Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Kansas City Fed: U.S. Agricultural Economy Generally Strong, as Demand for Livestock Loans Grew in Third Quarter

In an update from the Federal Reserve Bank of Kansas City earlier this month (“Larger Livestock Loans Boost Farm Lending“), Nathan Kauffman and Ty Kreitman stated that, “Demand for livestock loans grew in the third quarter, boosting agricultural lending activity at commercial banks. Demand for operating loans was more subdued however, and total non-real estate lending remained near its average of the past decade. The average size of loans for some livestock categories reached an all-time high and contributed to the increased lending. While the average size of operating loans also remained elevated, a smaller number of loans limited the overall financing of operating expenses.

The U.S. agricultural economy generally remained strong as elevated commodity prices continued to support farm incomes.

“Prices of most major crops were at multi-year highs moving into fall harvest and supported farm revenue prospects. Weakness in the cattle industry persisted, however, as low cattle prices continued to limit profit margins for producers. In addition, concerns about drought and higher input costs continued to intensify and likely contributed to an increase in producers’ financing needs in the livestock sector.”

A simple chart to emphasize that, although the ag economy has been strong since the middle of last year, it's been a more challenging time for cattle operations. pic.twitter.com/EdvZTZZ1dR

— Nathan Kauffman (@N_Kauffman) October 21, 2021

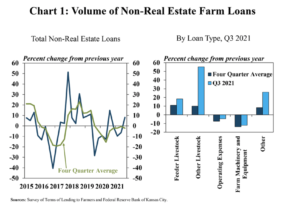

Kaufmann and Kreitman explained that, “The volume of non-real estate farm loans increased in the third quarter, but some types of lending remained limited. Total non-real estate lending was about 8% higher than a year ago but has declined at an average pace of about 2% over the last four quarters.

“A large share of the increase during the quarter was due to an increase in loans used to finance feeder livestock and other livestock, which grew by about 20% and more than 50%, respectively. In contrast, operating loan volumes declined by about 5%.”

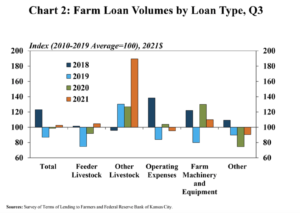

The Kansas City Fed indicated that, “With sharp increases from a year ago, lending for livestock purchases continued to trend above the recent historical average for the third quarter. The volume of loans for poultry and livestock other than feeders (other livestock) was nearly double the inflation adjusted average during the same quarter from 2010-2019. Feeder livestock loans were also slightly greater than the recent average while operating loans were slightly less.”

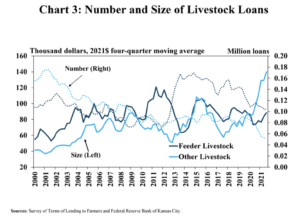

Kaufmann and Kreitman added that, “The increase in livestock loan volumes was driven by larger loan sizes. The average size of loans for other livestock continued a sharp upward trend, increasing about 30% in the third quarter and reaching an all-time high.”

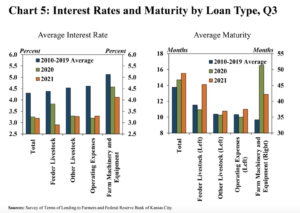

With respect to interest rates, the Kansas City Fed pointed out that, “Alongside an increase in loan sizes, interest rates remained low, and loan durations were higher than recent averages.

“Rates charged on all types of loans except operating loans declined slightly from a year ago and reached an all-time low for the third quarter.”