A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Amid Phase One Frustration, China Asks Food Companies To Boost Commodity Supplies as COVID-19 Fears Linger

David J. Lynch reported on the front page of Saturday’s Washington Post that, “President Trump on Friday linked China’s handling of the initial coronavirus outbreak with his irritation over slow progress toward implementing the trade deal he signed with Beijing in January, saying ‘it’s not like we’re thrilled‘ with the Chinese government.

The president grimaced and refused to respond when a reporter asked if he might reimpose tariffs on Chinese goods or tear up the deal. ‘I don’t want to talk about it,’ he said.

The Post article stated that, “Before later leaving for Camp David, the president again displayed his annoyance in a cryptic remark. ‘The trade deal, I don’t know,’ he said. ‘Somehow, I lost a little flavor for it.’

“‘No! Absolutely not,’ Kudlow told reporters outside the White House. ‘They’re a little slow on the commodity purchases. I think that has to do with market and economic conditions. … But with respect to the trade deal, it is continuing absolutely.'”

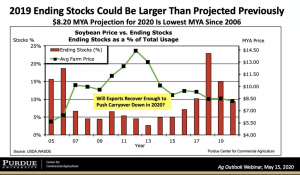

Mr. Lynch explained that, “Trump, who earlier this week ruled out renegotiating the deal, said he still expects China to buy the $200 billion in goods and services it promised. The president had threatened to ‘terminate’ the deal if China did not deliver. But for now, he seems inclined to confine his response to public grumbling while counting on an export surge later this year — even though some experts say it is now impossible for China to meet the deal’s targets.”

Saturday’s article reminded readers that, “Amid rising doubts about the deal, U.S. Trade Representative Robert E. Lighthizer and Treasury Secretary Steven Mnuchin released a statement following a May 7 call with Chinese Vice Premier Liu He, saying that ‘both countries fully expect to meet their obligations under the agreement in a timely manner.'”

Chris Buckley and Steven Lee Myers reported on the front page of Saturday’s New York Times that, “‘Evil.’ ‘Lunacy.’ ‘Shameless.’ ‘Sick and twisted.’ China has hit back at American criticism over its handling of the coronavirus pandemic with an outpouring of vitriol as acrid as anything seen in decades.

“The bitter recriminations have plunged relations between China and the United States to a nadir, with warnings in both countries that the bad blood threatens to draw them into a new kind of Cold War.”

The Times article added that, “While the hostility has so far been mostly confined to words, there are warning signs the relationship could worsen.

The trade truce that Mr. Trump and his Chinese counterpart, Xi Jinping, reached in January could fall apart, despite recent pledges to keep to its terms. Other tensions, including those over Taiwan and the South China Sea, are also flaring.

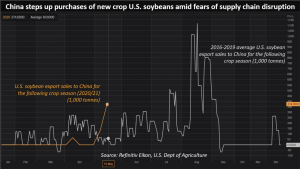

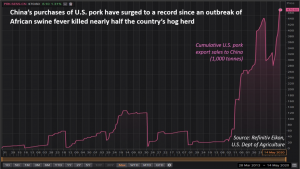

However, Bloomberg News reported late last week that, “China is buying more U.S. goods as well. State-owned buyers have purchased more than 1 million metric tons of American soybeans in the past two weeks. Beijing this week also added more U.S. products, including aircraft radar and medical disinfectant, to a list of goods exempt from tariffs and began allowing imports of fresh American blueberries.

“None of that means Trump’s musing should be discounted of course. But with the U.S. presidential election just six months away and political maneuvering in high gear, the old adage about actions speaking louder than words seems to ring truer than ever.”

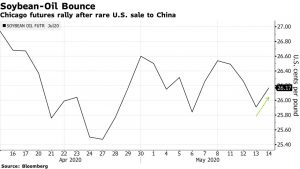

And Bloomberg writer Michael Hirtzer reported last week that, “China’s shopping spree of U.S. agriculture goods has extended to a rare purchase of soybean oil.

“The Asian nation is the world’s top soybean importer and crusher. That’s why a sale of 20,000 metric tons of U.S. vegetable oil that was announced Thursday is a bit of an outlier. It’s the biggest such deal since November 2016.”

Meanwhile, Reuters writers Naveen Thukral and Hallie Gu reported on Sunday that, “China has asked trading firms and food processors to boost inventories of grains and oilseeds as a possible second wave of coronavirus cases and worsening infection rates elsewhere raise concerns about global supply lines.

“Both state-run and private grain traders as well as food producers were urged to procure higher volumes of soybeans, soyoil and corn during calls with China’s Ministry of Commerce in recent days, three trade sources told Reuters.”

The Reuters article noted that, “‘There is a possibility of a breakdown in supply pipelines due to the coronavirus infections. For example, a port of origin or destination might shut down,’ said a senior trader at one of China’s leading food processors, which was on a call last week with authorities to discuss purchases.

“‘They have advised us to increase stocks, keep supplies higher than we usually have. Things are not looking good in Brazil,’ he added, referring to China’s main supplier of soybeans and a key meat exporter where the number of coronavirus cases has surpassed those in Spain and Italy.”

‘One of the main concerns is how the epidemic in South America might impact supplies (of beans) to China,’ the source said.

Thukral and Gu indicated that, “China’s state-owned agriculture conglomerate COFCO and grain stockpiler Sinograin have been stepping up purchases of U.S. soybeans and corn in recent weeks.”

The Reuters writers also pointed out that, “‘The effort is to build supplies, not just from Brazil, but from all over,’ said the senior trader at the food processing company. ‘U.S. beans are looking attractive from September onwards,’ he added.

“U.S. crop export sales data show that Chinese buyers have accelerated soybean purchases of the upcoming crop, with new crop bookings of 374,000 tonnes already registered, compared with an average of 60,000 tonnes for this period since 2016.”