A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Cause for Concern? Government Programs Increasingly Important Part of Farm Income

DTN Ag Policy Editor Chris Clayton reported last week that, “The American Farm Bureau Federation on Wednesday sent a detailed list of recommendations to Congress to help farmers, stating that even though lawmakers had provided earlier aid, more is needed because of economic losses facing the industry.

“AFBF stated ‘The economic losses across the U.S. agriculture sector are broad-based, directly impacting farmers and ranchers and their supply-chain partner — from input providers to end users.'”

Mr. Clayton pointed out that, “USDA’s Coronavirus Food Assistance Program (CFAP) kicked off in late May with $16 billion in aid to producers. That program already has paid out about $1.4 billion to 80,200 producers. USDA will have another $14 billion available to tap in the Commodity Credit Corp. in early July.

“The National Corn Growers Association [NCGA] also released an analysis Wednesday projecting losses at $49 an acre for the 2020 crop. At 89.6 million acres harvested — based on USDA’s [May] monthly estimate — that would translate into just under $4.4 billion in lost revenue for corn growers in the 2020 crop.”

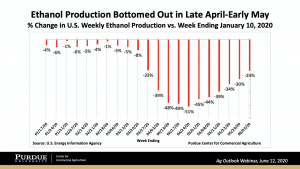

The DTN article added that, “The [NCGA] analysis states the average per-bushel price for corn has fallen 50 cents a bushel for the 2020 crop to $3.20 a bushel because COVID-19 and its related impacts on ethanol demand.”

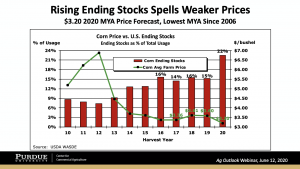

Meanwhile, Wall Street Journal writer Kirk Maltais reported on Thursday that, “A strong planting season for U.S. corn is expected to lead to a record-high supply, as demand for the crop remains muted thanks to the fallout from the coronavirus pandemic.

“Ending stocks of corn—unsold corn left over after the marketing year is done—are expected to total 3.32 billion bushels in 2020-21, the U.S. Department of Agriculture said in its monthly supply and demand estimate report Thursday. That figure is 58% higher than last year’s ending stocks, according to USDA data.”

The Journal article noted that,

Many farmers peg the break-even price for their corn crops at $3.20 per bushel, but some grains traders anticipate that the high supply figures will cause prices to sink to as low as $2.70 per bushel. That would be the lowest corn has traded at since 2006.

Also last week, Reuters writers Laila Kearney and Karl Plume reported that, “Farming, the state’s [North Dakota] biggest industry and responsible directly or indirectly for nearly a quarter of all its jobs, is in a prolonged downturn, North Dakota Agriculture Commissioner Doug Goehring said. The sector has suffered a string of crises in the past three years, from low prices due to global oversupply to crop-damaging storms and the U.S. trade war with China. North Dakota typically sells about two-thirds of its soybean crop to China, but those sales have been curtailed since 2018 due to the trade war.

“North Dakota’s farmers are cutting spending and hoarding grain instead of selling at loss-making prices, with spring stockpiles of corn and soybeans reaching the second highest on record for the state.”

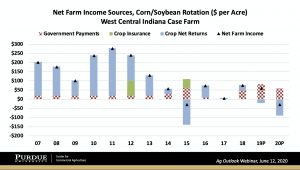

In a column on Saturday, Pat Westhoff, the director of the Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri, explained that, “The COVID-19 crisis has had profound effects on the farm and food sectors. In addition to its impacts on everything from where we buy our food to the price of farm commodities, it has made the financial health of the farm sector more dependent on government programs.”

Citing FAPRI’s recent baseline update, Dr. Westhoff stated that,

Our new estimates indicate that the government is on track to spend more on programs to support the agricultural sector than ever before, even as farm income declines.

Recent forecasts show that U.S. farm income may be down only slightly in 2020. But, the chart below highlights one concern that likely will be relevant again in 2021. Profit margins have trended lower while direct government payments have increasingly mitigated the weaknesses. pic.twitter.com/2KiU1VQdyJ

— Nathan Kauffman (@N_Kauffman) June 12, 2020

“In spite of this record level of government spending on agriculture, we estimate that farm income will decline in 2020…[and]…Without additional rounds of special payment programs, we project that 2021 net farm income could fall by an additional $11 billion. Rapidly changing circumstances mean that all of these projections could be overtaken by events, but it seems likely that government support programs will continue to be very important for the financial health of the farm sector for some time to come,” Dr. Westhoff said.

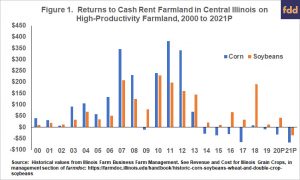

And University of Illinois agricultural economist Gary Schnitkey noted in a farmdoc daily article last week that, “Federal aid in the form of Market Facilitation Program (MFP) and Coronavirus Food Assistance Program (CFAP) payments have increased returns and the financial stability of grain farms in 2018, 2019, and likely in 2020. However, corn and soybean returns have been low since 2013, when the growth of corn use in ethanol plateaued. Recent declines in soybean exports have worsened returns.

“The uses of corn and soybeans must grow in the future if corn and soybean returns are to reach higher levels. If uses do not increase, a combination of two items will need to occur: 1) financial aid and intervention from the Federal government will need to continue, or 2) farmers will need to make financial adjustments as well as lower cash rents. These factors are illustrated by evaluating time trends of corn and soybean returns and then associating return periods with corn and soybean use.”