Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Corn, Soybean Prices Climb, While Record Chinese Corn Imports Expected

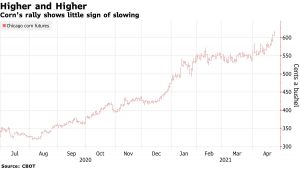

Bloomberg writers Kim Chipman and Michael Hirtzer reported on Wednesday that, “Corn prices climbed above $6 a bushel to the loftiest level in almost eight years after the U.S. said it expects China to buy an all-time high amount of the grain off global markets.

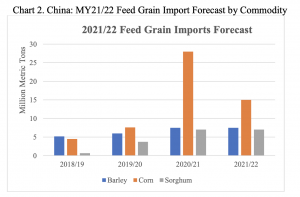

“A shortage of supplies and a need to replenish hog herds after a major outbreak of deadly African swine fever will continue to fuel China’s appetite for corn imports, with the total for the current season seen at 28 million metric tons, the U.S. Department of Agriculture’s Beijing office said on Wednesday. That would be the most on record based on Bloomberg data going back six decades.

“The U.S. also predicts China, the top pork producer, will slash global corn purchases next year down to 15 million tons as it attempts to reduce reliance on foreign grains. Despite the sharp cut, that would still be the second-highest amount on record.”

Chipman and Hirtzer explained that, “China is expected to rely more on rice and wheat stocks in the next season due to the high price of corn. Still, demand for the grain isn’t expected to change until late 2021 or 2022, USDA officials in Beijing said in a statement.

#Illinois Grain Bids- April 21st, https://t.co/S5XWBLnHEg @USDA_AMS

— Farm Policy (@FarmPolicy) April 21, 2021

Central Illinois Average Price:

* #Corn 6.21

* #Soybeans 15.01 pic.twitter.com/omvxNo9iDL

“Corn futures on the Chicago Board of Trade climbed as much as 2.84% on Wednesday to $6.0875 a bushel, the highest since May 2013. Prices have nearly doubled in the last year as China scooped up massive amounts of the grain to replenish pig herds that were decimated by the deadly African swine fever.”

Bloomberg writers James Poole and Megan Durisin reported on Wednesday that, “Corn extended gains above $6 a bushel and soy topped $15, setting fresh mulityear highs, as China’s rampant demand and adverse weather threaten to further tighten supply.

“Wheat has also rallied this month, adding to worries about global food-price inflation as consumers still contend with the coronavirus pandemic. Brazil’s second-corn crop is suffering from drought and U.S. planting has been slowed by a record cold snap. The freeze there may also have damaged some winter wheat, and western Europe lacks moisture for early growth of the grain.”

Front-month CBOT #soybeans have topped $15 per bushel for the first time since early June 2014. The most-active July contract has made a new high in the overnight on April 21-22 and is also making a run toward $15. November hit new highs, too. pic.twitter.com/sZ08Qby5Dz

— Karen Braun (@kannbwx) April 22, 2021

Meanwhile, Reuters writers Dominique Patton and Hallie Gu reported this week that,

China issued guidelines on Wednesday recommending the reduction of corn and soymeal in pig and poultry feed, a measure that could reshape the flow of grains into the world’s top corn and soybean buyer.

“China’s corn prices surged more than a third in the most recent year following a drop in output and state stockpiles. The country started importing a lot more corn to compensate for the domestic deficit. So feed makers have already been switching to cheaper alternatives, especially wheat.”

Major potential implications here for global feed markets: China is looking to make steep cuts to corn and soymeal use in feed rations. Full story here:

— Gavin Maguire (@GavinJMaguire) April 21, 2021

Reshaping grain trade? China moves to change animal feed recipes https://t.co/vwYc9mnY01 pic.twitter.com/ClCu84hOqN

The Reuters article added that, “Benchmark corn and soy futures on the Chicago Board of Trade notched fresh multi-year highs on Wednesday, so China’s new guidelines may not do much in the near term to temper soaring feed costs.

“The Ministry of Agriculture and Rural Affairs said in a statement on its website the new guidelines are aimed at improving the usage of available raw materials and creating a formula that better suits China’s conditions.”