A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Corn Trades Above $7 as Weather in Brazil Raises Concern- U.S. Corn Acres a Source of Speculation

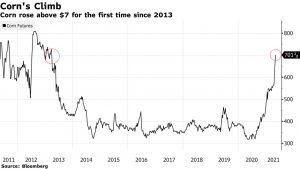

Bloomberg writers Breanna T Bradham, Kim Chipman, and Fabiana Batista reported on Tuesday that, “Corn futures surged above $7 a bushel for the first time in more than eight years as lack of rainfall in Brazil added to supply concerns.

“Corn climbed as much as 3.6% to $7.04 a bushel on the Chicago Board of Trade, the highest since March 2013. The futures for July delivery pared gains to close the day with a 2.5% advance at $6.9675. Soybeans and wheat also rose.”

The Bloomberg article explained that, “The rally across grain markets prompted major crop trader Bunge Ltd. on Tuesday to raise its earnings outlook for 2021 by as much as 25% above its previous forecast. The St. Louis-based company, which posted first-quarter earnings that were double analyst projections, is betting on strong demand for crops as the world emerges from the pandemic, China scoops up American supplies and the renewable diesel industry expands.”

AGRICULTURE MARKETS: Bunge, one of the largest commodities trading houses (and soybean processor) enjoying the markets. "We are optimistic that the favorable demand environment in the first quarter will continue through 2021,” said CEO Greg Heckman | #OATT #corn #soybeans #wheat

— Javier Blas (@JavierBlas) May 4, 2021

Tuesday’s article added that, “Dryness is hampering Brazil’s key second-crop corn, and rain in the coming week will fail to reach some key growing areas, according to Somar. That could further hurt yields, and analysts including Safras and StoneX Brazil have cut estimates for the coming harvest. A production shortfall there would compound stretched global grain supplies and risk further stoking food inflation.”

StoneX Brazil lowers its all #corn production estimate to 100.25 mmt, down from 105.06 mmt last month and down from USDA at 109 MMT. #soybeans are pegged at 135.73 mmt up from 134.03 mmt previously. #oatt

— Arlan Suderman (@ArlanFF101) May 3, 2021

Additionally, Bloomberg writers James Poole and Megan Durisin reported this week that, “Still, there are signs of better conditions in other major shippers, which may help cool the [corn] market. U.S. farmers are planting corn at the fastest pace in years, thanks to warm, sunny weather. Sowing is about halfway complete, the latest government data show. Early signs also point to a record-large crop in Ukraine, consultant SovEcon estimates.

The good U.S. conditions — coupled with high prices — has increased speculation in the market that farmers will end up with more corn acres than the U.S. Department of Agriculture is currently predicting.

“The agency will update its forecasts at the end of June.”

#Illinois Grain Bids- May 4th, https://t.co/S5XWBLFj2Q @USDA_AMS

— Farm Policy (@FarmPolicy) May 4, 2021

Central Illinois Average Price:

* #Corn 7.10

* #Soybeans 15.56 pic.twitter.com/88rffEcBeV

And Reuters columnist Karen Braun indicated on Wednesday that, “U.S. farmers are ahead of schedule in planting the 2021 corn and soybean crops to kick off May, the busiest planting month. The weather forecast is not exactly wide open to facilitate seamless planting in the coming weeks, but attractive prices may override those imperfections.

Ms. Braun stated that, “The market still expects a notable rise in corn and/or soybean acres in the June acreage survey after the March intentions fell well short of predictions, though corn acres are not usually added during wet Mays.

But previous comparisons might be out the window as new-crop corn futures have gone on an unprecedented rally in the last couple of months, further complicating the possible acreage scenarios for both the June survey and final number.

“In the last 40 years, final corn acres were higher than March planting intentions 15 times. May precipitation was materially above average in only two of those 15 cases: 2004 and 2017. The 2017 acreage gain was minimal, though 2004’s addition is a major outlier when considering the weather.”