A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

No Signs of Relenting- Implications From Elevated Input Costs Continue to Unfold for Producers

Earlier this week, Wall Street Journal writer Jinjoo Lee reported that, “High natural-gas prices today mean your electricity and heating bills will likely be expensive this winter. Next year, it could mean you will end up paying more to eat and to fill up your car.

“In Europe, where natural gas is almost six times as expensive as it was a year earlier, fertilizer companies—including Norwegian company Yara, as well as BASF and Borealis—have announced curtailments as a result of expensive gas. Fertilizer production in the region has dropped as much as 40% as a result of tight supplies, according to CME Group. Natural gas can account for up to 85% of the production cost of ammonia, a key ingredient for many fertilizers, according to estimates from the U.S. Department of Agriculture.”

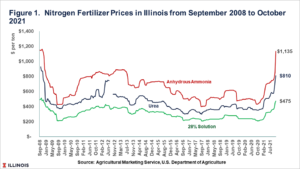

The Journal article noted that, “High natural-gas prices already have made nitrogen-based fertilizers more expensive, with both ammonia and urea prices in the U.S. roughly tripling compared with a year earlier, according to data from ICIS.

“Adding to the rally, China, one of the world’s largest fertilizer exporters, is said to be imposing curbs on shipments, according to a report released last Tuesday on Bloomberg.”

With respect to implications, the Journal article explained that, “If high prices persist, more farmers are likely to opt next year for planting soybeans, which require less fertilizer, according to Mark Milam, fertilizers senior editor at ICIS, who notes that ‘buyer reluctance‘ from farmers is starting to build as a result of surging costs.

Roughly three million acres of U.S. corn, out of around 90 million in total, could switch to soybeans next year, according to estimates from S&P Global Platts. Other crops that are sensitive to fertilizer price swings include wheat, oats and barley, according to the USDA. Corn futures for next harvest season have risen 4.2% in the past month.

University of Illinois agricultural economist Gary Schnitkey noted this week that, “As the price of nitrogen changes, corn and soybean prices will likely adjust to maintain about an equal level of relative profitability of the two crops.”

Also this week, DTN writer Russ Quinn reported that, “Retail fertilizer prices continue to skyrocket into historical price ranges the third week of October 2021, according to sellers surveyed by DTN. All but one of the eight major fertilizers had price increases of 10% or more compared to last month.”

On the issue of fertilizer availability, Bloomberg’s Michael Hirtzer reported this week that, “One of the world’s top crop traders says there’s no shortage of fertilizer — if you’re willing to pay for it.

“‘It’s a matter of price, of course,’ Archer-Daniels-Midland Co. Chief Executive Officer Juan Luciano told analysts Tuesday on an earnings call. ‘I would say at this point in time, it continues to be available for farmers only at higher price.'”

The repercussions of higher natural gas prices are expanding into other stages of agricultural production.

On Wednesday, Bloomberg writer Megan Durisin reported that,

French corn farmers are being told to leave crops unharvested in the latest sign of how soaring energy prices are heightening the risk of global food inflation.

“The grain typically needs to be dried down after it’s collected to ensure the proper moisture content, a task that’s becoming increasingly costly as natural gas prices skyrocket. Harvests in the country, one of Europe’s largest growers, are in full swing, with a third already collected.”

Recent news articles have also highlighted an increase in other farm related input costs.

Tyne Morgan reported this week at Farm Journal-Ag Web that, “One retail location in Missouri told Farm Journal glyphosate prices are up 100% this year, going from $19 per gallon to $38 per gallon. And glufosinate is showing a 50% increase, now at $70 per gallon compared to $45 last year.

“However, in northeast Iowa, glyphosate prices have shot up 294%. What cost the farmer $17 per gallon last year, is now showing a price tag of $50 per gallon.

“In northwest Indiana, glyphosate prices have seen a 300% increase in some locations, now at $80 per gallon.”

Average U.S. fuel prices per gallon rise in the week ended Oct. 25: diesel to $3.71 and gasoline to $3.38 https://t.co/eXXqMZajnV pic.twitter.com/sZLh9Hzul1

— St. Louis Fed (@stlouisfed) October 26, 2021

Meanwhile, Wall Street Journal writer Ryan Dezember reported on Monday that, “Propane prices haven’t been so high heading into winter in a decade, which is bad news for the millions of rural Americans who rely on the fuel to stay warm.

“At $1.41 a gallon at the Mont Belvieu trading hub in Texas, on-the-spot prices are about triple those of the past two Octobers.”