Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Easing Protein Demand in China Could Slow Soybean Imports

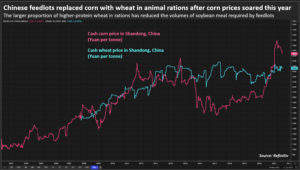

Late last week, Reuters writers Hallie Gu and Gavin Maguire reported that, “China’s soybean imports are set to slow sharply in late 2021 from a record first-half tally, confounding expectations for sustained growth from the top global buyer and denting market sentiment just as U.S. farmers look to sell their new crop.

“A collapse in hog sector profitability and a sharp rise in wheat feed use are crimping demand in China, where imports this year may now be less than 100 million tonnes, compared with a recent U.S. forecast of 102 million tonnes.

The collapse in hog margins and pork prices has been spectacular. It has sent shockwaves through the hog industry and triggered emergency pork purchases by China's state reserve system to try to prop businesses up. pic.twitter.com/pBiun6EZNX

— Gavin Maguire (@GavinJMaguire) July 23, 2021

“As China accounts for 60% of global soybean imports, its diminished appetite – just as U.S. farmers pull in what is projected to be their third-largest harvest ever – stands to add further volatility to the critical crop, which rallied to nine-year highs this year.”

The Reuters article noted that, “China imported a record 48.95 million tonnes in the first half of 2021, up nearly 9% on the year as hog herds recovered from a deadly disease outbreak and top producer Brazil shipped a record crop.

Now, however, demand is stumbling, analysts say.

Gu and Maguire added that, “Soybean flows to China are already slowing.

“China’s June soybean imports from all origins came in at 107.2 million tonnes, down 4% from 111.6 million tonnes in June 2020.

“July arrivals were seen at 8.3 million tonnes, with the majority originating from Brazil, according to Refinitiv. That’s down 30% from 109 million tonnes in the previous year.”

Also last week, Reuters writers Hallie Gu and Shivani Singh reported that, “China’s use of wheat in feed is expected to stay high as the grain retains a price advantage over corn, agriculture ministry official Song Danyang said on Tuesday.”

And the USDA’s Economic Research Service pointed out in this month’s Oil Crops Outlook report that, “USDA has lowered its soybean export forecast for Argentina and Brazil for the 2020/21 marketing year by 2.65 and 3 million metric tons, respectively. The expected decrease comes on the heels of drought conditions in Argentina limiting the ability of exports to reach the port for shipment. Additionally, weaker demand from China’s crush sector has decreased the need for soybean imports from Brazil. As such, 2020/21 exports from Argentina and Brazil are forecast at 3.7 and 83 million metric tons.”

Meanwhile, Bloomberg News reported last week that, “The heavy rains that pounded Henan province in central China will cause damage to some hog farms in the major pork-producing region and potentially trigger fresh cases of African swine fever.

“Small farmers will be severely affected by the torrential rains and there will be a ‘significant’ short-term impact on logistics, including the transportation of hogs, according to Shanghai JC Intelligence, an agriculture consulting firm.

“A bigger worry is the potential outbreak of African swine fever, said Lin Guofa, a senior analyst at consultancy Bric Agriculture Group. Floods increase the risk of disease as the virus can be found in pig’s blood, feces and tissue. Healthy hogs may be infected through contact with sick pigs or contaminated feed and water.”

More broadly with respect to African swine fever in China, Reuters News reported last week that, “China’s efforts to control African swine fever outbreaks among its pig herd remained complicated, with 11 outbreaks officially reported so far this year and new variants of the virus also present, an agriculture ministry official said on Tuesday.”