As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Kansas City Fed Update: Ag Lending Variables; Farmland Values Relatively Steady

Nathan Kauffman and Ty Kreitman indicated in a recent update from the Federal Reserve Bank of Kansas City (“Large Loans Drive Further Increases in Farm Lending“) that, “Growth in the average size of farm operating loans boosted agricultural lending in the second quarter of 2019. The size of farm loans has continued to rise and loans exceeding $1 million recently have had a significant effect on the overall volume of new loan originations. The average duration of farm loans also has lengthened alongside elevated demand for financing, another potential signal of increased credit stress. Despite increased pressure from weaker farm finances and recent increases in interest rates on farm loans, farmland values continued to hold relatively steady.”

Today’s update looks at the Kansas City Fed report in more detail with a focus on agricultural lending variables and farmland values.

Lending Variables

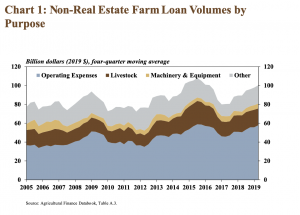

The Fed update stated that, “Non-real estate farm lending continued to increase at a moderate pace in the second quarter, according to the National Survey of Terms of Lending to Farmers. The volume of loans increased 11 percent compared with last year, the fastest pace of growth in the second quarter since 2011. Operating loans continued to comprise the majority of non-real estate farm lending and increased more than 16 percent.”

“The increase in loan volumes continued to be driven by larger-sized loans. The average amount of non-real estate farm loans in recent years has increased steadily. Compared with the period between 2000 and 2009, the average size of all non-real estate loans in the second quarter was nearly $34,000 larger in 2019,” the Fed report said.

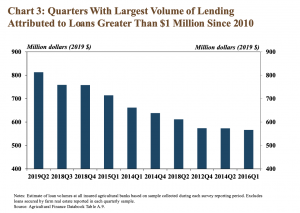

Last week’s report also noted that, “The volume of non-real estate farm loans exceeding $1 million was notably higher than previous years and contributed significantly to the average size of loans.”

“Alongside larger-sized loans, loan durations in recent quarters also have increased,” the report said.

Compared with a year ago, the average duration of all non-real estate farm loans in the second quarter increased nearly three months.

“Durations at the largest banks continued to trend upward, increasing about four months.”

The Fed update added that, “While the average risk rating of all new non-real estate loans remained sound overall, the share of problem loans in recent years has increased slightly.”

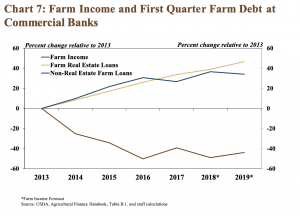

More broadly, Kauffman and Kreitman explained that, “Several years of low farm income have weighed on farm borrowers and contributed to steady increases in farm real estate debt. Reduced cash flow generally leads to more borrowers with carry-over debt at year-end, and those outstanding debts are secured with longer-term assets such as farm real estate.

In 2018, U.S. farm income was nearly 50 percent lower than 2013 and is forecast to remain 44 percent below that amount in 2019. Over that same period, farm real estate debt has increased about 47 percent, an average annual pace of almost 8 percent.

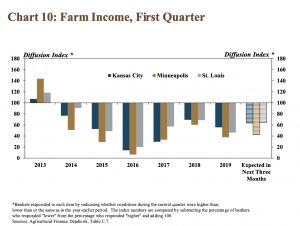

The Fed update also noted that, “According to Federal Reserve District Surveys, farm income declined for the sixth consecutive year. In the three Districts that collect information about changes in farm income, the pace of decline in farm income was slightly faster than a year ago.

“Nearly 70 percent of bankers in the Minneapolis District reported that farm income was lower than a year ago, a slightly higher share than the other Districts. Respondents in all Districts also were pessimistic about the prospects for farm income moving forward.”

Farmland Values

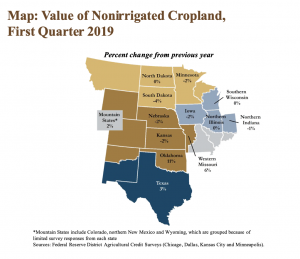

Turning to farmland values, Kauffman and Kreitman stated that, “Despite continued weaknesses in the farm economy and mounting agricultural credit stress, farmland values were relatively steady. Changes from a year ago were less than 3 percent in most states.

“The value of nonirrigated farmland increased moderately in Oklahoma and also increased slightly in Texas, states more heavily concentrated in energy production. Cropland values declined modestly in most other states.”

“The overall increase in financial stress in agricultural lending has remained relatively modest and stability in the value of farm real estate has remained an ongoing source of support,” the Fed report said.