Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Federal Reserve: Observations on the Ag Economy- April 2020, COVID-19 Variables Noted

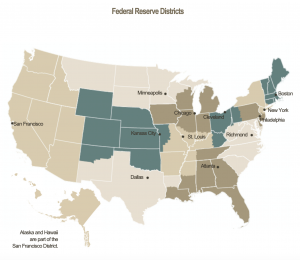

On Wednesday, the Federal Reserve Board released its April 2020 Beige Book update, a summary of commentary on current economic conditions by Federal Reserve District. The report included several observations pertaining to the U.S. agricultural economy.

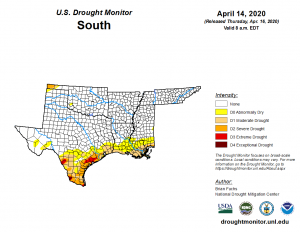

* Sixth District- Atlanta– “Agricultural conditions remained mixed. Most of the District remained drought free, with the exception of much of Florida and other parts of the Gulf coastal region, which experienced abnormally dry conditions.

“On a month-over-month basis, the March production forecast for Florida’s orange crop was down from both last month’s forecast and last year’s production while the grapefruit production forecast was down month-over- month but remained ahead of last year’s production. Contacts reported the COVID-19 pandemic has resulted in recent significant price increases for corn, rice, soybeans, milk and eggs, and an increase in demand for Florida oranges. Contacts also reported that some District states modified trucking weight and hour requirements in response to COVID-19, which has had a positive effect on getting product to market more quickly.”

* Seventh District- Chicago–

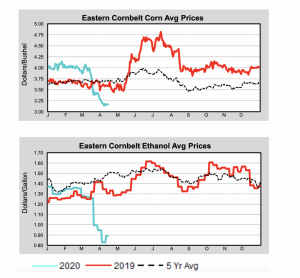

Income prospects for the agricultural sector deteriorated substantially as the spread of the coronavirus led to a dramatic fall in many commodity prices. A large drop in ethanol prices led ethanol plants to cut production and corn consumption, which pushed corn prices lower.

“The drop in ethanol production also reduced the availability of corn byproducts needed for nutritional balance in corn-based animal food rations.”

“This led livestock operations to switch to soymeal and helped support soybean prices. In spite of shortages of some meat products in stores, most livestock prices fell as demand from restaurants and other food service providers weakened. Milk sales declined substantially as schools closed, but egg prices spiked. Contacts expressed concern about the health and availability of agriculture workers, particularly for specialty crop production. Access to credit for farm operators was little changed, though loan requests increased.”

Change in Stock Market and #Livestock Prices Since the Beginning of 2020 (thru 04/13/2020) (#hogs, #cattle). pic.twitter.com/Y9Ctc7dL5p

— Farm Policy (@FarmPolicy) April 14, 2020

* Eighth District- St. Louis– “District agriculture conditions improved modestly from the previous reporting period. The number of acres planted in the District for corn, cotton, rice, and soybeans increased 8% compared with last year. All states in the District increased their number of acres planted as planting season in 2019 was severely affected by poor weather. Corn, rice, and soybeans were planted in greater quantities compared with last year. Southern parts of the District have planted fewer acres of cotton and more of rice.

“District contacts stated that the COVID-19 pandemic has had a relatively muted effect on the agricultural sector to date.

Several contacts reported that farmers and agricultural suppliers do not have current plans to reduce output or employment at this time.

“Contacts cited continued trade disputes with China, weather, commodity prices, and deteriorating credit conditions as sources of uncertainty for the industry.”

* Ninth District- Minneapolis– “District agricultural conditions were steady at low levels. Some contacts described the COVID-19 pandemic as a potential ‘perfect storm’ for an already struggling rural economy. Early reports suggested that District farmers intended to plant less wheat and more corn and substantially more soybean acres this year.”

* Tenth District- Kansas City– “Agricultural economic conditions weakened in March.

Macroeconomic developments related to COVID-19 were expected to put downward pressure on prices for many agricultural commodities, despite sharp increases in short-term demand for retail food products.

“Cattle prices declined rapidly in mid-March which reduced profit opportunities for producers. Corn prices also decreased sharply as demand declined alongside a substantial drop in ethanol production.

Low demand batters U.S. ethanol after industry hit with a production glut. Insights via @CMEGroup pic.twitter.com/FjvkzKMy1r

— QuickTake by Bloomberg (@QuickTake) April 15, 2020

“Credit conditions weakened modestly from the prior survey period, and while many farm lenders cited uncertainty about the extent of the impact, most expected conditions to deteriorate further in coming months. Contacts connected to food processing and retailing reported supply chains have been well maintained despite rapid increases in demand.”

* Eleventh District- Dallas– “Recent rainfall remedied drought conditions across most of the district.

“Wheat demand and prices rose due to increased purchases of breads and pastas during the coronavirus pandemic. Contacts expect some farmers will switch away from cotton to wheat or other grains this year, as cotton prices have plummeted and could slip further as people pare back discretionary spending on clothing. On the livestock side, pasture conditions were favorable and prices for cattle ready for feedlots rose because of pandemic-related increased demand for beef. Meat-packers have seen higher revenues in recent weeks as grocery stores increased orders and beef and chicken prices have risen.”

* Twelfth District- San Francisco– “Activity in the agriculture sector slowed somewhat as growers grappled with disruptions due to the COVID-19 outbreak. Several contacts noted that most agriculture businesses in states with shelter-in-place orders, like California and Washington, were designated as ‘essential’ and allowed to continue operations. Therefore, some farming contacts in Central California and Eastern Washington reported that activity was broadly stable, sales to grocery stores were solid, and production inputs and labor supply were generally available. However, a bulk food producer and distributor noted that starting in mid-March sales to restaurants across the District were virtually nonexistent. Washington fruit growers and Idaho corn growers saw a noticeable decline in domestic demand, which has severely jeopardized profitability for some businesses. A contact in Eastern Washington noted that production could be disrupted if the flow of migrant workers from Mexico is impacted by restrictions on Mexico-U.S. border crossings. On the export side, fruit and nut growers in California have seen continued weak demand from China, though wheat growers in Idaho saw an increase in new orders from China in the past few weeks. In general, contacts noted that the strong dollar also hampered export sales.”