As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

As Commodity Prices Surge, Biden Administration Invests in the Supply Chain and Food System

Wall Street Journal writers Tom Fairless, Alistair MacDonald and Jesse Newman reported on the front page of Tuesday’s paper that, “The run-up in commodity prices is casting a cloud over the global economic recovery, slamming vulnerable businesses and households and adding to fears that inflation could become more persistent.

“The world hasn’t seen such across-the-board commodity-price increases since the beginning of the global financial crisis, and before that, the 1970s. Lumber, iron ore and copper have hit records. Corn, soybeans and wheat have jumped to their highest levels in eight years. Oil recently reached a two-year high.

“Economists are expecting consumer-price data due later this week to underscore the trend. They say China’s producer-price index, a gauge of factory-gate prices, could climb to its highest level since August 2008 on Wednesday amid rising commodity prices. The U.S. consumer-price index, released a day later, is expected to show a sharp rise in the 12 months through May, also driven by higher labor costs.”

The Journal article noted that, “‘We are being hit from every possible angle,’ said Franz Hofmeister, chief executive of Quaker Bakery Brands Inc. in Appleton, Wis. He says his costs for items including wheat, energy and new aluminum equipment have shot up at least 25% to 35% this year.

“Customers protested when his firm lifted prices for pizza crusts, burger buns and other goods by as much as 8%, but more increases might be needed.

‘The scary thing is, we don’t really see an end in sight to these cost pressures,’ he said.

The Journal writers pointed out that, “The Food and Agriculture Organization of the United Nations said global food prices rose in May at their fastest monthly rate in more than a decade, led by surges in products such as vegetable oils and cereals that are crucial to developing world diets.

“Companies from General Mills Inc. to Hormel Foods Corp. are raising prices of goods including the latter’s Jennie-O ground turkey.

“James Jeppson, of Utah-based food-service distributor Nicholas and Co., says shortages of soybean oil mean he is rationing deliveries of frying oil to restaurant customers, some of whom have paid triple their normal cost for the oil.”

Tuesday’s Journal article added that, “The commodity boom also has winners: It is creating a windfall for farmers and agribusinesses, lifting prices for U.S. farmland and benefiting commodity-exporting nations.”

Contributing to the improvement in credit conditions, #farm income also strengthened rapidly.

— Farm Policy (@FarmPolicy) June 1, 2021

Respondents across all participating Districts reported higher incomes than a year ago for the second consecutive quarter https://t.co/ugEIf0XU8w @KansasCityFed pic.twitter.com/fpjFzluywp

With respect to agricultural commodity price variables, Bloomberg writers Breanna T Bradham and Megan Durisin reported this week that, “Oilseeds have rallied in recent months amid crop worries in some regions, relentless crop demand by China and higher energy prices that tend to boost markets in vegetable oils used in fuels.”

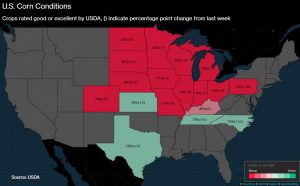

The Bloomberg article stated that, “The U.S. Department of Agriculture issued weekly report Monday after trading closed in Chicago showing the proportion of corn and spring wheat crops classified as ‘good’ or ‘excellent’ fell.

“‘Crop condition ratings were expected to drop, but not as much as they did in actuality,’ Jack Scoville, a vice president for Price Futures Group in Chicago, said about corn in an email.”

More specifically on the issue of inflation, an update on Monday from the Agricultural Market Information System stated that, “Higher prices year-on-year across a broad spectrum of goods and services have raised concerns about inflationary pressures within the agricultural sector.”

“Although inflationary tendencies might appear to be driving commodity food prices higher, the evidence points more to the unique supply and demand conditions that unfolded over the past year.

Projections for a sharp decline in demand and a slump in trade due to the pandemic proved wrong as US trade expanded in grains/oilseeds by 150 percent year-on-year, with a resurgent China dominating the maize and soybeans import markets.

“Additionally, markets fell into an over-supply trap, tumbling to multi-year lows as the USDA projected initial crop sizes (May 2020) at record levels, subsequently slashing numbers throughout the crop year – in the case of maize by 46 million tonnes.”

Monday’s update noted that, “In sum, the current high-price food environment appears to be mostly driven by fundamentals and will probably persist to some degree owing to the tight carryout situation projected through 2021/22.”

Meanwhile, New York Times writers Katie Rogers and Brad Plumer reported this week that, “The Biden administration on Tuesday planned to issue a swath of actions and recommendations meant to address supply chain disruptions caused by the coronavirus pandemic and decrease reliance on other countries for crucial goods by increasing domestic production capacity.

“In a call on Monday evening detailing the plan to reporters, White House officials said the administration had created a task force that would ‘tackle near-term bottlenecks’ in construction, transportation, semiconductor production and agriculture.”

More narrowly, a news release Tuesday from the U.S. Department of Agriculture (USDA) stated that, “Citing lessons learned from the COVID-19 pandemic and recent supply chain disruptions, the [USDA] today announced plans to invest more than $4 billion to strengthen critical supply chains through the Build Back Better initiative. The new effort will strengthen the food system, create new market opportunities, tackle the climate crisis, help communities that have been left behind, and support good-paying jobs throughout the supply chain. Today’s announcement supports the Biden Administration’s broader work on strengthening the resilience of critical supply chains as directed by Executive Order 14017 America’s Supply Chains. Funding is provided by the American Rescue Plan Act and earlier pandemic assistance such as the Consolidated Appropriations Act of 2021.

“Secretary Vilsack was also named co-chair of the Administration’s new Supply Chain Disruptions Task Force. The Task Force will provide a whole of government response to address near-term supply chain challenges to the economic recovery. The Task Force will convene stakeholders to diagnose problems and surface solutions—large and small, public or private—that could help alleviate bottlenecks and supply constraints related to the economy’s reopening after the Administration’s historic vaccination and economic relief efforts.

“USDA will invest more than $4 billion to strengthen the food system, support food production, improved processing, investments in distribution and aggregation, and market opportunities.”