As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Ag Lender Survey: Liquidity, Income and Leverage Are Top Concerns

A news release this week from the American Bankers Association (ABA) stated that, “As the farm economy continues to work through a prolonged downturn in the midst of an unparalleled, global economic dislocation, ag lenders remain focused on credit quality, according to the Fall 2020 Agricultural Lender Survey report produced jointly by the [ABA] and the Federal Agricultural Mortgage Corporation, more commonly known as Farmer Mac.

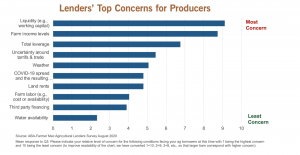

When it comes to their customers, lenders continue to be most concerned about liquidity, income and leverage.

“Uncertainty regarding tariffs and trade, the weather, and the impacts of COVID-19 and the resulting economic downturn are close behind.”

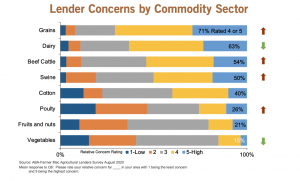

The ABA release explained that, “The agricultural economy and farm income remained stressed in 2020. On average, lenders reported that just under 51% of their agricultural borrowers were profitable in 2020, down from 57% last year. About half of the lenders surveyed did not expect borrower profitability to improve in 2021 at the time of this survey. Respondents expressed the most concern for the grain, dairy and cattle sectors. Lender concerns for vegetables, poultry, and fruits and nuts declined compared to the previous survey results.

“According to the survey results, banks that have been more heavily impacted by COVID-19 loan modifications also reported lower producer profit expectations. Many institutions reported modifying ag borrower loans due to either the coronavirus or the resulting economic turbulence. Of the banks that indicated that they had modified at least a quarter of their agricultural loan portfolio as a result of the pandemic, 46% reported average profit expectations for 2020. For banks that had modified less than 10% of their agricultural loans as a result of the pandemic, average profit expectations were just over 53%.”

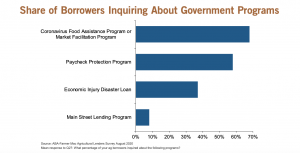

With respect to government payments, the ABA Survey stated that,

Lenders also note increasing reliance on government payments, such as those from the Market Facilitation Program (MFP) and the Coronavirus Food Assistance Program (CFAP).

“Nearly nine in 10 lenders (87.4%) across regions and asset size observed an increase in reliance on government payments during the past 12 months. Lenders expect this trend to continue next year: one in five expect that borrowers’ current reliance will stay about the same in 2021, while 77% expect reliance to rise.”

The Survey added that, “Lenders indicate that the loss of MFP or CFAP payments would negatively impact ag borrowers, with many noting the MFP payments in particular helped farmers maintain profitability in 2020. One respondent said, ‘it would be devastating to our already stressed customers.’ Another noted that it ‘would probably put many out of business this year.'”

Meanwhile, Bloomberg writer Kim Chipman reported on Tuesday that, “Separately, the Federal Reserve Bank of Kansas City had some more positive news for farm lenders last week.

“About 55% of agricultural bankers throughout the district — which includes Kansas, Colorado, Nebraska, Oklahoma, Wyoming, and parts of Missouri and New Mexico — reported lower incomes in the third quarter than a year ago. That compares with 75% in the second quarter, according to the Kansas City Fed.

“Higher agriculture commodity prices late in the quarter, along with direct government payments, ‘led to more optimistic expectations about changes in farm income through the end of the year,’ the bank said in its Nov. 12 report.”