As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

As 2021 Begins, Some Ag Commodity Prices Climb, Including Corn and Soybeans

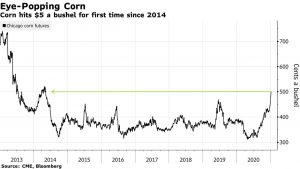

Bloomberg writers Kim Chipman and Megan Durisin reported on Wednesday that, “Soybean futures in Chicago extended their winning streak for a sixth day and corn exceeded $5 a bushel on expectations that the U.S. will cut domestic supply forecasts for the crops.

“The oilseed touched a six-year high and may still be under-priced due to the severe tightness of U.S. stockpiles, according to Rich Nelson, chief strategist at Allendale Inc. While corn isn’t seeing as extreme a shortage, soy bullishness will bolster the grain, he said. Meanwhile, farmer protests and dry weather in South America could further tighten supplies.”

The Bloomberg article noted that, “The U.S. Department of Agriculture is likely to reduce its domestic corn stock outlook in its next crop report on Jan. 12. That’s ‘great news’ for markets, and will support about $4.90 a bushel for the grain, Nelson said in a telephone interview.

“Meanwhile, crop giant Cargill Inc. said Wednesday that the global soybean rally still has further to go as the world needs higher prices to curb demand.”

Another Double-Digits Gain for the #Soybean Market Tuesday, https://t.co/NvYsivphTD pic.twitter.com/C4Zwt3bJY4

— Farm Policy (@FarmPolicy) January 5, 2021

Corn and soybean prices at a great place to make some sales, pay down debt and be well positioned for 2021.

— Nathan Kauffman (@N_Kauffman) January 6, 2021

The strength in the corn and soybean markets follows a steady increase in prices that began around August.

With respect price increases for 2020, Reuters News reported earlier this week that, “Corn ended up 24.8% for the year and soybean prices climbed 37.2% from a year ago. Wheat added 14.6%.”

Weekly Livestock, Poultry & #Grain Market Highlights, https://t.co/wnR9OVBc0a @USDA_AMS

— Farm Policy (@FarmPolicy) January 5, 2021

* Central #Illinois average #corn and #soybean prices.

* Change from year ago:

- Corn up 25%

- Soybeans up ~42% pic.twitter.com/JVVonjffPd

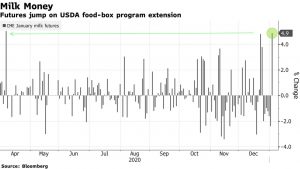

Meanwhile, Bloomberg writer Michael Hirtzer reported on Tuesday that, “The latest extension of a U.S. food aid program is lifting dairy prices and raising prospects of a boost in milk production in the coming months.

“Benchmark Class III futures for milk used to make cheese jumped 4.9% on Tuesday in Chicago in their biggest gain since April after the U.S. Department of Agriculture expanded its Farmers to Families Food Box Program. The USDA will buy $1.5 billion worth of food including produce, beef, pork, seafood, milk and cheese to distribute across the country, U.S. Secretary of Agriculture Sonny Perdue said Monday in a statement.”

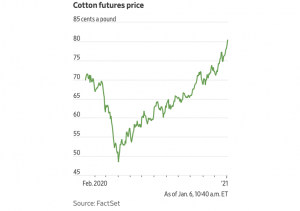

And Kirk Maltais, writing in Tuesday’s Wall Street Journal, reported that, “Cotton prices have risen to their highest level in nearly two years thanks to dry weather that has shrunk the crop and concerns of forced labor in China that have made a big chunk of the nation’s fiber output off-limits to clothing makers.”

The Journal article added that, “A lack of rainfall in key growing regions has reduced expectations for the current crop. The International Cotton Advisory Committee last month trimmed its estimates for the global harvest by about 1%. The U.S. Department of Agriculture expects the smallest domestic crop in five years.”

#WSJWhatsNow: Cotton prices have risen amid dry weather and concerns of forced labor in China https://t.co/wshU7SGZFx pic.twitter.com/0vYhg6kL3D

— The Wall Street Journal (@WSJ) January 5, 2021

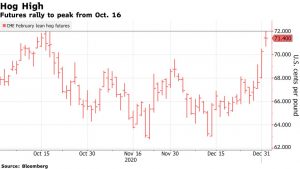

And on Monday, Bloomberg writers Michael Hirtzer and Isis Almeida reported that, “The blistering rally in global animal-feed markets is beginning to spill into the pandemic-battered U.S. hog sector.

“Chicago hog futures rose nearly 7% in the past four sessions to reach the highest since October, while U.S. Department of Agriculture data showed U.S. pork prices prior to the New Year’s Day holiday jumped 8.2%, the most since September.”

The Bloomberg article pointed out that, “The gains are a turnaround from 2020, when the spreading coronavirus sickened meat-plant workers and prompted shutdowns at pork facilities. The increase comes as corn and soy markets surged to six-year peaks amid dry weather for crops in South America and soaring demand for hog feed in China. With China’s herd recovering from the African swine fever outbreak, sales by the Asian nation’s biggest hog breeder increased by 75% in 2020.”