As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

China “On Course” to be World’s Top Corn Importer, as Biden Administration “Reviews” Phase One Deal

Last week, Reuters writers Mark Weinraub and Karl Plume reported that, “China booked its biggest purchase of U.S. corn yet, the U.S. Agriculture Department said on Friday, buying more at once than any country except the Soviet Union 30 years ago, as it tries to meet a surge in demand for animal feed.

“The purchase, and a string of deals earlier this week, mean China is on course to become the world’s largest corn importer.”

Today’s daily export sale of 2,108,000 MT of corn to China is the 2nd-largest daily corn sale on record since reporting began in 1977. This sale brings total daily sales of corn for the week of 1/25/21 to 5,848,000 MT. See the top 10 daily export sales at https://t.co/L5lKa4aOGZ. pic.twitter.com/cnZp4yISYW

— Foreign Ag Service (@USDAForeignAg) January 29, 2021

Weinraub and Plume explained that, “Chinese buyers also picked up an additional 132,000 tonnes of soybeans – about two cargoes – for delivery in the 2021/22 marketing year, USDA said on Friday.

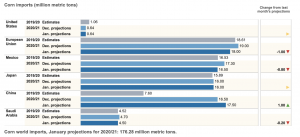

The country’s corn imports could climb to between 25 million and 27 million tonnes in the current crop year, including 18 to 20 million from the United States, president of AgResource Co, said on Wednesday.

“If realized, that would make China the world’s biggest corn buyer. In the 2019/20 marketing year, Chinese corn imports totaled just 7.6 million tonnes.”

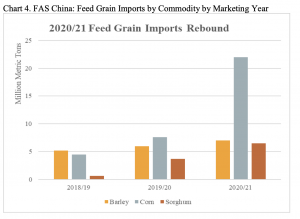

Meanwhile, a report earlier this month (“Grain and Feed Update- China“) from the USDA’s Foreign Agricultural Service (FAS), stated that, “FAS China’s MY2020/21 corn import forecast remains at 22 MMT, still 4.5 MMT tons higher than the USDA official forecast due to continued strong import demand fueled by high domestic prices, the need and drive to restock grain reserves, and growth in feed consumption. China imported more than the 7.2 MMT tariff-rate-quota (TRQ) in calendar year 2020 with no slowdown in sight. It remains unclear if the 65 percent out of quota duty was applied to imported corn or if additional TRQs were quietly issued as official government agencies remain silent on the matter. In addition, there is rampant industry speculation of a ‘special TRQ’ that will be used for China to import U.S. corn to meet its purchase commitments under the U.S.-China Phase One Economic and Trade Agreement.”

And Bloomberg writers Isis Almeida and Alfred Cang reported on Friday that, “Earlier this week, the boss of Archer-Daniels-Midland Co., one of the world’s largest agricultural commodity traders, said the Asian nation [China] will import 25 million tons of corn from all countries. Ukraine is another big supplier of corn to China.”

With respect to Chinese soybean demand, Bloomberg writers Michael Hirtzer, Kim Chipman, and Isis Almeida reported last week that, “China’s appetite for U.S. soy is draining silos to the point that American processors may need to import the most beans in years this summer.”

Reuters writer Karl Plume reported on Wednesday that, “U.S. soy processors, fresh off their busiest year on record, have booked soybean purchases well beyond their normal few weeks of supply due to soaring export demand, rising prices, and fears of soy shortages later this season, traders and analysts said.

“The aggressive buying foreshadows an expected battle for beans between exporters and processors this spring and summer that will likely increase prices further and could result in rare imports to the United States, the world’s No. 2 soybean producer and exporter.”

Addressing some of the implications of the strong demand for corn and soybeans, Reuters writers Gus Trompiz and Sybille de La Hamaide reported last week that, “Expected record Chinese imports of corn and soybeans in the coming seasons will continue to absorb U.S. supplies and keep prices on an upward trend, Chicago-based consultancy AgResource Co said on Wednesday.”

Turning to recent developments regarding the U.S./China Phase One Trade Deal, Bloomberg writers Jenny Leonard and Josh Wingrove reported last week that, “The Biden administration has former President Donald Trump’s so-called phase-one trade deal with China ‘under review‘ along with the rest of the U.S. posture toward Beijing, White House Press Secretary Jen Psaki said Friday.

“‘Everything that the past administration has put in place is under review,’ Psaki said in response to questions about whether President Joe Biden considers Trump’s agreement to still be in effect.”