A new 10% tariff on goods from around the world took effect Tuesday — with a list of exemptions including beef. Other exemptions affecting the food and agriculture industries include…

Farmers in China Are Planting More Corn This Year, With a Potential Impact on Import Demand

Reuters writers Hallie Gu and Gavin Maguire reported this week that, “Chinese farmers have sharply increased corn planting this year to cash in on demand-fuelled record prices, a trend that is likely to cool the country’s recent rampant appetite for imports heading into 2022.

The expansion, which comes mainly at the expense of soybeans and other crops including sorghum and edible beans, would boost China’s maize output in 2021/22 by at least 6%, according to market participants.

“That will likely ease a repeat of last year when strong feed demand from the hog sector propelled China’s corn use beyond local production and sparked a 26-million tonne import spree that turned the world’s largest grain producer into the top corn buyer.”

Chinese agri consultants are expecting a jump in corn output by at least 6% in 2021/22 from 2020/21, with some key areas having boosted corn acreage by more than 20% pic.twitter.com/WOVjrqbM6B

— Gavin Maguire (@GavinJMaguire) July 7, 2021

The Reuters writers explained that, “Key exporters who have benefited from China’s corn import binge include the United States and Ukraine.”

“The U.S. Department of Agriculture’s China attache expects 2020/21 imports to slip to 20 million tonnes, versus the USDA official estimate of 26 million tonnes, on a drop in international corn’s price competitiveness and higher local production,” the article said.

Lower soybean production bodes well for China's soybean imports in 2021/22. But if this year's China corn crop gets friendly weather on top of a big lift in planted area, China's corn imports may taper off quite quickly, say analysts. pic.twitter.com/ien3H3rEHZ

— Gavin Maguire (@GavinJMaguire) July 7, 2021

Gu and Maguire pointed out that, “Corn’s gains come mainly at the expense of soybeans, which could have the converse effect of increasing imports of the legume, which comes primarily from the United States and Brazil.

“The U.S. Department of Agriculture is projecting China’s soybean imports at 103 million tonnes in the 2021/22 season, up from 100 million tonnes in 2020/21.”

U.S. #corn exports in May 2021 reached 8.48 million tonnes (334 mln bu), the third largest for any month on record (behind March, April 2021). Some 40% of May exports were to #China, the largest ever monthly share. pic.twitter.com/BBVFu0c9Mn

— Karen Braun (@kannbwx) July 2, 2021

In other news regarding corn demand, Bloomberg writer Maya Averbuch reported last week that, “Mexico is considering boosting corn imports and capping cooking gas prices as an inflationary spike hits tortilla prices, a staple for the country’s families.

“Inflation in Latin America’s second-largest economy quickened to around 6% in the second quarter, driven by fuel and food prices. The spike led the central bank to increase the key interest rate by a quarter-point last week, surprising economists, who see inflation slowing to only 5.58% by the end of the year.”

The Bloomberg article noted that, “The president argued that Mexico was not self-sufficient in producing the yellow corn needed for tortilla, leading to price swings.”

Top 10 U.S. export markets for #corn, by volume https://t.co/V85OpkE44w @USDA_ERS

— Farm Policy (@FarmPolicy) July 6, 2021

* #China pic.twitter.com/nL6UaDDphv

Meanwhile, Reuters writer Roberto Samora reported last week that, “Brazil’s corn export season kicked off this month, albeit slowly, with the number of ships expected to load and depart with the product in July being less than half what it was in the same year-ago month, Cargonave shipping data showed.

“Some 39 vessels are lined up to load corn at Brazilian ports this month, down from 85 in the same period a year ago, according to Cargonave.

“In 2020, Brazil exported around 33 million tonnes but this year weather problems slashed output, compromising exports. According to market projections, Brazil is now poised to export about 20 million tonnes of corn this year.”

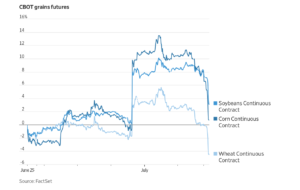

And Wall Street Journal writer Kirk Maltais reported this week that, “Prices for U.S. grains are locked in a volatile pattern as growing areas of the country wait for rain.”

The Journal article noted that, “In their reports, the USDA projected that U.S. farmers planted 92.7 million acres of corn, 87.6 million acres of soybeans and 46.7 million acres of wheat this spring. While the combined corn and soybean acreage is a record, it isn’t as high as what the market anticipated.

“Meanwhile, the USDA also reported that U.S. grains inventories are down to their lowest levels since 2015. Robust demand for U.S. grains on the world export markets means inventories are dwindling faster than predicted.”

Mr. Maltais added that,

Potentially exacerbating a supply squeeze due to weather is how much U.S. grain exports China buys.

“The nation has been hands-off in recent weeks, leading some to question if it will cut its appetite for U.S. agriculture as it rebuilds its hog herd after devastation from African swine fever.

“However, in separate reports issued last week, the USDA’s Foreign Agricultural Service said that China imported $7.7 billion of U.S. soybeans in the first quarter of 2021, the second-highest on record for the quarter. The FAS also forecast that China will remain strong importers of U.S. grains as higher domestic prices there make importing attractive.”