A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Corn Prices Climb Nearly 50% in 2021, as U.S. Food Makers Contend with Labor and Ingredient Shortages

Wall Street Journal writers Ryan Dezember and Kirk Maltais reported on Monday that, “America’s biggest cash crop has rarely been more expensive.

Corn prices have risen roughly 50% in 2021 and a bushel costs more than twice what it did a year ago.

“Corn has been one of the sharpest risers in the broad rally in raw materials that is prompting companies to boost prices for goods and fueling concern among investors that inflation could hobble the post-pandemic economic recovery.”

The Journal article noted that, “Farmers have a few factors to thank for high prices.

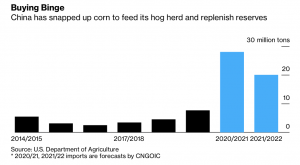

“China is on a corn-buying binge while racing to fatten millions of hogs to replace the pigs it had to kill during an outbreak of African swine fever before the pandemic. China is expected this year to import about four times what it normally buys from abroad, most of it from U.S. farmers.

“Corn-growing regions of South America are parched. Brazil expects a meager safrinha, or second crop, which will reduce its export. In Argentina, the Paraná River is too shallow for fully loaded boats to pass from the country’s interior to Atlantic shipping lanes.

A dry April, a dry first week of May and more dryness forecasted for the rest of the month. Despite some good areas in Mato Grosso, that’s the recipe for a #safrinha under 70 mmt and a total #corn production smaller than 100 mmt in #Brazil: https://t.co/bVJBMqIhJr. pic.twitter.com/4avXRihbqg

— Daniele Siqueira (@siqueiradaniele) May 10, 2021

“At home, the reopening economy means more drivers and greater demand for the corn that becomes ethanol and is blended into gasoline.”

Weekly Livestock, Poultry & #Grain Market Highlights, https://t.co/CNQielLvKt @USDA_AMS

— Farm Policy (@FarmPolicy) May 10, 2021

* Central #Illinois Avg #Corn Price, $7.44 (Change From Past Year, ⬆️149.8%).

* Central Illinois Avg #Soybean Price, $16.17 (Change From Past Year, ⬆️92.8%). pic.twitter.com/0dc7htZUMx

On Tuesday, Bloomberg News reported that, “China is building up its agricultural buffer as well. The government has bought huge amounts of U.S. corn for state reserves and may release them to quell any price spikes ahead of the domestic harvest in the fourth quarter. Authorities have also imposed curbs on state wheat sales amid concern that increased purchases by feed mills to replace expensive corn could push up prices of the new wheat crop, which will be reaped in June.

“Beijing is also replenishing its soy reserves, adding locally grown soybeans for the first time since 2017 to curb any possible food inflation. The domestic crop isn’t genetically modified and is used for foods such as tofu rather than animal feed. China has also frequently released pork reserves to cool rising prices of the nation’s most widely consumed meat.”

For the most part, U.S. #corn export inspections have been running at well above normal/record pace since late February. May got off to a bit of a slower start, but the last week in April featured the third biggest weekly volume on record and the second biggest of the year. pic.twitter.com/yofmUGDslw

— Karen Braun (@kannbwx) May 10, 2021

Meanwhile, Wall Street Journal writers Jesse Newman, Jaewon Kang and Annie Gasparro reported last week that, “Friction between food retailers and their suppliers is adding costs across the food chain.

“Big buyers including Walmart Inc. and Sysco Corp. are fining suppliers over infractions like late or incomplete orders. Retailers excused such penalties for months during the pandemic when surging demand led to widespread shortages.

Meanwhile, many food makers and distributors say labor shortages, supply constraints and high freight costs are making it difficult to deliver complete, timely orders for goods from cake mix to ramen noodles. Similar tensions are mounting throughout the U.S. economy, as industries contend with shortages of supplies and complications of reopening businesses in the wake of the coronavirus pandemic. Prices for many foods, consumer products and other goods are rising as a result.

The Journal article noted that, “‘The supply-chain challenges are still there,’ said Henk Hartong, chief executive officer of Brynwood Partners, which owns Hometown Food Co., the maker of Pillsbury cake mixes and Buitoni pasta. He said wheat costs have soared and shipments for ingredients including vitamin C for Sunny D are running behind: ‘It’s not just one thing, it’s everything.'”

And Wall Street Journal writer Jaewon Kang reported this week that, “Costs are rising at every step in the production of many goods. Prices for oil, crops and other commodities have shot up this year. Trucking companies are paying scarce drivers more to take those materials to factories and construction sites. As a result, companies are charging more for foods and consumer products including foil wraps and disposable cups.

“Kellogg Co. , maker of Frosted Flakes, Cheez-Its and Pringles, said Thursday that higher costs for ingredients, labor and shipping are pushing it and other food makers to raise prices. ‘We haven’t seen this type of inflation in many, many years,’ Chief Executive Officer Steve Cahillane said.”

Bloomberg writer Michael Hirtzer reported on Monday that, “Tyson Foods Inc. warned it’s struggling to meet rebounding chicken demand because of a worker shortage and slow hatchings, even as a strong beef market will boost overall sales.

“The biggest U.S. meat company is seeing robust demand as the world economy mends from the pandemic, and it’s raising prices across businesses to pass through higher animal-feed costs and other expenses. That will help make up for thinner returns in chicken, where labor tightness means that plants are operating at about 80% of capacity. Tyson also said it can’t maximize profit in its pork unit because of a dearth of skilled labor to strip down carcasses.”

The Bloomberg article indicated that, “‘We’re seeing substantial inflation across our supply chain, which will likely create margin pressure during the back half of the year,’ Tyson Chief Executive Officer Dean Banks said in the statement.”

U.S. consumer prices are set to surge, having dipped during the pandemic slowdown. With commodity prices skyrocketing, should investors prepare for transient or permanent inflation? Presented by @CMEGroup pic.twitter.com/rc2bRt8eru

— Bloomberg Quicktake (@Quicktake) May 10, 2021

And last week, Wall Street Journal writers Heather Haddon and Jacob Bunge reported that, “Chicken wings are flying off the shelves.

“After a year promoting takeout wings and crispy chicken sandwiches, restaurants including KFC, Wingstop Inc. and Buffalo Wild Wings Inc. say they are paying steep prices for scarce poultry. Some are running out of or limiting sales of tenders, filets and wings, cutting into some of their most reliable sales.

“Independent eateries and bars have gone weeks without wings, owners say. Chicken breast prices have more than doubled since the beginning of the year, and wing prices have hit records, according to market-research firm Urner Barry.”