As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

FAPRI Baseline: University of Missouri Analysts See Signs of Optimism in Agricultural Market Outlook

A news release on Friday from the University of Missouri indicated that, “Farm income could decline in 2021, in spite of large increases in the value of crop and livestock sales, according to the latest analysis of national and global agricultural trends from the University of Missouri. Lower government payments and higher farm production costs could outweigh the increase in sales.

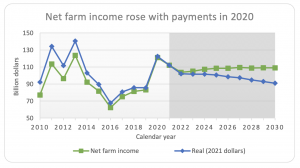

Even with the decline projected by analysts at the Food and Agricultural Policy Research Institute (FAPRI), net farm income of $112 billion in 2021 would still be much higher than it was from 2015-2019. Net farm income increased to $121 billion in 2020, the highest level since 2013, primarily because of $46 billion in government payments.

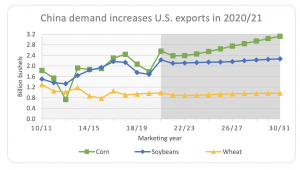

The release added that, “Increasing imports by China explain much of the recent strength in grain and oilseed markets. If China’s purchases continue at the recent pace, U.S. exports and market prices could be higher than projected.”

“Economists with FAPRI and the MU Agricultural Markets and Policy (AMAP) team release the annual U.S. Agricultural Market Outlook report each spring. The baseline projections for agricultural and biofuel markets were prepared using market information available in January, but does not reflect any subsequent policy changes,” the release said.

Before getting into additional details of the FAPRI report, recall that earlier this year USDA released its 2021 Farm Income forecast, as well as its 10-year projections; and USDA Chief Economist Seth Meyer provided a broad outlook for U.S. agriculture in late February. Also in February, the Federal Reserve Banks of Chicago, Kansas City and Minneapolis each released updates regarding farmland values and agricultural credit conditions from the fourth quarter of last year.

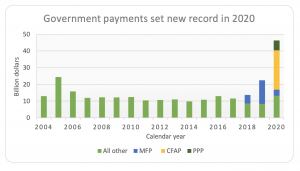

The FAPRI baseline report stated that, “Direct government payments to agricultural producers in 2020 exceeded the previous record by more than $20 billion.

“Most of the increase was explained by three ad hoc programs. The coronavirus food assistance program (CFAP) and the paycheck protection program (PPP) were both designed to respond to the pandemic. The market facilitation program (MFP) made payments from 2018-2020 to compensate farmers for losses in trade because of foreign trade barriers. These payments contributed to a significant increase in net farm income in 2020.”

Without MFP, CFAP and PPP, projected government outlays on farm-related programs drops sharply after the current fiscal year. These projections from the @FAPRI_MU outlook this morning do not include provisions of the just-passed reconciliation bill. pic.twitter.com/K0LsXNwJkp

— Pat Westhoff (@WesthoffPat) March 12, 2021

Friday’s report explained that, “Trade disputes, the impact of African swine fever (ASF) on pork production in China and strong competition from other exporters limited U.S. corn and soybean exports in 2018/19 and 2019/20. Exports of those two crops have increased sharply in 2020/21, primarily because of increased purchases from China as it rebuilds its swine herd. Future U.S. grain and oilseed exports depend on developments in China and elsewhere. Recent market strength suggests exports could exceed these projections, which are based on information available in January 2021.”

With respect to acreage, the report stated that, “Much higher prices and an assumed return to more favorable spring weather allows projected corn, soybean and wheat area planted to all increase in 2021.”

The @FAPRI_MU baseline released this morning has soybean, corn and wheat area all up this year. Corn is at 91.3 million acres, soybeans at 90.4 million. pic.twitter.com/biDAH7vsCC

— Pat Westhoff (@WesthoffPat) March 12, 2021

Regarding farm income, Friday’s update indicated that, “Projected crop and livestock receipts are up by $25 billion in 2021, but net farm income falls because of a $22 billion reduction in payments and a $13 billion increase in production expenses.”

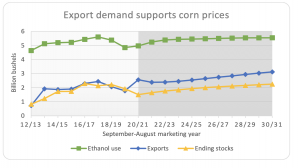

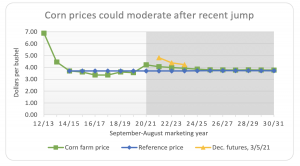

In a closer look at corn related variables, FAPRI stated that, “Corn prices have increased in 2020/21 because of a smaller-than- anticipated 2020 harvest and a large increase in U.S. exports. A modest recovery in ethanol use also contributes to a reduction in 2020/21 corn ending stocks to the lowest level since 2013/14. Projected ethanol use depends in part on implementation of the RFS. The outlook for U.S. corn exports depends in part on China’s import demand and the ability of the U.S. infrastructure to handle increased shipments.

“Corn prices jumped in late 2020 and nearby futures prices topped $5.50 per bushel in early March. Current MYA farm prices for 2020/21 are much lower, in part because of early sales at much lower prices. Projected MYA prices decline slightly in 2021/22, but remain above $4.00 per bushel. December 2021 futures prices on March 5, 2021 suggest a slightly higher 2021/22 price, even after considering the normal basis between futures and farm prices. Projected average prices remain slightly above the reference price.”

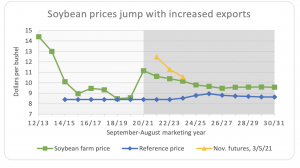

More narrowly on soybean related indicators, FAPRI stated that, “At the peak of the trade dispute, China imported almost no U.S. soybeans between September 2018 and January 2019. Two years later, a huge jump in imports by China is expected to result in record total U.S. soybean exports in 2020/21. Recovery of China’s pork industry from ASF and the U.S.-China Phase 1 deal both play a role in the increase. The outlook for U.S. soybean exports depends both on China’s internal demand and on competition from Brazil and other exporters.”

“After four straight years when soybean MYA prices averaged less than $10 per bushel, the 2020/21 price is projected to exceed $11 per bushel. The increase in futures prices has been even more dramatic, with nearby futures over $14 per bushel in early March.

“Projected prices decline slightly in 2021/22, given the large expected increase in production and moderating export demand. Futures markets in early March suggest a higher price for the 2021/22 crop. In some stochastic outcomes, prices are high enough to cause increases in soybean reference prices.”