A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Federal Reserve Ag Credit Surveys- 2019 Third Quarter Farm Economy Conditions

Last week, the Federal Reserve Banks of Chicago, St. Louis, Kansas City and Minneapolis released updates regarding farm income, farmland values and agricultural credit conditions from the third quarter of 2019. And earlier this year, the Federal Reserve Bank of Dallas released its Agricultural Survey for the third quarter of 2019. Today’s update highlights core findings from the Fed reports.

Federal Reserve Bank of Chicago

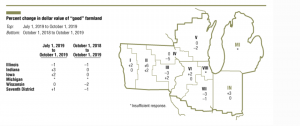

David Oppedahl, a Senior Business Economist at the Chicago Fed, explained in The AgLetter that, “In the third quarter of 2019, farmland values for the Seventh Federal Reserve District were down 1 percent from a year ago, despite signs of strength in some areas. Moreover, according to the 170 District agricultural bankers who responded to the October 1 survey, values for ‘good’ agricultural land were 1 percent higher in the third quarter of 2019 than in the second quarter.”

Noting variability among States, the Fed update indicated that, “Farmland values for Illinois and Wisconsin were down on a year-over-year basis (1 percent and 2 percent, respectively), while Indiana and Iowa farmland values were both unchanged from a year ago. The District’s agricultural land values were up 1 percent from the second quarter of 2019, although Illinois’s experienced a 1 percent quarterly decrease.”

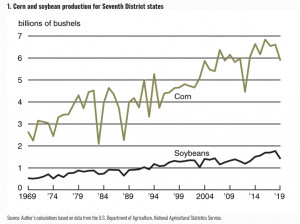

The AgLetter stated that, “Challenging weather conditions during planting, a touch of drought in the summer, excess precipitation during harvest, and early frost all hampered District crop production in 2019.”

“For the third quarter of 2019, the average price of corn was 16 percent higher than a year ago, based on USDA data, while the average price of soybeans was 5.7 percent lower than a year ago.

Still, given the reduced supplies of crops, the USDA recently raised its price forecasts for the 2019–20 crop year for both crops—to $3.85 per bushel for corn and $9.00 per bushel for soybeans. When calculated with these price estimates, the projected revenues from the 2019 corn and soybean harvests for District states would decrease from 2018 by 5.1 percent and 16 percent, respectively.

The Chicago Fed pointed out that, “In the third quarter of 2019, agricultural credit conditions for the District were yet again worse relative to a year ago.”

#Flood, #Drought and #Farming: AgLetter in Perspective November 2019, @ChicagoFed https://t.co/uLMl410AHl

— Farm Policy (@FarmPolicy) November 15, 2019

Mr. Oppedahl added that, “One responding banker from Indiana observed ‘an overall sense of unease among our farmers.’ Furthermore, a survey respondent from Illinois commented on ‘trade issues causing most of the uncertainty and stress’ among local bank customers.”

Federal Reserve Bank of St. Louis

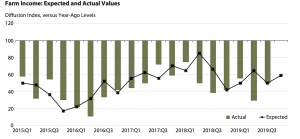

The Agricultural Finance Monitor stated on Thursday, “For the twenty-third consecutive quarter, a solid majority of bankers reported a decline in farm income compared with the same period a year ago.”

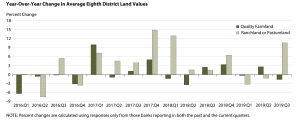

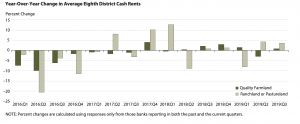

With respect to land values and cash rental rates, The Monitor noted that, “Quality farmland values fell 1.7 percent in the third quarter from a year earlier, and a slight majority of bankers expect farmland values to decline further over the next three months…[and]…cash rents for quality farm- land and for ranchland or pastureland rose modestly in the third quarter, but a majority of bankers expect rents to decline over the next three months.”

The St. Louis Fed also indicated that, “Proportionately more bankers reported a decline in the rate of loan repayment in the third quarter. Bankers reported that, compared with the second quarter, interest rates were lower across all loan types in the third quarter.”

Federal Reserve Bank of Kansas City

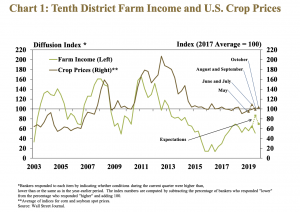

Nathan Kauffman and Ty Kreitman, writing in Thursday’s Ag Credit Survey from the Kansas City Fed, noted that, “Farm income in the region remained relatively weak and continued to decline, according to the Tenth District Survey of Agricultural Credit Conditions. Despite slightly higher crop prices and support from trade relief payments, farm income decreased compared with a year ago.”

