As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

By Reducing Red Tape, China Lures Small Pig Farmers Into Production

Reuters News reported this week that, “China will no longer require small pig farms to get environmental approval from the government before breeding pigs as the country seeks to rebuild its hog herd following a disease outbreak, the agriculture ministry said on Monday.

“The move, which will reduce costs and red tape for small farmers, comes as China tries to lure them back into pig production. A deadly African swine fever virus wiped out around half of the country’s huge pig herd during 2018 and 2019 and hit small farmers particularly hard.”

The Reuters article explained that,

The world’s largest pork producer still relies heavily on small farmers for output, but the outbreak left them with large debts and they are hesitant to rebuild stocks due to ongoing disease risks and a lack of capital.

“While China has rapidly rebuilt some of the lost stock, there have been further outbreaks this year in northern China and the southwestern Sichuan province, and more strains of the virus circulating,” the Reuters article said.

Meanwhile, the USDA’s Foreign Agricultural Service (FAS) indicated on Monday in its Livestock and Poultry: World Markets and Trade report that, “Global pork production for 2021 is revised up nearly 4 percent from April to 105.1 million tons primarily on higher production in China which was raised 8 percent to 43.8 million tons. Since early 2021, China hog slaughter has been strong and carcass weights higher. Rebounding pork production at a time of weak seasonal demand has caused prices to drop rapidly, prompting liquidation of animals as Chinese producers have sought to protect margins. However, the reported culling of breeding animals, continued productivity challenges, and weaker producer margins are expected to slow China production growth later in the year.”

With respect to pork exports, FAS stated that, “Global pork exports for 2021 are revised up 2 percent to 11.8 million tons on higher estimates for all major exporters. China imports continue to underpin global trade and are raised 3 percent to 5.0 million tons. Meanwhile, Philippines imports are revised up 21 percent to 425,000 tons on lower tariffs and a continued ASF-induced supply deficit. Mexico imports are raised nearly 3 percent to 985,000 tons on high domestic prices, a stronger peso, and as an offset to strong exports.”

In a closer look at June meat imports by China, Reuters News reported this week that, “China imported 743,000 tonnes of meat in June, down 17% from the same month a year earlier, customs data showed on Tuesday, as weak domestic pork prices hit demand for imports.”

The Reuters article added that, “Meat imports in the first half of the year, however, totalled 5.08 million tonnes, the data from China’s General Administration of Customs showed, higher than last year’s 4.75 million tonnes in the first six months of 2020.”

Livestock production dynamics continue to be one of several variables impacting Chinese protein demand.

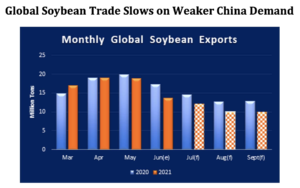

In its monthly Oilseeds: World Markets and Trade report this week, FAS explained that, “Global soybean trade has slowed in recent weeks. While trade had been matching last year’s strong pace earlier in the year, June trade volumes are estimated to fall 3.6 million tons below last year. With China demand a major driver, the weakening export pace can be attributed to a softening in China purchases.

“Soybean stocks in China, already at high levels, continue to grow as earlier imports exceeded the monthly crush pace.

Large pork supplies have dragged pig prices lower, reducing feed margins and lowering soybean meal demand at least in the short term.

“With large soybean supplies on hand, and markets offering lower prices for shipments in the last quarter of the year, lower global soybean shipments are expected over the next 3 months and prior to the U.S. harvest.”

Regarding last month’s soybean imports by China, Reuters News reported this week that, “China’s soybean imports in June rose 11.6% from May, customs data showed on Tuesday, continuing the trend of resurgent demand in the world’s top buyer as it strives to meet meal demand for its burgeoning hog herds.

“China took in 10.72 million tonnes of soybeans in June, up from 9.61 million tonnes in May, and the third-highest monthly amount on record, data from the General Administration of Customs showed.

“While down 3.9% from a record 11.16 million tonnes a year earlier, the imports underline a surge this year in China’s soybean demand for soymeal to feed replenished hog herds after the decimation from African swine fever.”

Looking ahead, the Reuters article noted that, “Chinese soybean imports may fall in the second half of the year as crush margins have turned negative, said two analysts who follow the market that asked to remain unidentified.”

The Reuters article added that, “China also brought in 15.3 million tonnes of corn in the first half of the year, up 318.5% from a year ago. Wheat imports in the first half rose 60.1% to 5.37 million tonnes, according to the customs data.”

In a related article, Reuters writers Hallie Gu and Shivani Singh reported this week that, “China will add 10.85 million tonnes of storage capacity to its already massive grains stockpiling programme, official media reported on Sunday.

“Sinograin, the country’s state grains stockpiler, will start building 120 storage facility projects located in 18 provincial administrations this year, reported huanqiu.com, the website under the Global Times, controlled by the ruling Communist Party.

“The move came after Beijing strengthened its focus on food security, and pledged to carry out near and long term plans to bolster grains supplies in the world’s top population.”