As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Farm Lending Remains Strong in 2020- American Bankers Association Report

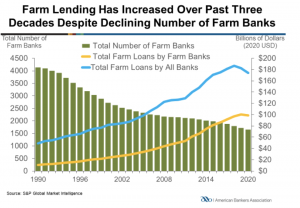

A news release this week from the American Bankers Association (ABA) stated that, “Despite the global economic slowdown in 2020 due to COVID-19, total agricultural lending by U.S. farm banks remained strong at $98.6 billion, decreasing by only 1.8% from the year before according to the American Bankers Association’s annual Farm Bank Performance Report.”

More specifically, the Report noted that, “This paper examines the performance of the 1,642 banks that specialize in lending to agriculture and met ABA’s criteria for classification as a farm bank in 2020. Most farm banks are small institutions. The median-sized farm bank, for example, had $154 million in assets in 2020. However, there are 72 farm banks with more than $1 billion in assets.

“Farm banks have 7,721 offices and employ 81,000 workers. Employment at farm banks increased by 2.4% in 2020. Since the end of 2010, employment at farm banks is up 26.4%.”

“The U.S. banking industry is a critical provider of credit to the agricultural sector. Banks had more than $174 billion in farm loans outstanding in 2020, accounting for nearly 50% of the total farm credit outstanding in the U.S.” the Report said.

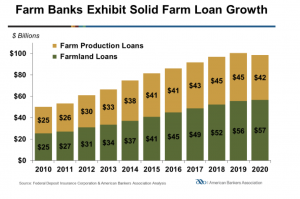

The ABA update indicated that, “Amid the deepest economic contraction in modern U.S. history, total agricultural lending by farm banks decreased 1.8% in 2020 to $98.6 billion, down from $101 billion in 2019. The change was attributable to a 6.7% decline in agricultural production loans, from $44.8 billion in 2019 down to $41.8 billion. By contrast, outstanding loans secured by farmland increased 2.1% to $56.7 billion.

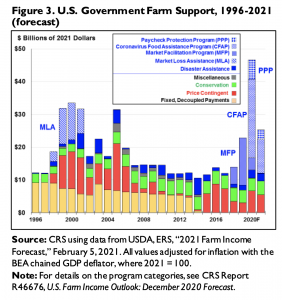

“Rising costs, supply and production bottlenecks, price volatility, and a significant increase in federal cash payments depressed demand for agricultural production loans in 2020.

Government payments also enabled producers to pay down existing loan balances.

“While land values have plateaued the past few years, farmland continued to provide a strong equity base for producers to tap.”

With respect to equity, the ABA update stated that, “Equity capital at farm banks increased 9.0% to $52.6 billion in 2020 while Tier 1 capital increased by $3.6 billion to $48.3 billion. Since the end of 2010, farm banks have added $26.3 billion in equity capital and $24.1 billion in core capital.”

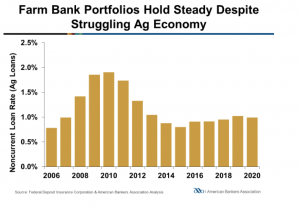

In a closer look at bank portfolios, the Report explained that, “Farm banks saw an initial uptick in noncurrent loans at the start of the recession. However, significant federal support for farmers in the form of direct cash payments and loan forbearance helped buoy borrower balance sheets, which led to an increase in asset quality at farm banks.”

“While farm and ranch customers continue to repay their loans, long-term delinquencies (90 days past due or more) fell in 2020.”

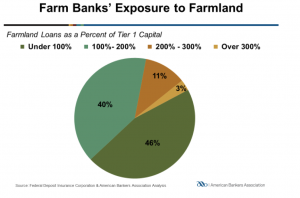

More narrowly on the issue of farmland exposure, the Report pointed out that, “Over the last several years, farmland loans at farm banks have represented around half of total farm loans.

“In 2020, very few farm banks were heavily concentrated in farm real estate loans relative to Tier 1 capital. Most farm banks had a farmland concentration ratio of under 200%—a level that has not raised supervisory concerns.”