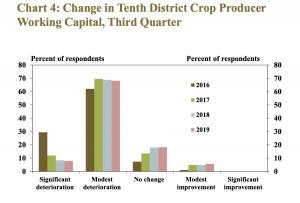

Thursday’s update stated that, “Ongoing reductions in farm income put further downward pressure on liquidity positions of crop producers. Working capital deteriorated at a modest pace throughout the District for the sixth consecutive year, but weaknesses were less severe than in prior years.”

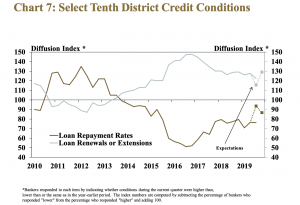

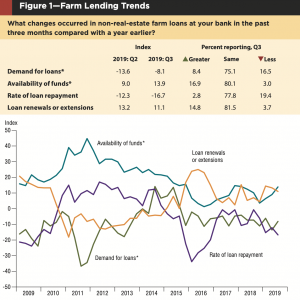

Kauffman and Kreitman also noted that, “The strain on farm finances in the District has led to steady deterioration of agricultural credit conditions. The rate of farm loan repayments continued to decline, at a pace similar to recent quarters, while the number of renewals and extensions remained high.”

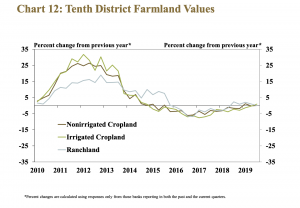

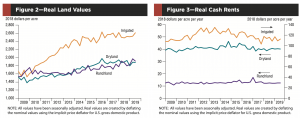

Turning to land values, the Kanas City Fed explained that, “Steady farmland values continued to provide support to farm finances amid an ongoing environment of weaker agricultural economic conditions. The values of all types of farmland (nonirrigated cropland, irrigated cropland and ranchland) remained similar to values a year ago.

Although land values, on average, have declined since 2015, the decrease has been modest relative to the sharp increases in preceding years.

“Moreover, farmland values have shown some signs of stabilizing since 2018.”

In summary, Thursday’s report stated that, “Bankers in the Kansas City Fed region expected agricultural credit conditions and farm income to continue to decline in coming months. Although numerous contacts indicated that government payments connected to ongoing trade disputes provided some support, most bankers pointed to an ongoing environment of low agricultural commodity prices and elevated costs as the primary factors contributing to the weakness. As profit opportunities have remained limited, borrower liquidity has continued to decline and most bankers expected a modest increase in asset liquidation. The stability of farm real estate values has continued to provide support to farm finances, and likely will be a key determinant of credit conditions in the year ahead.”

Federal Reserve Bank of Minneapolis

In last week’s Agricultural Credit Conditions Survey, the Minneapolis Fed noted that, “In contrast to recent years when bountiful harvests have offset some of the impact of low commodity prices, heavy precipitation throughout the growing season had a severe impact on crop production in the Ninth District this year. Meanwhile, low crop prices and trade woes didn’t let up on farmers from July through September 2019.”

Farm incomes fell relative to the same period a year earlier, according to lenders surveyed. Spending on capital equipment and farm household purchases also decreased. Falling incomes pushed the rate of loan repayment down, while renewals and extensions increased. Land values fell across district states, and interest rates on loans decreased from the previous quarter. The outlook for the fourth quarter is similar, with lenders in the district generally expecting farm incomes to decrease further.

Federal Reserve Bank of Dallas

Earlier this year, the Federal Reserve Bank of Dallas released its Agricultural Survey for the third quarter of 2019, which stated that, “Demand for agricultural loans continued to decline, with the loan demand index registering its 16th consecutive quarter in negative territory. Loan renewals and extensions continued to increase, and the rate of loan repayment declined to its lowest level since the end of 2016. With the exception of operating loans, which were mostly flat, loan volume fell across all major categories compared with a year ago.”

The Dallas Fed added that, “District irrigated cropland values picked up notably this quarter, while dryland values were stable and ranchland values declined moderately.”

“The anticipated trend in farmland values index was flat for a fourth consecutive quarter, suggesting respondents expect farmland values to hold steady,” The Survey said.