As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

China Purchases U.S. Soybeans and Sorghum, As Trade Talks Face Hurdles

Last week, China purchased U.S. soybean and sorghum exports. Nonetheless, farmers remained concerned about a trade resolution between the U.S. and China as more melancholy reports emerge about progress in the on-going negotations.

China Purchases Soybeans, and Sorghum

Reuters writer Karl Plume reported late last week that, “Chinese state-owned firms bought at least 500,000 tonnes of U.S. soybeans on Thursday for shipment primarily from Pacific Northwest grain export terminals from June to September, two traders with knowledge of the deals said.

“The purchases were the first since U.S. Agriculture Secretary Sonny Perdue said on Twitter that China had committed to buying an additional 10 million tonnes of U.S. soybeans during trade talks on Feb. 22.”

Private exporters report sales of 664,000 MT of #soybeans for delivery to China during MY 2018/2019. https://t.co/7ow65EehLO

— Foreign Ag Service (@USDAForeignAg) March 8, 2019

Private exporters report the sale of 926,000 MT of #soybeans for delivery to China during MY 2018/2019. https://t.co/UzbBxXOaxN

— Foreign Ag Service (@USDAForeignAg) March 11, 2019

And Reuters writer Tom Polansek reported last week that, “China bought U.S. sorghum for the first time since August last week, U.S Department of Agriculture data showed on Thursday, fueling hopes for more deals as Beijing and Washington seek to resolve their trade dispute.

“The sale of 65,000 metric tonnes of U.S. sorghum marked China’s biggest purchase since Beijing imposed a 25 percent tariff on imports of American grains in July.”

Great news for U.S. sorghum producers: China has made its biggest purchase of U.S. sorghum since last year. I appreciate @POTUS and @USTradeRep fighting for our farmers and for achieving real results in trade negotiations with China. https://t.co/8ePPY9yY0r

— Rep. Arrington (@RepArrington) March 8, 2019

Also last week, Reuters writers Hallie Gu and Dominique Patton reported that, “China’s soybean imports in February fell to their lowest monthly level in four years, as buying slowed amid uncertainties over trade relations with the United States and flat demand for soymeal, customs data showed on Friday.

“The world’s top buyer of soybeans brought in 4.46 million tonnes of the oilseed in February, according to data from the General Administration of Customs. That was down 17 percent from the same month a year earlier as a hefty tariff on soybeans from the United States, China’s second-largest supplier, weighed.”

Top 10 US #export markets for #soybeans, by volume https://t.co/5gB50sJ063 @USDA_ERS

— Farm Policy (@FarmPolicy) March 8, 2019

2017-2018 calendar year:

* Exports to #China down 74%

* Exports to #Argentina up significantly

* Exception of China, exports up to other countries

* Overall soybean export volumes down pic.twitter.com/4ydwEsSSEW

Meanwhile, the March World Agricultural Supply and Demand Estimates (WASDE) report, which was released on Friday by the World Agricultural Outlook Board, noted that, “With exports unchanged, soybean stocks are projected at 900 million bushels, down 10 million from last month.”

In a summary of the WASDE report, DTN reported on Friday that, “Despite expectations for new soybean exports, USDA left soybean exports at 1.875 billion bushels, unchanged from February.”

USDA monthly outlook shows oversupply of corn and wheat, but soybean exports remain unchanged. Insights via @CMEGroup pic.twitter.com/rwM0BX9lri

— TicToc by Bloomberg (@tictoc) March 11, 2019

In other news regarding U.S. soybean exports, USDA’s Foreign Agricultural Service (FAS) indicated on Friday (“Oilseeds: World Markets and Trade“) that, “U.S. soybean sales and shipments to the European Union (EU) have risen since April 2018, 2 months prior to the imposition of duties on U.S. soybeans by China. With premiums for Brazilian soybeans and with tight supplies in Argentina and Uruguay due to drought, EU buyers turned to the United States as the most economical and readily available source for soybeans.

Using a 12-month moving total based on data obtained from the FAS export sales reports, soybean exports to the EU are over 9.0 million tons ending February. This is roughly double the amount exported through the end of February 2018.

“The last time 12-month exports of U.S. soybeans to the EU reached this level was in 1995.”

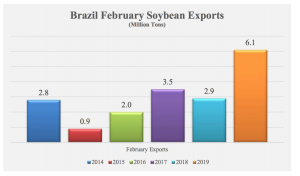

The FAS report also explained that, “In February 2019, Brazil soybean exports reached a record 6.1 million tons, more than twice the level observed in February 2018. This is in response to an early harvest and to strong demand, principally from China. Despite the continued 25-percent duty on U.S. soybeans to China, premiums enjoyed last year by Brazilian producers have evaporated. In fact, export values quoted from Paranagua are a few dollars below those quoted for U.S. soybeans from the Gulf. For commercial buyers in China, the current prices are a significant improvement over those observed 6 months earlier and are likely contributing to the strong demand.”

