December 21st, Karen Braun, a global agriculture columnist at Thomson Reuters tweeted a recap of U.S. soybean sales for the week of December 17th (see below).

Some #corn and #soybeans to unknown this morning. Here's all the daily sales we had this week: pic.twitter.com/Q6OJ5mZ3po

— Karen Braun (@kannbwx) December 21, 2018

Then, on the night of Friday, December 21st, , the U.S. government began a partial government shutdown.

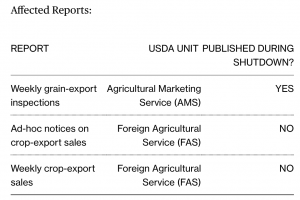

On December 28th, Reuters writer Julie Ingwersen reported that, “Commodity traders are in the dark because of the partial U.S. government shutdown, unable to see daily and weekly reports of agricultural exports to obtain clues as to whether China is following through with promises to buy grain and soy amid the ongoing trade war.”

“Now, trade experts and grain analysts warn the suspension of the reports is clouding the marketplace and potentially giving an advantage to big grain companies directly involved in the export trade. The government shut down partially at midnight on Dec. 21,” the Reuters article said.

Ms. Ingwersen added,

The USDA on Friday reiterated that the shutdown, if it continues, would halt its World Agricultural Supply and Demand Estimates (WASDE) report and reports by its National Agricultural Statistics Service, which tracks quarterly U.S. grain stocks and U.S. winter wheat seedings.

And Bloomberg writer Lydia Mulvany reported on Monday that, “As the partial U.S. government shutdown enters its second week, the lack of data from the U.S. Department of Agriculture is sending market participants to Twitter and other sources to gather crop information.

“Most of the department’s key reports — including figures on export sales — have been halted since the shutdown began on Dec. 22. Given thin holiday trading last week, the dearth of information sent investors to the sidelines, according to Steve Georgy, the president of agriculture broker and adviser Allendale Inc., based in McHenry, Illinois.”

The Bloomberg article noted that, “After the New Year, however, Georgy said traders are going to turn to the media and to Twitter to make up for the lack of government information, and that will lead to higher volatility.”

#Grains Inspected and/or Weighed for #Export Reported in Week Ending

— Farm Policy (@FarmPolicy) January 1, 2019

December 27, 2018, https://t.co/0E59RZ8l9E @USDA_AMS #corn, #sorghum, #soybeans, #wheat pic.twitter.com/7ZRWYQ2enA

Trade Aid Payments to Farmers

Associated Press writer Juliet Linderman reported on Friday that, “The end of 2018 seemed to signal good things to come for America’s farmers. Fresh off the passage of the farm bill, which reauthorized agriculture, conservation and safety net programs, the Agriculture Department last week announced a second round of direct payments to growers hardest hit by President Donald Trump’s trade war with China.

“Then parts of the government shut down.

“The USDA in a statement issued last week assured farmers that checks would continue to go out during the first week of the shutdown. But direct payments for farmers who haven’t certified production, as well as farm loans and disaster assistance programs, will be put on hold beginning next week, and won’t start up again until the government reopens.”

Need to make something clear because of some reporting on MFP payments & commodity purchases in trade mitigation program. Farmers who have certified production WILL receive payments even with a government shutdown. Commodity purchasing will go on. Don’t want confusion about this.

— Sec. Sonny Perdue (@SecretarySonny) December 22, 2018

The AP article noted that, “USDA has earmarked about $9.5 billion in direct payments for growers of soybeans, corn, wheat, sorghum and other commodities most affected by tariffs. The first round of payments went out in September. The deadline to sign up for the second round of payments is January 15.”

Farmers are worried their federal aid may dry up pic.twitter.com/GOUidldNub

— TicToc by Bloomberg (@tictoc) December 27, 2018

Meanwhile, Adam Belz reported on the front page of the business section in the December 19th Minneapolis Star Tribune that, “So the soybean farmers were particularly hard hit by the Chinese tariffs. They will receive about 75 percent of the total $9.6 billion in [trade] aid. Hog, corn, dairy, almond, cotton, sorghum, cherry and wheat producers also are eligible for payments under the program, which was first announced in July.

“Soybean growers will get $1.65 per bushel of their 2018 harvest, up to $125,000 per farm.

“Up until this week’s announcement, farmers were guaranteed 82 cents per bushel in aid on soybeans, and this second half of the payment could help push many farmers over break-even for the year.”

The Star Tribune article noted that, “The large amounts of soybeans in storage, however, remain a problem, said [Joel Schreurs, a farmer west of Marshall], as do the lower prices offered to soybean farmers in northern Minnesota and North Dakota because of their proximity to the Chinese market.”