The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

African Swine Fever in China Continues to Impact Markets

Earlier this month, Bloomberg News reported that, “African swine fever is re-emerging in Asia, threatening to upend efforts to replenish national herds after the virus killed tens of millions of pigs in the region and created a huge shortage of meat protein.

“Fresh outbreaks have been reported in China and Vietnam this year, and the disease has even landed on Malaysia’s shores. While new cases are scattered and isolated, they’ve put governments on notice that the virus is alive and well and there could be dire consequences if it’s not kept under control.”

The disease has been a variable impacting both pork trade and prices, as well as protein feed demand and soybean exports.

More narrowly on pork production prospects in China, the USDA’s Foreign Agricultural Service (FAS) indicated in a report this month (China: Livestock and Products Semi-Annual) that, “China’s hog herd is forecast to grow, but overall pork production will remain below pre-African Swine Fever (ASF) levels as large new facilities increase production while also contending with low sow productivity and high feed prices. These factors, along with animal disease in breeding sows and piglets, will constrain China’s hog inventory and pork production in 2021.”

The FAS update stated that, “Pork production in 2021 is forecast to increase by 14 percent following record low rates in 2020 as expansions by large companies over the last two years come into use.”

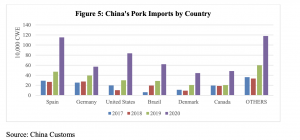

The report added that, “Competitively priced imported pork and pork products will continue being an important component of the domestic pork supply. Pork imports in 2021 are forecast to reach 4.5 million metric tons as consumers are increasingly receptive to chilled or frozen pork.”

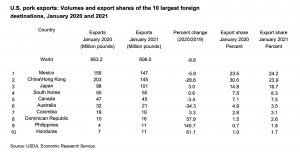

Additionally on the issue of pork trade, USDA’s Economic Research Service stated on Monday (“Livestock, Dairy, and Poultry Outlook“) that, “Total U.S. pork exports in the first quarter are expected to be 1.825 billion pounds, almost 10 percent below a year earlier, mostly on anticipation of reduced shipments to China\Hong Kong. Total U.S. pork exports are unchanged from last month at about 7.2 billion pounds, 1.5 percent below 2020 exports.”

In a closer look at ASF impacts on protein feed demand, Wall Street Journal writer Kirk Maltais reported on Tuesday that,

A resurgence of a lethal pig disease is putting new strain on China’s efforts to rebuild its herds—a threat to U.S. farmers’ hopes to sell more soybeans there this year.

“A new outbreak of African swine fever in the world’s leading hog-producing nation is killing increasing numbers of Chinese pigs, with the sow herd falling 3% to 5% each month since December, according to a report Tuesday from Rabobank. Chinese officials had forecast that the country would return to pre-disease hog herds this year. The new outbreaks could delay that until 2023, Rabobank found.

“African swine fever, a disease harmless to humans but nearly always fatal to pigs, has taken a huge bite out of China’s hog supplies in recent years. In 2019, the spread of the disease cut China’s hog herd by roughly 40% to 260 million head, according to Rabobank.”

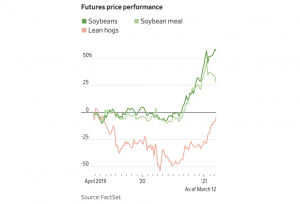

The Journal article noted that, “The disease’s return threatens otherwise strong export demand expected for U.S. soybeans. The U.S. Department of Agriculture forecasts that soybean export sales will total 2.25 billion bushels in the 2020/21 marketing year—over one-third more than last year’s figure. Soybean prices have risen to their highest levels since June 2014 this month at nearly $14.50 a bushel, lifted by the strong export outlook.

Demand from China has lifted soybean futures to a six-year high. What factors will drive soybean futures in 2021? Presented by @CMEGroup pic.twitter.com/PeFZG7aac1

— Bloomberg Quicktake (@Quicktake) March 11, 2021

“As a result, U.S. farmers are expected to plant more soybeans—90 million acres this spring, the most since 2017, the USDA estimated last month.”