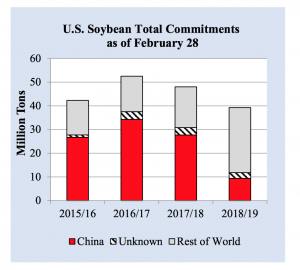

In addition, Friday’s FAS update pointed out that, “For the week ending February 28, 2019, U.S. 2018/19 soybean export commitments (outstanding sales plus accumulated exports) to China totaled 9.4 million tons compared to 27.7 million a year ago. Total commitments to the world were 39.3 million tons, compared to 48.0 million for the same period last year.”

Farmer Concerns

On Wednesday, Reuters writer Humeyra Pamuk reported that, “So far, the American rural heartland that helped carry President Donald Trump to victory in 2016 remains largely supportive of his hard line on trade, saying unfair Chinese practices had to be addressed for longer-term economic gain.

But it has also taken the brunt of the dispute, losing a massive export market. With credit conditions eroding in the agrarian economy and total debt hitting levels unseen for decades, the pain has deepened and patience is wearing thin.

The article noted that, “Agriculture Secretary Sonny Perdue last week said the current debt levels in farm country have rapidly risen to levels seen in the 1980s, when thousands of farm operations financially collapsed after producers dealing with low crop prices fell behind on high-interest land and equipment loans.”

"There's a lot of economic anxiety and stress," over tariffs in farm country, says Senator John Thune https://t.co/fARHjwA3OP pic.twitter.com/1WoMB2cI01

— Bloomberg TV (@BloombergTV) March 6, 2019

Associated Press writer Kevin Freking reported Thursday that, “The president’s willingness to pick trade fights with multiple trading partners at once has set off volleys of retaliatory tariffs, driving down the price of pork, corn and soybeans in political bellwether Iowa and elsewhere, and contributing to a 12 percent drop in net farm income nationally last year.”

“I’m going to be pounding the pavement in the House Ag Committee to make sure our soybean farmers don’t get crushed under tariffs.” @HouseAgDems #TheHillWomen116th pic.twitter.com/XRD8yAjgJd

— Rep. Abigail Spanberger (@RepSpanberger) March 7, 2019

And Wall Street Journal writers Paul Kiernan and Josh Zumbrun reported last week that, “China’s move to cut off U.S. soybean purchases caused prices to drop midyear, when there is often a seasonal uptick, as China started buying a lot of soybeans from Brazil instead. That forced some U.S. farmers who had been holding on to their soybeans in hopes of better prices to sell at a loss, said Bill Gordon, who plants around 2,000 acres of soybeans and corn in Minnesota.

‘It’s really tough,’ Mr. Gordon said. ‘There’s a lot of farms that are going bankrupt now.’

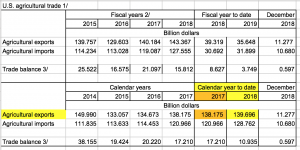

Meanwhile, USDA’s Economic Research Service (ERS) noted last week that, “Net farm income, a broad measure of profits, is forecast to increase $6.3 billion (10.0 percent) from 2018 to $69.4 billion in 2019,” and recent ERS trade data showed that the overall value of U.S. agricultural exports were slightly higher in calendar year 2018, than in calendar year 2017.

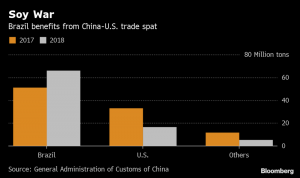

Also last week, Bloomberg News reported that, “Here’s a look at the potential implications of a trade deal between the U.S. and China from an agricultural markets perspective:

“The biggest impact by far is likely to be on soybean suppliers. China imported 88 million metric tons of soy last year, valued at $38 billion, with Brazil overtaking the U.S. as the dominant supplier.

“If a deal is made, the share for U.S. soybeans could ‘easily’ increase to over 50 percent from 34 percent in 2017, representing about $20 billion to $25 billion worth of purchases, Rabobank said.”

U.S., China Trade Negotiations Faces Roadblocks

Lingling Wei, Jeremy Page and Bob Davis reported in Saturday’s Wall Street Journal that, “A U.S.-China trade accord is facing a new roadblock, as Chinese officials balk at committing to a presidential summit until the two countries have a firm deal in hand, according to people familiar with Beijing’s thinking.

“A week ago, the sides appeared to be closing in on a draft accord. But Chinese leaders were taken aback by President Trump’s failed meeting in Vietnam with North Korean leader Kim Jong Un, the people said.

“Mr. Trump’s decision to break off those talks and walk away sparked concern that China’s President Xi Jinping could be pressured with take-it-or-leave-it demands at a potential summit at Mr. Trump’s Mar-a-Lago estate in Florida late this month, these people said.”