Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

U.S. Corn and Cotton to China, But Buying Pace Needs a Big Boost to Meet Phase One Pledges

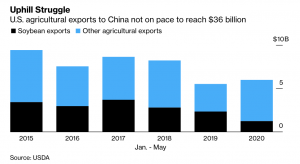

Bloomberg writers Michael Hirtzer and Dominic Carey reported last week that, “While U.S. shippers sent sizable orders of wheat, corn, cotton, pork and other agriculture goods to China in May, China would need to pick up the buying pace further to meet its trade-deal pledges.

“Wheat and corn monthly shipments were each the largest in more than a year, according to U.S. government data, as Beijing seeks to meet buying targets laid out in the U.S.-China trade deal signed in January that promised $36.5 billion in purchases. Still, even with the boost in grain sales, China was on pace to buy only about $27 billion, according to the Peterson Institute for International Economics’ trade-deal tracker.”

The Bloomberg writers explained that, “Soybeans traditionally were the highest-value U.S. agriculture export to China. Through May, exporters sent 3.4 million metric tons of U.S. soybeans to China, in deals valued at about $1.25 billion.

“However, buyers have purchased nearly 7 million tons of soy to be shipped in the current season that ends on Aug. 31 and during the next season that begins on Sept. 1, according to U.S. Department of Agriculture data. Next season’s total is the highest for this time of year since 2014, the data show.”

US ag exports to China through May. Need a big boost to hit 2017 levels. Soybean sales through June 25 will help but a lot more will be needed. pic.twitter.com/qX5qcgIPI7

— JoeGlauber--IFPRI (@JoeGlauber1) July 2, 2020

On Monday, Wall Street Journal writers Lingling Wei and Bob Davis reported that, “As senior U.S. and Chinese economic officials plan to discuss China’s compliance with a trade deal signed early this year, more than 40 American business groups called on Beijing to step up purchases of U.S. manufactured goods as well as energy and other products as part of the agreement.

“In a letter sent Monday to Treasury Secretary Steven Mnuchin, U.S. Trade Representative Robert Lighthizer and Chinese Vice Premier Liu He, the business associations, led by the U.S. Chamber of Commerce, voiced strong support for the ‘Phase One’ trade pact but pressed both sides—especially China—to ‘redouble efforts to implement all aspects of the Agreement.'”

The Journal writers noted that,

Beijing has focused on agricultural purchases, which President Trump made the core of his demands during two years of negotiations. Chinese officials believe that if they keep ramping up such purchases, that will help keep the deal alive, according to people with knowledge of Beijing’s thinking.

The Journal article also explained that, “Since the signing of the agreement, however, relations between the two world powers have strained further. The Trump administration is challenging the Chinese leadership under President Xi Jinping over a host of issues, ranging from its handling of the coronavirus outbreak, to Beijing’s tighter rule over Hong Kong, its repression of Uighurs in Xinjiang in western China and military maneuvers in the South China Sea.

“For now, the trade deal, however limited, is emerging as one of the few channels through which both sides are engaging with each other. U.S. and Chinese negotiators led by Messrs. Lighthizer and Liu plan to have a phone conversation in mid-August to assess the deal’s implementation, according to people familiar with the matter.”

U.S. #agricultural exports, year-to-date and current months, https://t.co/V85OpkE44w @USDA_ERS

— Farm Policy (@FarmPolicy) July 6, 2020

* Agricultural export volume.

* #Wheat, #corn, #soybeans. pic.twitter.com/NeuuoEEdFp

“While China has recently stepped up its purchases of made-in-the-U.S. chicken feet, pork and other farm products, it remains a long way from meeting the targets, partly because of reduced demands during the pandemic,” the Journal article said.

Top 10 U.S. #export markets for #soybeans by volume, https://t.co/V85OpkE44w @USDA_ERS (#China). pic.twitter.com/vuVqgRt8PB

— Farm Policy (@FarmPolicy) July 6, 2020

Meanwhile, a report late last month from USDA’s Foreign Agricultural Service (“China: Oilseeds and Products Update“) stated that, “China’s swine sector recovery and poultry production growth are expected to push up soybean meal use for feed during the coming marketing year. Soybean imports are forecast at 91 million metric tons (MMT) in marketing year (MY) 20/21 and estimated at 90 MMT in MY 19/20. Domestic soybean production is forecast to reach 18 MMT in MY20/21 in response to a stable subsidy rate and higher soybean prices during the sowing months in 2020.”

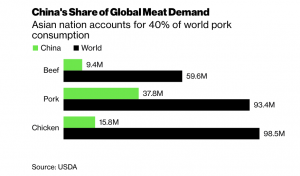

With respect protein export variables, Bloomberg News reported this week that, “China’s pork consumption this year may drop by about 35% when compared with normal levels, before the pandemic and outbreaks of African swine fever, said Lin Guofa, a senior analyst at Bric Agriculture Group, a Beijing-based consulting firm. The country accounts for 40% of global pork demand.

“Pan Chenjun, a senior livestock analyst with Rabobank, forecasts a similar decline. Higher prices, lower supply, Covid-19, and food-safety concerns are the major reasons behind the drop, she said in an email. The nation’s meat imports, which have helped to make up for deficits left from swine fever’s impact, may have peaked in the first half of the year, she said.

“‘Global supply is full of uncertainty for the rest of the year,’ she said.”

And on Wednesday, Financial Times writers Sun Yu, Emiko Terazono and Bryan Harris reported that, “Since mid-June, Beijing has suspended imports from 14 pork, poultry and beef plants in countries including the US, Brazil, the Netherlands, Germany and Canada, while another seven plants, including those in Argentina, UK and Italy, have voluntarily stopped shipments to China.

“As a result, Chinese pork prices have rebounded by almost 50 per cent since this year’s low in May.”

The FT article stated that, “China has been rebuilding its pig herds after mass culls to tackle the spread of African swine fever, a virus which is deadly to pigs but cannot be transmitted to humans. However, the sector has suffered fresh outbreaks and, as a result, analysts expect domestic meat suppliers will struggle to meet demand.

“Despite this, Chinese officials moved to tighten regulations on food imports after the virus was detected on cutting boards used to prepare imported salmon at Beijing’s Xinfadi market in June. Foreign exporters are now required to sign a document pledging food safety and submit to more inspections.”