A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Higher Fertilizer Prices Could Impact U.S. Acreage Allocation, as Power Issues in China Impact Feed Costs

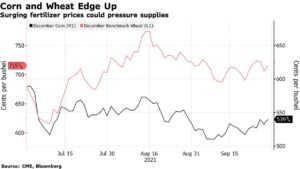

Bloomberg writer Kim Chipman reported this week that, “Corn and wheat rebounded in Chicago as ripple effects from soaring fertilizer prices threatens to squeeze already tight grain supplies.

“Higher crop-nutrient costs worldwide — spurred by energy crises in Europe and China — could cause farmers to switch from wheat to other less fertilizer-intensive plants, adding pressure on already tight stockpiles, Alex Sanfeliu, head of Cargill Inc.’s World Trading Group, told Bloomberg.”

The Bloomberg article pointed out that, “An even ‘bigger conversation’ is the potential for farmers to shift from nitrogen-heavy corn to soybeans in next year’s U.S. growing season, Justin Gilpin, chief executive officer of the Kansas Wheat Commission, said in an email.”

And Dow Jones writer Kirk Maltais reported this week that, “The cost for fertilizer is at its highest level since 2008 at nearly $900 per short ton. That has farmers concerned about higher input costs going into the next crop year. The uptick comes amid news that China is halting its exports of phosphate through next year – while prices for other fertilizer ingredients are well up from this time last year. ‘The talk is turning to the new crop, where soaring natural gas prices have fertilizer costs through the roof, which means that costs of planting are going up for corn, and the implication is that it will shift some undetermined amount of acres over to beans,’ said Charlie Sernatinger of ED&F Man Capital.”

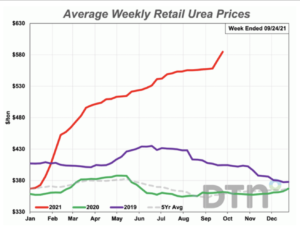

Also this week, DTN writer Russ Quinn reported this week that, “Retail fertilizer prices compared to a year ago show all fertilizers have increased significantly.”

“10-34-0 is now 39% more expensive, urea is 62% higher, DAP is 63% more expensive, UAN32 is 72% higher, MAP is 74% more expensive, UAN28 is 78% higher, anhydrous 82% is more expensive and potash is 85% higher compared to last year.”

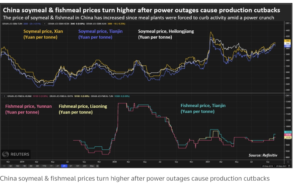

Beyond the implications of higher input costs for U.S. farmers, Reuters writers Hallie Gu and Dominique Patton reported this week that,

China’s huge livestock sector is facing a hike in feed costs as the country’s worst power outages in years forces soybean crushing plants to close, diving down supplies and sending prices higher, analysts and industry participants said.

“The rise in feed costs comes at a bad time for China’s farmers, many of whom are struggling with losses and weak margins due to low prices for hogs in particular.

“At least half the soybean crushing plants in northern and northeastern China have been shut since last week and will stay closed until at least after the National Day holiday on Oct 1, a plant manager and a feed purchase manager told Reuters, on condition of anonymity as they were not authorised to speak to media.”

The Reuters article stated that, “The feed cost hikes come as pig farmers grapple with weak hog prices, under pressure from higher production as stocks are rebuilt after the deadly African swine fever disease decimated the massive pig herd.”

“‘Right now, pig farmers are being squeezed on each end. The price for hogs is incredibly low and demand is weak, at the same time the price for soybean meal and feed is rising,’ said Darin Friedrichs, senior Asia commodity analyst at StoneX.”

“The electricity curbs have hurt production across a range of sectors, prompting many analysts to downgrade the outlook for growth in the world’s second-largest economy,” the Reuters article said.