“‘For the most part, we’re looking at less than five bushels to an acre,’ said Shelley Mills, of Valley County Extension.”

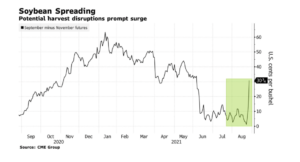

Also Thursday, Bloomberg writers Elizabeth Elkin and Michael Hirtzer reported that, “Prices for some soybean contracts are rising as storms in the Caribbean Sea threaten to disrupt the early U.S. harvest.

“Grains and oilseeds have been generally getting cheaper due to better crop prospects. But because of the storm, the nearby September contract traded in Chicago is gaining sharply against November futures, the contract that’s currently the most traded, in a move known as bull spreading.”

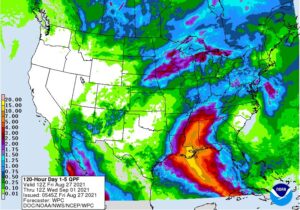

The Bloomberg article pointed out that, “The tropical storm is moving toward the Gulf of Mexico, and Mississippi River Delta soybeans are typically among the first to hit the U.S. market. In Louisiana, the soy harvest has already begun and was 2% complete as of Sunday, the U.S. Department of Agriculture said earlier this week.”

Friday’s Agricultural Weather Highlights report, from the USDA’s Office of the Chief Economist, stated that, “In fact, Mississippi Delta producers potentially in Ida’s path are attempting to complete storm preparations, including corn and rice harvesting, where possible.”

Meanwhile, Reuters News reported this week that, “Brazil is expected to harvest a record grain crop of 289.6 million tonnes in 2021/2022, driven by higher soybean and corn production in the season starting next month, government agency Conab said on Thursday.

“In its first forecast for the coming grain season, Conab forecast Brazil’s soybean crop will grow by 3.9% to 141.3 million tonnes and its corn output will rise 33.8% to 116.0 million tonnes.”

In more specific news regarding export transportation costs for Brazil and the U.S., the USDA’s Agricultural Marketing Service (AMS) indicated yesterday in this week’s Grain Transportation Report that, “The world’s two leading producers of soybeans—United States and Brazil—have long competed for the same overseas markets. According to USDA’s August World Agriculture Supply and Demand Estimates (WASDE), in marketing year (MY) 2021/22, Brazil is projected to produce 144 million metric tons (mmt) and export 93 mmt of soybeans, while the United States is projected to produce 118.08 mmt and export 55.93 mmt. Two key export markets for the United States and Brazil are China and Europe. Low transportation and landed costs of soybeans to these export destinations are essential to the competitiveness of both the United States and Brazil. This article compares quarterly and yearly changes in the costs of moving soybeans from the United States and Brazil to Shanghai, China and to Hamburg, Germany.”

The AMS Report indicated that, “From first quarter 2021 to second quarter 2021 (quarter to quarter), costs fell for exporting U.S. soybeans through the U.S. Gulf to China and Germany. However, costs to ship soybeans from the Pacific Northwest (PNW) to China rose.”

“In Brazil, transportation costs rose in response to higher truck and ocean freight rates.”

The AMS update noted that, “From second quarter 2020 to second quarter 2021 (year to year), transportation costs increased in the United States and Brazil. In the United States, higher truck, barge, and ocean freight rates pushed up total transportation costs. In Brazil, higher truck and ocean rates pushed up total transportation costs.”

Yesterday’s update added that, “Quarter to quarter, landed costs increased in both the United States and Brazil;” and, “Year to year, landed costs rose in both countries.”

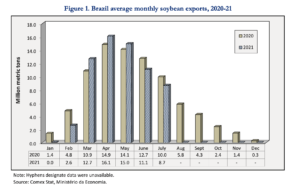

A separate AMS report on Thursday (“Brazil Soybean Transportation“) stated that, “Brazil’s soybean transportation costs increased mostly because of a significant rise in ocean rates.”

The report added that, “In the first 6 months of 2021, Brazil exported nearly 58 mmt of soybeans, valued at $24.7 billion. During this time, Brazil exported 39.8 mmt of soybeans to China, valued at $17.0 billion, nearly 6 percent less than its total of 42.2 mmt in from January to June 2020.”