The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

China Continues to Buy American Soybeans

Bloomberg writer Isis Almeida reported on Wednesday that, “China continues to buy American soybeans despite worsening rhetoric from President Donald Trump over Hong Kong.

“State-run and private buyers have purchased at least 10 cargoes this month, with three being sold overnight, according to people familiar with the matter, who asked not to be named because the deals are private. China will need the supply and U.S. prices are attractive for cargoes delivered after the harvest.

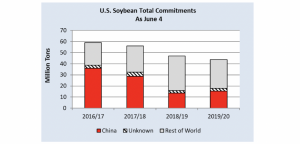

Last week saw the biggest combined sale (old+new crop) of U.S. #soybeans so far this marketing year (largest since Dec. 2018). Total of 2.22 mmt, some 39% of that to #China, and 39% to unknown (very likely a lot/most to China). pic.twitter.com/LYvMldlb7t

— Karen Braun (@kannbwx) June 11, 2020

“The deals offer respite to markets concerned about the return of trade disruptions as the countries have been exchanging blows over everything from the origins of the coronavirus to new security legislation in Hong Kong.

The chief financial officer of Archer-Daniels-Midland Co., one of the world’s top agriculture commodity traders, said the phase one deal is still ‘on track.’

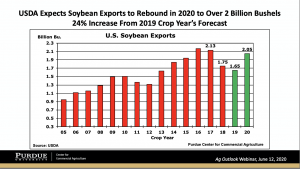

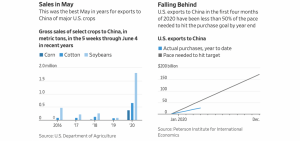

Ms. Almeida explained that, “China pledged to buy $36.5 billion in American agricultural goods in 2020, but has only purchased $4.65 billion in the first four months of the year, fueling speculation coronavirus disruptions mean it can no longer meet its phase one obligations. ADM’s [CFO Ray Young] said he is expecting a ‘very strong’ fourth quarter for U.S. exports to China.

“‘When we talk to different officials within both sides of the governments, right, whether it be the U.S. side and the China side, clearly, there’s a commitment towards making sure that we honor the phase one part of the trade agreement, particularly the agricultural commitments,’ he said. ‘My viewpoint is that U.S.-China trade, we still believe this is on track.'”

Also last week, Reuters writer Karl Plume reported that, “U.S. exporters reported sales of 720,000 tonnes of soybeans to China, the U.S. Department of Agriculture (USDA) said on Thursday, as active purchases by the world’s top soy importer continued for a second straight week.

“The USDA confirmed the sales after reporting that weekly U.S. soybean export sales last week were the largest in at least 16 months, with the majority slated for shipment to China or undisclosed destinations widely believed to be China.”

Mr. Plume pointed out that, “China has been ramping up U.S. soybean purchases as supplies in Brazil, China’s top soy supplier, are tightening and Brazil’s strengthening currency has driven up prices.”

A weaker dollar could lift soybean prices as U.S. farmers look to stay competitive. Insights via @CMEGroup pic.twitter.com/ooP2jhZWA3

— Bloomberg QuickTake (@QuickTake) June 10, 2020

And Josh Zumbrun reported on the front page of Monday’s Wall Street Journal that, “China has retaken its mantle as America’s largest trading partner, emerging as a rare bright spot for U.S. farmers and other exporters as the coronavirus pandemic constrains global commerce.”

The Journal article noted that, “U.S.-China trade remains well below the record $61.4 billion set in October 2018, and economic fallout of the coronavirus pandemic has cast doubt on China’s ability to meet ambitious purchase targets set in the trade accord. China is nonetheless the only major world economy likely to post positive growth this year, according to a recent World Bank forecast.”

Mr. Zumbrun stated that, “Despite the rise, China is so far not on pace to meet purchase terms under the trade pact, which specifies that it increase purchases of U.S. goods and services by $200 billion over 2017 levels over a two-year period.”

The Journal article also pointed out that, “U.S. farmers felt the brunt of the trade war, as China retaliated against U.S. tariffs by scaling back purchases of soybeans, corn and other farm exports.

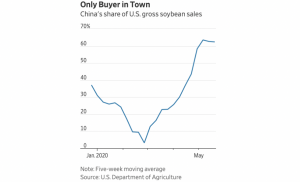

In recent months, however, China has boosted its purchases of crops like corn, wheat and soybeans to higher levels than before the trade war. And China has emerged as a more pivotal buyer than ever—in the five weeks through June 4, for example, China purchased about two-thirds of all gross sales of U.S. soybeans.

Private exporters report sales of 390,000 MT of #soybeans for delivery to China during MY 2020/2021. https://t.co/Ka2HGPCMXL

— Foreign Ag Service (@USDAForeignAg) June 15, 2020

“To be sure, even with the economic benefits of the refreshed relationship with China, the massive shortfall in the Chinese purchase targets could present a growing quandary for the Trump administration if the aggressive two-year purchase targets aren’t met.”