A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Global Food Prices Soar in May- Highest Value Since September 2011

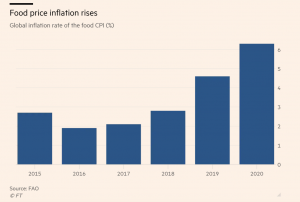

Financial Times writer Emiko Terazono reported this week that, “Global food prices surged by the biggest margin in a decade in May as one closely watched index jumped 40 per cent, raising fears of further food inflation later in the year.

“The year-on-year leap in the UN Food and Agriculture Organization’s monthly food price index was the largest since 2011 and signalled that inflation initially stoked by pandemic disruption is accelerating.

“China’s soaring appetite for grain and soyabeans is adding to upward pressure on prices, along with a severe drought in Brazil and growing demand for vegetable oil for biodiesel.”

The FT article indicated that,

‘China has continued to buy, but with Brazil’s drought proving to be more severe than expected, everyone has to pray that the weather in the US is going to be good,’ said [Abdolreza Abbassian, senior economist at the FAO.]

Bloomberg’s Megan Durisin reported on Thursday that, “Drought in key Brazilian growing regions is crippling crops from corn to coffee, and vegetable oil production growth has slowed in Southeast Asia. That’s boosting costs for livestock producers and risks further straining global grain stockpiles that have been depleted by soaring Chinese demand. The surge has stirred memories of 2008 and 2011, when price spikes led to food riots in more than 30 nations.”

Global #foodprices rose rapidly in May reaching the highest value since Sept 2011, even as world cereal production is on course to reach a new record high.

— FAO Newsroom (@FAOnews) June 3, 2021

A surge in the intl prices of vegetable oils, sugar and cereals led the increase.

More: https://t.co/TSbd1Y1axR pic.twitter.com/WoZJUorjV3

Meanwhile, Washington Post writer Laura Reiley reported last week that, “As food prices continue to rise, beef and pork have surged out front.”

“Michael Nepveux, an economist for the American Farm Bureau Federation, ticks off the factors contributing to skyrocketing prices: Labor shortages in the meatpacking industry on the heels of months of slowdowns and shutdowns due to covid-19; a surge in restocking food service as restaurants reopen; high grain and transportation costs; and strong exports and domestic demand.”

What Your #Breakfast Can Tell You About #Inflation Worries

— Farm Policy (@FarmPolicy) June 2, 2021

Add'l background here: https://t.co/76VuQlhTlEhttps://t.co/ibAJwScTCu

More broadly, the June issue of the AMIS Market Monitor explained that, “Higher prices year-on-year across a broad spectrum of goods and services have raised concerns about inflationary pressures within the agricultural sector. The May FAO Food Price Index revealed a steep appreciation, reporting a 30.8 percent rise compared to last year. US futures markets, the global benchmarks for primary commodities, also confirmed outsized gains since last year, with wheat, maize and soybean prices in May reaching their highest levels in 8 years. Similar increases were also observed to varying degrees in sectors such as energy, metals, raw materials, equities, housing, and the more recent phenomenon of crypto currencies, precipitating a debate on whether high prices were transitory or presaged a more lasting development.”

The Monitor noted that,

Although inflationary tendencies might appear to be driving commodity food prices higher, the evidence points more to the unique supply and demand conditions that unfolded over the past year.

In addition, The Monitor stated that, “In sum, the current high-price food environment appears to be mostly driven by fundamentals and will probably persist to some degree owing to the tight carryout situation projected through 2021/22.”

Also this week, Wall Street Journal writer David Winning reported that, “Production at JBS SA meat-processing plants in Australia is coming back online faster than authorities had expected after the ransomware attack on the company this week, the country’s agriculture minister said Thursday.”

The Journal article added that, “Andre Nogueira, chief executive of JBS’s U.S. operations, said on Wednesday that most of the company’s beef facilities in Australia and the U.S. had resumed work.”