As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Strains in Food Supply Chains- Higher Costs Curb Expansion Plans, as Food Prices Climb

Wall Street Journal writers Jennifer Smith and Paul Page reported on Friday that, “Americans are returning to restaurants, bars and other dining places as Covid-19 restrictions come down, adding new strains in food supply chains.

Suppliers and logistics providers say distributors are facing shortages of everyday products like chicken parts, as well as difficulty in finding workers and surging transportation costs as companies effectively try to reverse the big changes in food services that came as coronavirus lockdowns spread across the U.S. last year.

“‘Over the last six weeks, we have seen the market come roaring back faster than anybody would have anticipated,’ said Mark Allen, chief executive of the International Foodservice Distributors Association. ‘The start up has been, in many ways, as difficult as the shutdown…Everybody is trying to turn it on immediately and the capacity might not be there.'”

The Journal article noted that, “Kerry Byrne, president of Total Quality Logistics LLC, a Cincinnati-based freight broker with a large portfolio of business serving food-processing companies and distributors, said shortages of raw materials are leading to erratic deliveries of items that usually arrive on predictable schedules. ‘That disrupts entire supply chains. Everything is stressed,’ he said.”

“The shortfalls are turning promotional efforts into a high-wire act for retailers and restaurants. ‘Companies are putting things on sale or restaurant chains are offering promotions on special items but then they’re not sure they can get the shipments they need to meet the demand,’ Mr. Byrne said. ‘I’ve never seen anything like it, and there are no indications it’s going to let up anytime soon.'”

The Journal writers explained that, “Supply-chain executives say the lack of available workers may be the biggest strain on the sector since the impact cascades from the production facilities to trucking to distribution centers.”

Also this week, Wall Street Journal writers Saeed Shah, Luciana Magalhaes, and Nicholas Bariyo reported that, “A surge in food prices is deepening the pain caused by Covid-19 across the developing world, forcing millions into hunger and contributing to social problems that could lead to more political unrest and migration.

“Food prices have jumped by nearly a third over the past year, according to the Food and Agriculture Organization of the United Nations, even as pandemic-related job losses are making it harder for families to afford basic staples. Corn prices are 67% higher than a year ago, the FAO says, while sugar is up nearly 60%, and prices for cooking oil have doubled.

“Overall prices have risen for 11 consecutive months to the highest levels since 2014, the FAO says.”

Previous spikes in food and fuel prices contributed to political instability in recent decades, including the ‘Arab Spring’ revolutions in 2011. While nothing of that scale has emerged this year, expensive food is part of the mix in several countries now experiencing unrest.

The Journal writers pointed out that, “Other factors have exacerbated the situation. China’s rapid economic recovery has added demand, including for feed to rebuild pig herds, struck by disease in recent years. Such feed contains staples such as corn and soybeans, which are also consumed by humans. Adverse events including dry weather in Argentina and Brazil in October and locust infestations in African nations have also contributed.”

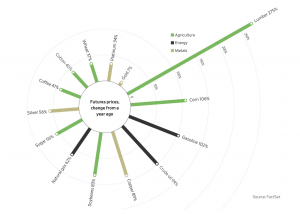

Meanwhile, Ryan Dezember, Joe Wallace and Andrew Barnett reported at The Wall Street Journal Online on Thursday that, “Prices for the building blocks of the economy have surged over the past year. Oil, copper, corn and gasoline futures all cost about twice what they did a year ago, when much of the world was locked down to fight the spread of the deadly coronavirus. Lumber has more than tripled.

“A lot of investors would probably see this chart [below] and say it screams inflation.”

The Journal article stated that, “At the heart of the debate is how much of the climb in commodity prices can be attributed to transitory, temporary shocks that should ease as the world’s economy moves further from lockdown, and how much of the rise will last and spread to other things.

“In many markets, the factors driving up prices appear fleeting. The economic reopening has been bumpy. Inventories are depleted, leading to big restocking orders and putting premiums on near-term deliveries of raw materials. Supply lines are jammed, creating pockets of scarcity and adding costs that are passed on to consumers. Some of the price gains seem sharp but have only just completed their recovery from last spring’s pandemic market panic.”

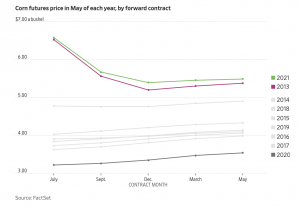

More narrowly, the Journal writers indicated that, “Corn is a good example of a commodity sent soaring by low supplies and transportation problems.

“Near-term corn futures are much higher than those for later in the year. That is unusual. The remnants of the previous year’s harvest usually cost less than the coming autumn’s crop this time of year. When near-term futures shoot up like they have, it is usually because of a big shock to either supply or demand, as in 2013 after drought withered the U.S. crop and prices hit records.

“This time it is a drought in South America that has left the global market short of supply. Meanwhile, demand is rising. U.S. drivers are returning to the road, meaning more corn blended into motor fuels as ethanol. China is expected to import about four times what it normally buys from abroad as it races to fatten millions of hogs to replace those killed to fend off an outbreak of African swine fever before the coronavirus pandemic.”

Also with respect to supply chain issues and food, Bloomberg writer Daniela Sirtori-Cortina reported this week that, “The cost of raw materials is so high right now that the third-largest chicken producer in the U.S. is considering shelving plans to build a new processing plant — even as the company struggles to keep up with demand.

“Sanderson Farms Inc. is one of the first companies to signal it could pause plans for expansion as the price of everything from lumber to steel skyrockets, driving up construction costs.

“‘I need a plant to open up next week, but it is not a good time to be building,’ Chief Executive Officer Joe Sanderson said. The company, which had planned to begin construction on a new facility during the first half of 2021, will ‘look very hard’ at building costs given the market for raw materials, he said.”

The Bloomberg article added that, “The timing is unfortunate, with the economic recovery also boosting demand for chicken to the point that Sanderson can’t take on any more orders without expanding.”