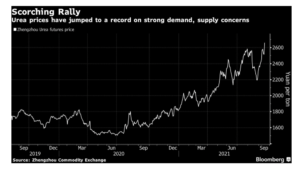

As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Global Corn Production Higher, but Farmers Face Ida-Related Input Supply Disruptions- Increased Fertilizer Costs

Reuters writer Nigel Hunt reported last week that, “The International Grains Council (IGC) on Thursday raised its forecast for the 2021/22 global corn crop, predominately reflecting improved outlooks for the United States and Ukraine.

“In its monthly update, the inter-governmental body increased its 2021/22 world corn (maize) crop outlook by 7 million tonnes to a record 1.209 billion tonnes.

World #maize (#corn) production in 2021/22 is forecast to exceed the previous record, set five years ago, with y/y gains in production expected in a number of key growers, including the major exporting countries. pic.twitter.com/t5UhJbdFcQ

— International Grains Council (@IGCgrains) September 23, 2021

“The crop in the United States, the world’s top corn producer, was seen at 380.3 million tonnes, up from a previous projection of 374.7 million but marginally below the U.S. Department of Agriculture’s forecast of 380.9 million issued earlier this month.”

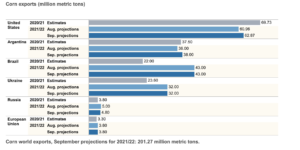

With respect to U.S. corn exports, the USDA’s Economic Research Service (ERS) indicated earlier this month in its Feed Outlook report that, “With higher projected corn supplies this month, U.S. corn exports for 2021/22 are projected larger, up 1.5 million tons to 62.5 million. The United States is currently (seasonally) the least price-competitive global corn exporter. Moreover, its ability to ship grain was affected by Hurricane Ida (at the very end of August) that damaged key export terminals around the Gulf Coast, although port disruptions caused by Hurricane Ida are presumed to be temporary (based on all available information). The increase in corn exports assumes larger shipments to Canada and Mexico, the two destinations where grain can be transported via rail and trucks, thereby avoiding the current disruptions with the Gulf.”

ERS added that, “For the 2020/21 trade year, U.S. corn exports are reduced by 3 million tons, to a still record- high of 69.5 million. Declining price competitiveness and a subsequent lower export pace in August were likely exacerbated by Hurricane Ida at the end of that month. The hurricane’s negative effects are expected to affect September shipments (which is the end of the 2020/21 international trade year). The (downwardly revised) record exports are 22.5 million higher than in 2019/20.”

In addition to export flows, Hurricane Ida has also negatively impacted the supply chain for agricultural inputs.

Reuters writers P.j. Huffstutter and Mark Weinraub reported last week that, “Ida disrupted grain and soybean shipments from the Gulf Coast, which accounts for about 60% of U.S. exports, at a time global crop supplies are tight and demand from China is strong.

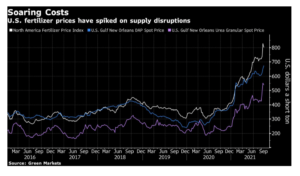

Now, the storm’s ripple effects are hampering production and movement of some fertilizers and crop chemicals ahead of U.S. harvest. This is straining an agricultural and food supply chain already battered by trade and logistics delays during the pandemic.

“Rising input costs threaten the incomes of farmers who had banked on booming profits this year, as crop prices soared to the highest in nearly a decade, after years of stagnating around break-even levels. [Kentucky corn and soybean farmer Caleb Ragland] and other farmers have been rethinking what they will plant in the spring; crops requiring less fertilizer look more attractive.”

And Bloomberg writer Elizabeth Elkin reported last week that, “A perfect storm of events — from extreme weather and plant shutdowns to new government sanctions — has hit the chemical fertilizer market this year, slamming farmers already buckling under the strain of rising costs to produce food. Prices for urea, a popular nitrogen-based fertilizer, skyrocketed earlier this month to the highest since 2012 in New Orleans, the U.S.’s major fertilizer trading hub. A common phosphate fertilizer known as DAP is the most expensive in that market since 2008, Bloomberg data show.

“‘As fertilizer prices continue to rise, farmers will either cut application rates, cut fertilizer entirely in hopes for lower future pricing, or cut other farm products to account for the bigger expected spend,’ said Alexis Maxwell, an analyst at Green Markets, a business owned by Bloomberg. Some are holding out before buying for the next growing season in hopes costs come down — a risk, she said, since prices could continue to rise.”

The Bloomberg article added that, “‘We’re anticipating this will impact the acreage battle next year,’ said StoneX chief commodities economist Arlan Suderman. ‘We are looking for lower corn acres next year as a result.’ Suderman estimates acres of U.S. corn at 91 million, down from 93.5 million this year.”