A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

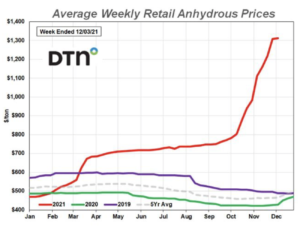

Fertilizer Prices- Still No Reprieve

DTN writer Russ Quinn reported last week that, “Average retail prices for most fertilizers continued to rise at a good clip the first partial week of December 2021, according to sellers surveyed by DTN. Once again, the nitrogen fertilizers maintained their spot as the clear leaders.

“Five of the eight major fertilizers recorded a sizable move higher compared to last month. DTN designates a substantial move as anything 5% or more.

Leading the way higher, as it has for several weeks now, was anhydrous, which was up 18% from a month prior. The nitrogen fertilizer’s average price was at $1,313 per ton, which continues to be all-time high in the DTN data set.

Mr. Quinn noted that, “UAN32 was 9% more expensive compared to last month with the average price at $661/ton, this is also an all-time high. Both UAN28 and urea were 6% higher looking back a month, with UAN28 having an average price of $575/ton and urea at $873/ton, both all-time highs.”

For a more detailed look at global market variables impacting urea, click here.

Recall that fertilizer prices have been climbing since early October.

On Thursday, Reuters writers Emily Chow and Roberto Samora, Bernadette Christina Munthe reported that, “With global food prices at their highest in more than a decade, rising fertiliser costs will only add to pressures on food affordability, especially in import-reliant economies, while stretched budgets leave little room for government subsidies, said Frederic Neumann, HSBC’s co-head of Asian economics research.”

The Reuters writers explained that, “But analysts say fertiliser supply tightness will worsen early next year. European, North American and North Asian farmers all need to step up purchases ahead of spring planting, while key producers China, Russia and Egypt have curbed exports to ensure domestic supplies.

“‘Most stockpiles of urea are now secured, meaning global producers will be ‘sold out’ until Jan. 1,’ said U.S.-based Josh Linville, director of fertiliser at StoneX Group Inc. ‘Producers start the new year very low on unsold inventories and they will be met by sizeable global demand in Q1 as U.S., Canada, Brazil, Europe, Asia all step forward to purchase.’

In response, farmers across the world are either delaying purchases or reducing fertiliser use to save money.

Meanwhile, Bloomberg writers Sybilla Gross and Mumbi Gitau reported last week that, “The market for manure — from pigs, horses, cattle and even humans — has never been so hot, thanks to a global shortage of chemical fertilizers.”

The Bloomberg article stated that, “Prices of synthetic fertilizer, which rely on natural gas and coal as raw materials, have soared amid an energy shortage and export restrictions by Russia and China. That’s adding to challenges for agricultural supply chains at a time when global food costs are near a record high and farmers scramble for fertilizers to prevent losses to global crop yields for staples.

The Green Markets North American Fertilizer Price Index is hovering around an all-time high at $1,072.87 per short ton, while in China, spot urea has soared more than 200% this year to a record.

“The demand for dung is playing out globally. In Iowa, manure is selling for between $40 to $70 per short ton, up about $10 from a year ago and the highest levels since 2012, according to Daniel Anderson, assistant professor at Iowa State University and a specialist on manure.”

In an opinion column last week at The Wall Street Journal editorial page, Missouri farmer Blake Hurst indicated that, “My family and I have finished applying the first of three fertilizers, and the increased costs for our farm are about $50,000, with an anticipated $40,000 increase for the remaining two inputs.”

And Reuters News reported last week that, “Farmers have asked the U.S. Department of Justice to investigate whether recent spikes in fertilizer prices are attributable to market manipulation by fertilizer companies, according to a letter sent Wednesday by the Family Farm Action Alliance.”

The Reuters article noted that, “Global fertilizer prices have reached record highs this year, in part due to soaring prices for the natural gas used to produce them, and severe storms in the United States that disrupted production.”