A new 10% tariff on goods from around the world took effect Tuesday — with a list of exemptions including beef. Other exemptions affecting the food and agriculture industries include…

Caustic Round of U.S., China Talks Conclude, as Chinese Corn Buying Continued

William Mauldin reported in Saturday’s Wall Street Journal that, “High-level talks between the Biden administration and Beijing that veered into acrimony put the U.S.-China rivalry in sharp relief, complicating efforts by the two powers to erect guardrails and keep tensions from spiraling further.

“The two-day meetings, which ended Friday, covered an array of issues that over the past year sent U.S.-China relations to their most unsteady point in decades: China’s clampdown on Hong Kong, repression of Muslims in Xinjiang and aggressive behavior with its neighbors. The two sides also explored some areas of hoped-for common ground.

“Secretary of State Antony Blinken told reporters afterward that the governments ‘are fundamentally at odds’ on issues such as Hong Kong and cyberattacks, though interests intersect on Iran, North Korea, Afghanistan and climate change.”

The Journal article stated that, “Yang Jiechi, China’s senior-most foreign-policy official, also noted ‘important disagreements’ remained, and in remarks to Chinese state media suggested Beijing wouldn’t back down. ‘China will unswervingly defend its national sovereignty, security and development interests. China’s development and strengthening is unstoppable,’ said Mr. Yang.”

“Although U.S. officials played down the public sparring, the divisiveness, on display in front of reporters, exposed a deepening distrust between the two governments that is likely to make cooperation more difficult,” the Journal article said.

Tracy Wilkinson reported in Saturday’s Los Angeles Times that, “In two days of talks that concluded Friday in Anchorage, two of Biden’s most senior officials traded barbs with their Chinese counterparts and failed to show any signs of agreement on numerous outstanding issues, from trade to human rights.”

And Lara Jakes and Steven Lee Myers reported in Saturday’s New York Times that, “China’s more aggressive diplomatic posture is likely to inflame tensions with the United States, which has itself declared China a national security rival.”

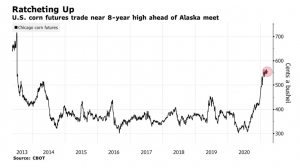

Meanwhile, Bloomberg writers Eric Lam and Felix Tam reported late last week that, “The talks between U.S. and Chinese officials in Alaska are turning the market spotlight back on key bellwethers that might be affected.”

The Bloomberg article pointed out that, “Traders will be monitoring whether China decides to buy more corn, a key U.S. export. More large purchases are possible because of strong demand from the refining industry as well as feed mills, according to Meng Jinhui, a senior analyst with Shengda Futures in Beijing.”

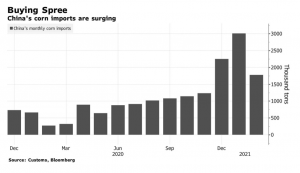

A separate Bloomberg News article on Thursday reported that, “China, the world’s biggest importer of farm commodities, ramped up purchases in the first two months of this year to plug growing local shortages and to keep food prices under control.

The country shipped in almost 5 million tons of corn in January and February, more than five times the amount unloaded a year earlier, according to customs Thursday. That included an all-time monthly high of 3 million tons in January.

The Bloomberg article added that, “China has been scooping up record amounts of corn and soybeans from overseas to feed the world’s largest hog herd, which is recovering from African swine fever. The country faces shortages of farm commodities because of a lack of productive farmland and increasing demand from a more affluent population, and is trying to boost yields and reduce wastage.”

Last week, the USDA’s Foreign Agricultural Service reported large sales of U.S. corn to China on Tuesday, Wednesday, Thursday and Friday.

Additionally, Reuters writers Hallie Gu and Dominique Patton reported late last week that, “China’s agriculture ministry has launched a campaign to lower the content of corn and soymeal in animal feed, according to a document issued this week, which could have repercussions for the global grain trade.

“The document, sent to animal feed producers and other government departments, outlines a plan for nutrition experts to draw up guidelines by the end of this month on ways corn and soymeal could be replaced by alternative grains, three industry sources with knowledge of the matter told Reuters.”

Chinese #corn imports started stepping up in December. #oatt pic.twitter.com/XRr9opJ2Yh

— Arlan Suderman (@ArlanFF101) March 19, 2021

The Reuters article explained that, “The document comes amid a growing deficit of corn in China, which has pushed prices of the grain used largely in animal feed to record highs and triggered a surge in imports by the world’s second-largest consumer.

“Customs data on Thursday showed corn imports in the first two months of the year rose 400% to 4.8 million tonnes, while wheat and sorghum imports also surged.”