President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

China Hog Futures Fall as Pig Farmers Urged to Maintain Production- 2020/21 U.S. Corn Exports Increased

Financial Times writers Hudson Lockett and Thomas Hale reported this week that, “Hog futures in China have fallen to record lows as mass slaughtering of pigs prompts fears that the world’s second-biggest economy faces a deluge of pork.

“Rising concerns that the local pork market is becoming inundated have led to a more than 30 per cent fall in Dalian-traded hog futures, which allow investors to bet on the future direction of prices, since they were launched in January.

“The situation contrasts with that in the world’s biggest producer, consumer and importer of pork over much of the past two years, when outbreaks of African swine fever resulted in price surges on fears of supply shortfalls.”

The FT writes explained that, “Prices have been hit as authorities have encouraged farmers to raise more pigs and replenish the country’s pork reserves following outbreaks of ASF.

“Analysts said that the situation had been made worse by farmers, concerned that prices will fall further, bringing forward plans to cull their herds. Oversupply fears have also been stoked by some farmers fattening their sows to weights of up to 300kg-400kg — comparable with some polar bears — versus their usual 200kg, according to Chinese media reports.”

Also this week, Reuters writer Dominique Patton reported that, “China’s state economic planning agency urged pig farmers on Wednesday to keep pig production capacity at a reasonable level, after a closely watched indicator of production costs last week fell far below the point at which most farmers make money.

“The average hog-to-grain price ratio fell to below 6:1 last week, said the National Development and Reform Commission (NDRC), adding that it had issued a level-3 warning of an excessive drop in live hog prices.”

The Reuters article pointed out that, “Live hog prices have plunged by 60% since the start of the year and are currently at an average 14.68 yuan ($2.29) per kilogramme, according to Shanghai JC Intelligence Co Ltd – their lowest level in two years.

The sharp decline has caught the market by surprise, coming even before the herd fully recovered to levels prior to the African swine fever outbreak that began in 2018.

“NDRC attributed the plunge in prices to farmers sending heavy pigs to slaughter, an increase in pork imports and weak seasonal demand.”

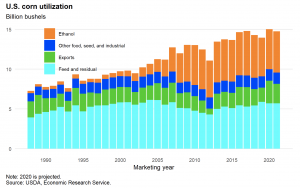

Meanwhile, with respect to U.S. corn demand and exports, the USDA’s Economic Research Service (ERS) indicated in its monthly Feed Outlook report this week that, “U.S. corn export prospects for 2020/21 are boosted further, while Brazil’s outlook is downgraded. A reduction in projected corn supplies and exports in Brazil this month is projected to support U.S. exports further, during the latter part of 2020/21. The changes for 2021/22 coarse grain trade are largely limited to barley, with China being the only beneficiary of higher barley exports, which push Chinese record barley imports further.”

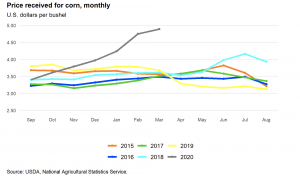

More specifically, ERS stated that, “Corn exports are estimated to total 2,850 million bushels for 2020/21. This is a 75-million-bushel increase from the previous month, based on the recent pace of official exports reported by the U.S. Census Bureau through April 2021 and grain inspections reports from the USDA’s Agricultural Marketing Service (AMS) through early June. According to the Census Bureau, corn exports from September to April have totaled 1,814 million bushels—an 80-percent increase from the same period last year. Much of the increased pace is attributed to higher shipments to China. For 2021/22, corn exports are projected to be 2,450 billion bushels—still large by historical standards, but lower on an annual basis, due to improved supply projections for other large global corn exporters.”

always love chatting about grains with @ScottIrwinUI https://t.co/klzN9Aoow7

— Joe Weisenthal (@TheStalwart) June 14, 2021

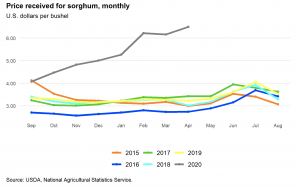

ERS also noted that, “Sorghum markets continue to be driven by strong export demand, particularly shipments destined for China’s livestock feed markets. This demand is expected to continue into 2021/22.”

The Feed Outlook report added that, “The season-average farm price estimates for 2020/21 are raised $0.10 to $5.15 per bushel, while the projection for 2021/22 remains unchanged from the previous month at $6.10.

“Like corn, the season-average farm price for 2021/22 is expected to be impacted by producers that contract at the relatively high current cash-market levels.”