A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Cargill’s Sanfeliu Sees “Mini-Supercycle” for Crop Markets, as China’s Pig Herd Expands

Bloomberg writers Andy Hoffman and Vanessa Dezem reported this week that, “Two of the world’s top agricultural traders said crop markets are in a ‘mini-supercycle’ that could last half a decade, driven by increased demand for biofuels and continued grains buying from China.

‘Yes we are in a supercycle,’ Alex Sanfeliu, group leader of Cargill Inc.’s world trading group, told the FT Commodities Global Summit. ‘Let’s call it a mini-supercycle.’

“The high prices could last for two to four years, said Sanfeliu. Rising demand for biofuels will drive a massive jump in vegetable oil and waste feed stock demand of 15 million to 16 million tons over the next five years.”

The Bloomberg article noted that, “After spiking in 2020 and 2021, growth in China’s corn demand will likely slow to 1% to 2% a year, the Cargill executive said.

“David Mattiske, chief executive officer of Viterra, Glencore Plc’s food-trading arm, agreed agricultural markets are in a mini-supercycle, with strong demand for plant-based fuels and grains lasting four to five years.”

Meanwhile, after recent news articles pointed to lower hog prices in China, Reuters writer Dominique Patton reported this week that, “China’s pig herd rose 23.5% in May from a year earlier, state media said on Wednesday citing the Ministry of Agriculture and Rural Affairs.

“The sow herd increased 19.3% during the same period, according to the CCTV report, reaching 98.4% of the stocks at the end of 2017.”

The Reuters article added that, “‘We can now say with complete confidence that the original three-year mission for the restoration of pig production has been completed ahead of schedule,’ Xin Guochang, an official with the agricultural ministry’s Animal Husbandry and Veterinary Bureau told CCTV.”

And Reuters writer Julie Ingwersen reported this week that, “Chicago Mercantile Exchange (CME) lean hog futures fell their daily 3-cent limit on Wednesday, pressured by falling U.S. wholesale prices for pork products and news of increasing hog numbers in China, traders said.

“China’s pig herd rose 23.5% in May from a year earlier, state media said on Wednesday, citing the Ministry of Agriculture and Rural Affairs.”

In a closer look at U.S. feed grain export variables, the USDA’s Foreign Agricultural Service (FAS) released a report on Wednesday stating that, “Sharply lower second-crop corn supplies in Brazil and continued strong foreign demand have brightened U.S. [corn] export prospects for 2020/21 (Oct-Sep). Exports are currently forecast at 73.0 million tons (estimated value of $17.9 billion), which if realized, would be the largest in history.”

“U.S. exports to China for 2021/22, however, are expected to remain strong. In May, exporters have reported a flurry of new crop sales to China. It is unclear why China is making such large purchases before the crop is fully planted,” the FAS report said; adding that: “USDA currently projects China’s corn imports at 26.0 million tons for 2021/22.”

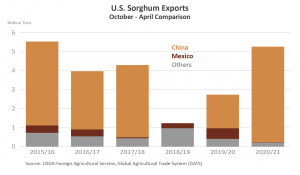

Regarding sorghum, the FAS report indicated that, “For 2020/21 (Oct-Sep), U.S. exports are currently forecast at 7.8 million tons (estimated value of $2.4 billion). If realized, this would be the largest level since 2015/16. During the first 7 months (Oct-Apr) of 2020/21, China was the top destination accounting for 95 percent of U.S. exports.”

“U.S. sorghum production is currently projected at 10.8 million tons, of which 9.0 million tons are slated for exports for 2021/22. If realized, exports would be the largest level since 2014/15. There are already 1.6 million tons of new crop sales on the books, of which more than half is slated to China,” the FAS report said.

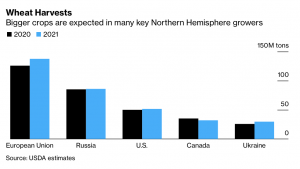

In other news, Bloomberg writers Megan Durisin and Kim Chipman reported this week that, “Farmers from Kansas to Kyiv are gearing up to collect abundant wheat crops in coming weeks, helping ease a global grain shortfall that’s fueled a surge in prices.

“Spring rains showered fields in the Black Sea region, U.S. Plains and European Union, bolstering prospects for the approaching winter-wheat harvest across major suppliers. The staple is the first major crop collected in the Northern Hemisphere, and hefty harvests will aid in replenishing grain silos drained by surging Chinese demand and poor weather last year.”

The Bloomberg writers stated that, “The outlook for refreshed supplies is contributing to a cool-down in prices after a rally across agricultural markets propelled a gauge of global food costs to near a decade high. Still, weather issues linger in some growing areas and easing lockdowns are boosting grain demand, tempering the likely retreat.”