Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

American Bankers Association Farm Bank Performance Report

Last week, the American Bankers Association (ABA) released its annual Farm Bank Performance Report. Today’s update includes several highlights from the ABA update.

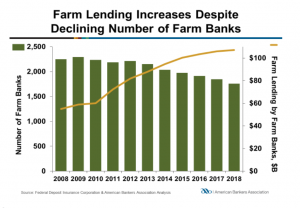

The ABA report indicated that, “The U.S. banking industry is a major provider of credit to agriculture with more than $186 billion in farm loans extended— approximately 50 percent of the total farm credit outstanding in the U.S.—as of year-end 2018.”

The U.S. Department of Agriculture (USDA) is forecasting net farm income to increase 6.3 billion (10.0 percent) to $69.4 billion in 2019. Despite positive news in farmland values, the Kansas City Federal Reserve Ag Lenders survey describes declines in credit and farm finances quality as well as the risk of potential geopolitical turmoil and global economic concerns. Farm banks are well-prepared for possible turbulence in the agricultural sector.

“Farm banks have benefited from several years of strong agricultural sector performance and have, during these years, increased their quality and quantity of capital while strengthening their balance sheets.”

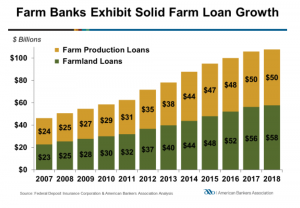

“Farm lending posted solid growth during 2018,” the report said; adding that, “Farm real estate loans grew at a faster rate than farm production loans.”

More narrowly on farmland value issues, the ABA report stated that,

One area of concern for farm bankers and their supervisors has been the appreciation in farmland values in some areas of the country. However, the run up in farmland values has not been a credit driven event.

“Farm banks are actively managing risks associated with agricultural lending, and underwriting standards on farm real estate loans are very conservative. The key consideration of farm bankers is the ability of their farm customers to repay debts regardless of their collateral position. To help manage risk, farm bankers regularly run stress tests on their customers’ portfolios to evaluate the health of borrowers under different adverse scenarios.

“Furthermore, according to Federal Reserve surveys, after several years of large increases in farmland values, farm bankers have indicated that farmland values have edged down slightly or remained relatively stable in most states. According to the latest ABA and Farmer Mac Agricultural Lender Survey Report, 22 percent of lenders reported lower farm land values in 2018, while an additional 68 percent of respondents reported no change in land values. The majority (54 percent) of respondents expect no further change in land values into 2019.”

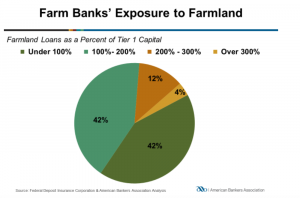

With respect to loan portfolios, the ABA report pointed out that, “Over the last several years, farmland loans at farm banks have represented around half of total farm loans. In 2018, very few farm banks were overly concentrated in farm real estate loans relative to Tier 1 capital. Most farm banks had a farmland concentration ratio of under 200 percent—a level that has not raised supervisory concerns.”

Regarding loan repayments and income, last week’s report noted that, “While farm and ranch customers continue to repay their loans, long-term delinquencies (90 days past due or more) did rise in 2018, possibly reflecting weaker farm incomes and reduced cash flow among farmers. These results are in line with various Federal Reserve District Banks reports which indicate only a modest deterioration in credit conditions despite the drop in farm income.

According to the most recent ABA and Farmer Mac Agricultural Lender Survey Report, nearly 82 percent of respondents reported an overall decline in farm profitability in 2018.

“Furthermore, on average survey respondents indicated that 51 percent of their current agricultural borrowers were profitable in 2018 and expect 51 percent will remain so into 2019.”