President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

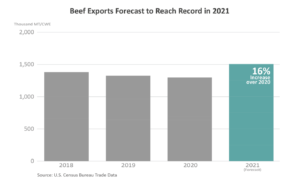

Record U.S. Beef Exports Forecast for 2021- Robust Demand from China a Factor

A report last week from the USDA’s Foreign Agricultural Service (FAS), “Banner Year for U.S. Beef Exports in 2021,” stated that, “As countries roll back COVID-19 restrictions, foreign market demand for beef is becoming a bright spot for U.S. producers.

“With record U.S. beef production forecast this year, U.S. beef exports are forecast to strengthen their position in the global marketplace. Meanwhile, lower production in Australia and tighter exportable supplies from Argentina are expected to limit the global availability of beef.

For 2021, U.S. beef exports are forecast to reach a record 1.5 million metric tons (mt) carcass weight equivalent (cwe), up 16 percent compared to last year and 8 percent above the 2018 high.

The FAS update noted that, “Since 2016, South Korea has been a top destination for U.S. beef. Exports were up 26 percent on a volume basis and 30 percent on a value basis from January to May 2021 compared to the same period a year ago. This market accounts for 25 percent on both a volume and value basis of the U.S. overseas beef market in the first 5 months of the year.”

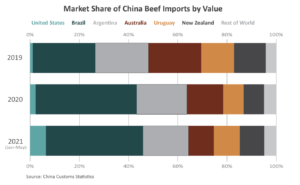

With respect to China, where pork imports are expected to slow down in the near-term, FAS stated that, “The potential for growth in U.S. beef exports is strong in future years as China import demand is expected to grow more than 30 percent during the next decade.

“From January to May 2021, U.S. beef to China surged 13-fold in both exports and sales from the same period last year. U.S. beef has benefited from the Economic and Trade Agreement between the United States and the People’s Republic of China (also known as the Phase One Agreement), which expanded market access for U.S. beef by eliminating several long-standing non-tariff barriers. Through May 2021, China ranks as the third-largest U.S. market by both volume and value, surpassing both Mexico and Canada which have historically been ranked as top U.S. markets consistently.”

U.S. year-over-year #beef exports to major destinations, https://t.co/m8yw94pwlt @USDA_ERS

— Farm Policy (@FarmPolicy) July 16, 2021

* #China pic.twitter.com/ehSFdr4nDI

Also last week, the July edition of The Economic Landscape, from the USDA’s Agricultural Marketing Service, pointed out that, “May 2021 beef and veal exports (including variety meats) totaled 133 thousand MT, up 68 percent yearly and up 10 percent monthly. The export value jumped 88 percent from last year and rose 12 percent from last month to $904 million. Beef and veal total exports for the year to date are up 15 percent in volume and 22 percent in value. Twenty-seven percent of U.S. beef exports went to South Korea, 24 percent went to Japan, 15 percent to China, nine percent to Canada and seven percent to Mexico.”

And the USDA’s Economic Research Service noted in its monthly Livestock, Dairy, and Poultry Outlook report last week that, “South Korea received its largest volume of beef yet from the United States, exceeding the record 75.1 million pounds posted in August 2020 by 8.6 million pounds. Since January, U.S. beef exports to South Korea have been up due to strong demand and a lower tariff rate than a year earlier. The second- largest shipment in May went to Japan. The increase in U.S. beef exports to Japan has also been partially driven by a lower tariff rate than a year ago. For exports to China, the story of year-over-year increases continues. China is the U.S. third-largest beef destination and imports have been up substantially, partly due to the change in U.S. access to China’s market that was established in March 2020 along with the strength of import demand for animal proteins to help offset China’s low domestic supplies of pork. U.S. producers have increased production of cattle geared toward meeting China’s import requirements, which has supported higher beef shipments.”

More broadly on the issue of U.S., China trade, New York Times writers Alan Rappeport and Keith Bradsher reported in Saturday’s paper that, “Although China has resumed large-scale purchases of U.S. goods since the countries’ trade war, neither the overall value of these purchases nor the composition of purchases has met the Trump administration’s hopes.

“China fell short of its commitments by 40 percent last year and is off by more than 30 percent so far this year, said Chad P. Bown of the Peterson Institute for International Economics, who has been tracking the purchases. The pace of agricultural purchases has picked up, but China is not buying enough cars, airplanes or other products made in the United States to meet its obligations.

“China also pledged in the Phase 1 agreement that its purchases of American goods would continue rising from 2022 through 2025.”