Reuters reported Tuesday that "the top U.S. oil and corn industry lobby groups said on Tuesday they were suing the administration of President Joe Biden over its plans to slash…

U.S. Refiners Accumulate $1.6 Billion Shortfall in Biofuel Credits, as Biden Administration Weighs RFS Volume Cuts

Late last week, Reuters writers Jarrett Renshaw and Stephanie Kelly reported that, “U.S. merchant refiners have amassed up to a $1.6 billion shortfall in the credits they will need to comply with U.S. biofuel laws, according to a Reuters review of corporate disclosures, an apparent bet that the Biden administration could let them off the hook or that credit prices will fall.

“The big liability among companies including PBF Energy Inc, CVR Energy Inc, Par Pacific Holdings and Delta Airlines comes as the administration of President Joe Biden considers granting oil refiners relief from their biofuel mandates amid soaring credit costs and economic turmoil from the coronavirus pandemic that has hurt the fuel industry.

“‘There is a sense among refiners that they have to do something right now,’ said Robert Campbell, head of oil products research at Energy Aspects, referring to the decision among some companies to carry a shortfall in the biofuel credits. ‘They feel that the point of obligation is extremely challenging for them.'”

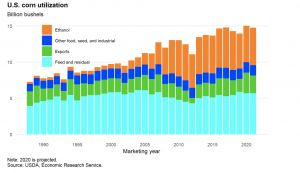

The Reuters article noted that, “Under the U.S. Renewable Fuel Standard program, refiners must blend billions of gallons of biofuels like ethanol into their fuel or buy compliance credits, known as RINs, from those that do. Merchant refiners have long opposed the policy because of its cost.”

“Refiners could avoid some of the outstanding liabilities if the Biden administration chooses to reduce or waive the U.S. mandates, as some lawmakers and refining industry representatives have requested to help the industry. The Biden administration has not yet said what action, if any, it will take to relieve refiners of RFS obligations,” the Reuters article said.

Also last week, Bloomberg writers Jennifer A Dlouhy and Kim Chipman reported that, “The Biden administration is developing targets for biofuel that are likely to be relatively flat or even lower as it seeks to balance the interests of blue-collar refining workers and advance a clean-energy agenda.

“The Environmental Protection Agency is set to propose renewable fuel requirements within weeks, according to several people familiar with the strategy who asked not to be named before a formal announcement.

The targets will dictate how much corn-based ethanol, biodiesel and other renewable fuels oil refiners must blend into their products in 2021 and 2022.

“The proposal is on track to be issued after the Supreme Court makes what could be a pivotal ruling on the EPA’s ability to exempt refineries from the mandates.”

The Bloomberg article pointed out that, “Oil refiners meet the government’s biofuel quotas either through blending renewable fuels themselves, or by purchasing credits from others that have. Prices for some of those credits have hit all-time highs this year on expectations the Biden administration would impose more ambitious quotas and stop exempting refineries from them. Corn and soybean prices have also climbed on expectations of more demand from biofuel makers.

“Instead, the EPA is considering more modest targets under the Renewable Fuel Standard program, according to three people familiar with the matter who asked not to be identified describing internal deliberations. The agency is also moving to abandon a plan for incorporating waived quotas that had been adopted under former President Donald Trump.”

And DTN writer Todd Neeley reported on Wednesday that, “With reports the Biden administration may be considering providing relief to oil refiners from their Renewable Fuel Standard obligations, a group of Democratic lawmakers on Wednesday pushed back in a letter to EPA Administrator Michael Regan and Brian Deese, director of the National Economic Council.

Biofuels can play a critical role in meeting our climate goals and creating jobs.@SenAmyKlobuchar, @RepCindyAxne, @RepAngieCraig & I are leading a group of our colleagues in a call to uphold the renewable fuel standard our family farmers rely on.https://t.co/36e9zhNwwC

— Rep. Cheri Bustos (@RepCheri) June 16, 2021

“In recent days media reports indicate the Biden administration may be considering a number of measures including cutting back on RFS volumes for 2020 and 2021, as well as providing other relief to oil refiners. Despite the administration’s reported efforts, the price of renewable identification numbers, or RINs, have been falling in recent days. Obligated parties to the RFS can either blend biofuels or purchases RINs credits, which are generated by companies that do blend biofuels.

“In the letter, 16 members of Congress urged the administration to stick to its agenda to decarbonize the transportation fuel sector by expanding biofuels blending.”

Mr. Neeley added that, “The biofuels industry’s RFS struggles span several administrations. Most recently, the Trump administration granted 88 small-refinery exemptions in four years, setting off a legal fight all the way to the Supreme Court. Industry groups have placed their hope in the Biden administration to set a different course on the RFS.”

Meanwhile, Reuters writer Stephanie Kelly reported last week that, “The U.S. Department of Agriculture (USDA) will give $700 million in aid to biofuels producers as part of a package to assist industries recovering from the financial devastation of the coronavirus pandemic, officials said on Tuesday.

“Biofuel groups had been advocating for relief after the pandemic slashed fuel demand and sank consumption of biofuels like ethanol. The USDA said it plans to implement the aid in the next 60 days.”