China, the world’s largest soybean importer, has ramped up orders for Brazilian cargoes of the oilseed after meeting an initial shipment volume from the US as part of a trade…

China: Corn Crop Impacted by Adverse Weather, as U.S. Wheat and Soybean Exports Increase

Reuters writers Hallie Gu and Gavin Maguire reported on Wednesday that, “China’s corn crop is expected to fall by up to 10 million tonnes, or nearly 4%, from the latest government estimates after heavy wind and rains toppled crops in major production areas in the northeastern cornbelt, analysts said.

“Expected production losses have pushed Chinese corn futures to a record high and stoked worries over supply shortages in the world’s second-largest consumer of the grain after it ran down once-mammoth state stockpiles and boosted imports.

‘We think that corn output in the northeastern region would fall 5-10 million tonnes this (crop) year,’ said Zhang Dalong, analyst with COFCO futures, referring to the latest output estimate from the Ministry of Agriculture for the 2019/20 crop year of 260.7 million tonnes.

The Reuters article explained that, “Three typhoons buffeted China’s main corn belt of the provinces of Heilongjiang, Jilin, Liaoning and the Inner Mongolia region in late August and early September, flattening plants and flooding fields just as the corn crop reached maturity.”

If this proves correct, corn imports by China could surge well beyond current expectations in 2020/21... https://t.co/ZdGmw2tqCd

— Abdolreza Abbassian (@Abbassian_AMIS) September 16, 2020

“The crop losses come just as demand strengthens from a fast recovering meat production industry, fanning concerns about potential feed-sector shortages,” the Reuters article said.

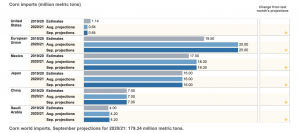

Meanwhile, this month’s Feed Outlook report, from the USDA’s Economic Research Service (ERS), pointed out that, “Corn feed use for China is projected larger for the second consecutive year – up 3.0 million tons for 2019/20 and up 2.0 million tons for 2020/21, a 1.6 percent increase year-over-year. The robust demand for feed grains is coming from the quickly recovering hog industry recently affected by the African Swine Fever (ASF) and the COVID-19-related reduction in consumer demand. Grains such as corn, barley, wheat, sorghum, and oats have traditionally supplied energy to animal feedstock—while protein has come from meals produced from oilseeds such as soybeans. Those two components of feeding are in general highly correlated. There are current indications of higher than expected SME (soybean meal equivalent) protein consumption, suggesting augmented grain (corn) feeding.”

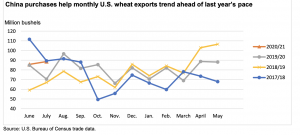

And with respect to wheat demand variables and China, ERS noted in its Wheat Outlook report this week that, “This month, the U.S. Bureau of the Census released trade data through the month of July, indicating wheat exports are up nearly 13 million bushels above the 4-year average. The USDA, Foreign Agricultural Service weekly sales reports further indicate that commitments through the end of August have totaled 45 percent of the marketing year forecast, compared with 42 percent the year prior. While the Philippines is now the number one export market for U.S. wheat, China has been entering the U.S. marketing with significant recent purchases, helping export sales and commitments to exceed last year’s pace.”

The Wheat Outlook added that, “U.S. sales have been buoyed by China’s creation of a Tariff Rate Quota (TRQ) for wheat totaling 9.64 million metric tons (354.2 million bushels). This TRQ is not required to be filled with purchases of U.S. wheat, however, calendar year-to-date, China commitments to purchase U.S. wheat have totaled 1.47 million metric tons, second only behind the Philippines.

In the 2020/21 marketing year, despite U.S. wheat often not being the most price-competitive, China has continued to make significant purchases.

“On July 10, China purchased 190,000 metric tons of HRS and 130,000 metric tons of HRW followed by smaller purchases by Chinese Taipei towards the end of both July (98,200 metric tons) and August (net nearly 100,000 metric tons).”

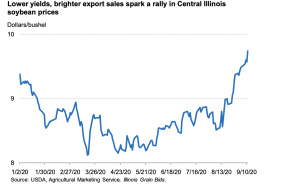

Regarding soybeans, ERS indicated in this month’s Oil Crops Outlook report that, “A recent rally in soybean prices reflects the yield deterioration as well as an acceleration of export sales.

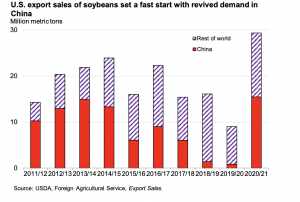

“As of September 3, U.S. export sales commitments of soybeans total 29.9 million metric tons (1,098 million bushels). Exporters have booked record high sales for this date that are nearly four times the level of a year earlier. Revitalized U.S. sales to China are primarily responsible for the gains.

“A resurgence in soybean exports is forecast for 2020/21 to 2.125 billion bushels from a revised 1.68 billion in 2019/20.”

The ERS Outlook added that, “USDA’s forecast of the 2020/21 average farm price is raised to $9.25 per bushel from $8.35 last month.”