As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

“Fertilizer Price Spike Continues,” as Demand Remains Strong, and Corn Still Seen as Profitable

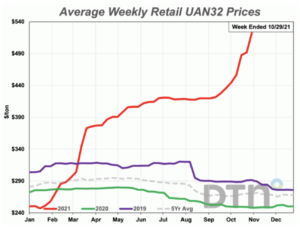

DTN writer Katie Micik Dehlinger reported on Wednesday that, “The retail fertilizer price spike continues, with seven of the eight major fertilizers tracked by DTN posting significant gains and one setting a new record. UAN32 cost an average of $522 per ton in the fourth week of October, the highest in DTN’s 13 years of gathering bids.

“While the nitrogen fertilizer increased 18% in price from the previous month, it wasn’t the largest price jump seen in the data this week. That honor goes to anhydrous, which climbed 26% from last month to $982/ton. It’s nearing prices last seen in November 2008.

“Urea, at $751/ton, increased 21% in price from last month. Like other nitrogen fertilizers facing supply crunches this year, it’s closing in on its historical highs. According to DTN data, urea’s highest retail price was $770/ton in the week of May 21, 2012.’

Oklahoma's agriculture industry isn't immune to the global supply chain crisis. With fertilizer prices soaring near 2008 high's, costs are hampering farmers' abilities to plant their crop and provide and affordable food and fiber supply.https://t.co/OiDQKSLmhL

— Frank Lucas (@RepFrankLucas) November 3, 2021

The DTN article added that,

All nitrogen fertilizers are now more than double in price what they were a year ago, with anhydrous up 131%, UAN28 119%, and urea and UAN32 110%. Potash is 120% higher, MAP is now 83% more expensive, DAP costs 81% more and 10-34-0 is up 46%.

Earlier this week, Bloomberg writer Jen Skerritt reported that, “Fertilizer demand is so strong that farmers are lining up for the crop nutrients, even as prices soar, according to Nutrien Ltd., one of the world’s largest producers.

“Growers won’t be deterred by the company’s pricey products because corn is also expensive, said Chief Executive Officer Mayo Schmidt. ”

The Bloomberg article noted that, “Mosaic Co., the world’s largest phosphate producer, is also seeing a huge leap in demand, Chief Executive Officer Joc O’Rourke said on a third quarter earnings call Tuesday.”

During today's Ag Committee hearing on supply chain challenges, I voiced concerns I've heard from farmers in #IA04 regarding fertilizer supply shortages & rising prices. Some have reported being quoted prices up to 6x higher than 2021. #IowaAg

— Rep. Randy Feenstra (@RepFeenstra) November 3, 2021

Read more⬇️https://t.co/stkF05U0Kg

Also this week, Dow Jones writer Patrick Chu reported that, “CF Industries Holdings Inc. sees strong demand for its products based on a stronger global economy and higher crop prices, and higher energy prices that restrain supplies, the Deerfield, Ill., fertilizer maker said Wednesday.”

The Dow Jones article noted that, “On higher crop prices:

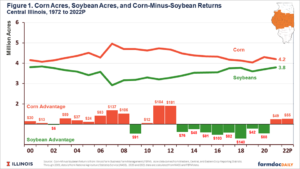

‘North America: Management projects that farmers will continue to plant nitrogen-consuming crops (corn, wheat, cotton and canola) at high levels given their relatively high front month and futures prices.’

Similarly, University of Illinois agricultural economist Gary Schnitkey pointed out this week that, “Compared to 2021, fertilizer costs in 2022 will be about $100 per acre higher for corn and $50 higher for soybeans. Even given the large increase in corn fertilizer costs, corn is projected to be more profitable than soybeans at current 2022 fall delivery bids. Given historical experience, large acreage shifts should not be expected between corn and soybeans.”

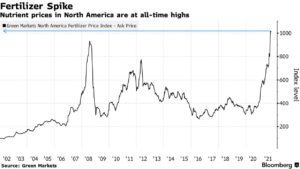

And with respect to global fertilizer supply, Bloomberg writers Yuliya Fedorinova and Megan Durisin reported on Wednesday that, “Russia plans to impose a six-month quota on some fertilizer exports to safeguard local supplies and limit costs for farmers after the energy crisis sent nitrogen nutrient prices soaring.

“The move — covering exports of nitrogen and complex fertilizers containing nitrogen — comes as nutrients prices have surged globally as soaring gas prices boost production costs and force some plants to cut production. That risks curbing harvests in the year ahead and accelerating food inflation.”

Recall that last month China imposed new hurdles for fertilizer exporters.

Meanwhile, Bloomberg writers Elizabeth Elkin and Tatiana Freitas reported this week that, “Since we first started making synthetic fertilizers a little more than a century ago, the planet has gone from roughly 1.7 billion people to about 7.7 billion, largely thanks to enormous growth in crop yields. Some experts have even estimated the global population might be half of what it is today without nitrogen fertilizer.

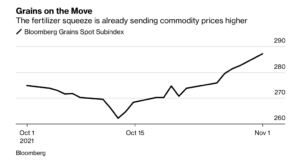

“With fertilizer markets now seeing unprecedented supply shocks and record prices, it means even more food inflation across the world.

“Global commodity futures are already convulsing. Benchmark wheat prices have shot up to the highest since 2012, coffee is near multi-year highs and corn has also jumped.”