Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

China Demand Fuels U.S. Farm Economy, as Federal Support Subsides

Financial Times writer Aime Williams reported on Monday that, “Donald Trump’s trade war with China left American farmers dependent on government handouts to survive. But China is now at the heart of a reversal in farmers’ fortunes, as booming exports and soaring food prices fuel a recovery in the US agricultural economy.

“The US is on course to ship a record $37.2bn worth of farm goods to China this year, led by sales of soyabeans, corn, tree nuts, beef, wheat and poultry, the US Department of Agriculture has forecast. The sum is 23 per cent of total US agricultural exports estimated at $164bn.

“Increased demand from China, along with a supply constraints on corn and soyabeans caused by a drought in Brazil, have driven a surge in global food prices, providing a further boost for American farmers.”

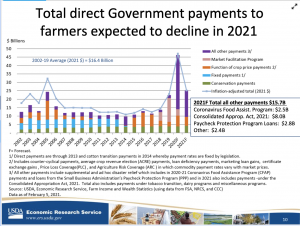

The FT article stated that, “American farmers received unprecedented government subsidies after China hit back at Trump’s tariffs with punitive levies on US farm goods in 2018. A hoped-for reprieve in early 2020, when Beijing pledged massive agricultural purchases under a trade deal with the US, quickly vanished as the pandemic spread and led Washington to deliver more aid.”

“Corn and soyabean prices this spring neared all-time highs reached when a brutal drought in the summer of 2012 devastated US production. While the growing season is early, forecasters this year expect healthy crops, enabling farmers to take advantage of soyabeans selling for more than $15 a bushel and corn above $6 a bushel,” the FT article said.

The FT article indicated that,

Whether the sales would continue was ‘the $64,000 question that everyone wants to know the answer to,’ said Scott Irwin, an agricultural economist at the University of Illinois. But he added: ‘I don’t see any reason that China’s buying is going to alter substantially, at least on a global scale.’

Meanwhile, Reuters News reported this week that, “China’s soybean imports rose in May from the previous month, customs data showed on Monday, as more cargoes from top supplier Brazil cleared customs.

“China, the world’s top importer of soybeans, brought in 9.61 million tonnes of the oilseed in May, up 29% from 7.45 million tonnes in April, when some Brazilian shipments were delayed, data from the General Administration of Customs showed.

“May’s imports were also up from 9.38 million tonnes in the same month a year ago.”

#China imported 9.61 million tonnes of #soybeans in May, just a cargo and change off 2018's high for the month. Jan-May imports totaled 38.2 mmt, +3% on 2017's record and +13% YOY. Arrivals in June and July are expected to exceed 10 mmt each. pic.twitter.com/vHBGwup0Kq

— Karen Braun (@kannbwx) June 7, 2021

In other market related news, Wall Street Journal writer Kirk Maltais reported this week that, “Prices for soybean oil shot to an all-time high last week, powered by growing demand from the biofuels sector.

“Soybean-oil futures on the Chicago Board of Trade have soared almost 70% this year, closing at nearly 72 cents per pound on Friday. That topped the previous high hit in 2008. The climb makes soybean oil one of the year’s best-performing assets among a basket tracked by The Wall Street Journal, along with other commodities like lumber, corn and hogs.

“Soybean oil is commonly used as an ingredient in foods like cereals, bread, and other snack foods. Demand for the vegetable oil is growing, however, from the biofuels industry, a chief part of the push toward renewable energy highlighted by President Biden’s call for the U.S. to cut carbon-emissions levels in half by 2030.”

The Journal article stated that, “The U.S. Agriculture Department expects the biofuels sector to consume 12 billion pounds of soybean oil in the 2021-22 marketing year—up from an estimated 9.5 billion pounds in 2020-21, according to its monthly supply-and-demand report published in May.”

“‘The enthusiasm for this new generation of renewable fuels mimics what we saw in the early days of the ethanol boom,’ said Arlan Suderman, chief commodities economist with StoneX.”