As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

USDA Agricultural Projections to 2030- Focus on Corn, Soybeans

On Tuesday, the U.S. Department of Agriculture released its 10-year projections for the food and agricultural sector.

Background

The baseline update explained that, “The projections, colloquially referred to as the baseline projections, were prepared using data available through the October 2020 World Agricultural Supply and Demand Estimates (WASDE) report, except where noted. The Agriculture Improvement Act of 2018 is assumed to remain in effect through the projection period. The scenario presented in this report is not a USDA forecast about the future. Instead, it is a conditional, long-run scenario about what would be expected under the continuation of current farm legislation and other specific assumptions.”

The report added that, “The projections only include policies in place or are already expected to be implemented as of October 2020. Recent trade deals or negotiations such as the Phase One deal with China, the United States-Mexico-Canada (USMCA) agreement, and a Japan-U.S. free trade agreement were considered for these projections. The macroeconomic assumptions were completed in August 2020. Support payment programs to assist producers directly affected by the coronavirus pandemic in 2020 announced after the projections was developed, such as those under the Consolidated Appropriations Act 2021, are not included in the calculations here.”

Corn

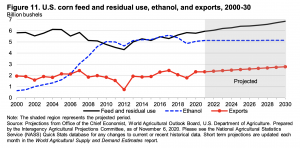

The USDA update stated that, “The baseline projects U.S. corn production to grow over the next decade as yield gains offset a gradual decline in acreage. Expanding meat production is expected to boost feed and residual use over the baseline period. Planted area is stable at 90.0 million acres in the near-term (2021/22-2025/26), and then recedes to 89.0 million acres for the rest of the projection period. Yield growth supports rising production during most of the projection. Through the baseline period, supply grows somewhat faster than use, raising the stocks-to- use ratio.”

With respect to ethanol, the report stated that, “Corn-based ethanol production marginally increases over the projection period, from 5.125 billion bushels to 5.150 billion by 2030/31, lower than in recent years.”

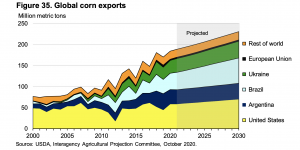

While addressing long-term corn exports, USDA explained that, “In 2021/22, the baseline projects U.S. corn exports at 59.1 million tons (2.3 billion bushels) compared with the next largest exporters: Brazil (41.3 million tons), Argentina (33.6), and Ukraine (32.9). A gradual weakening of the U.S. dollar modestly improves U.S. export prospects. With continued competition from Brazil, Argentina, and Ukraine, together with growing domestic feed use and stable corn use for ethanol, the U.S. market share of global corn exports is projected to remain relatively flat at about 31 percent during the projection period. Prior to 2010, the U.S. market share of global exports was more than 50 percent.”

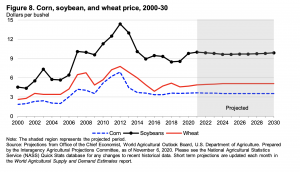

“Season average nominal producer prices decline moderately from $3.65 per bushel in 2021/22 to $3.55 per bushel for second half of the projection period,” the report said.

Soybeans

Tuesday’s report indicated that, “U.S. soybean plantings rebounded sharply after 2019/20 and the baseline projects area to remain elevated over the course of the decade. Plantings remain near 90 million acres, supported by higher prices and net returns relative to the last 5 years…[and]…Nominal soybean prices are projected to start at $10 per bushel in 2021/22, and to fall through 2025/26 before slowly rising the remainder of the projection period.”

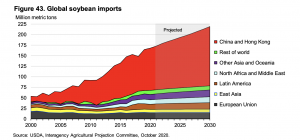

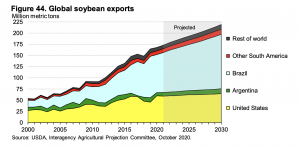

U.S. soybean exports are sharply higher after slumping in 2019/20. Exports climb to record highs as consumption recovers, particularly in China. The U.S. share of global trade drops from 34.2 to 29.5 percent between 2021/22 and 2030/31

The update pointed out that, “China’s soybean imports are expected to resume their strong growth after recovering from an African swine fever epidemic that curtailed soybean meal demand during 2019/20. Driven by growth in livestock numbers and vegetable oil consumption, China’s soybean imports grow from 103.9 million tons to 140.5 million tons during 2020/21–2030/31.”

Turning to world soybean exports, USDA stated that, “Brazil’s soybean exports are projected to rise 32.4 million tons (36.2 percent) to 121.5 million tons by 2030/31, strengthening its position as the world’s leading exporter. Soybeans remain more profitable to produce than other crops in most areas of Brazil.

“With increasing plantings in the Cerrado region and production extending into the Amazônia Legal region, the growth rate in area planted to soybeans is projected to be in excess of 2.5 percent per year during the coming decade.”