A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Global Market Variables Impacting Urea

New York Times writer Raymond Zhong penned an article this week discussing market factors associated with urea, and pointed out that, “[Prices] are soaring to levels not seen in over a decade. In this time of everything shortages and inflation worries, that alone might not sound too surprising. But urea links up several disparate-looking strands of global economic disruption, showing how easily extreme weather and shipping turmoil can cause supply shortfalls to radiate.

“People and industries of all kinds are feeling the shocks. In India, a lack of urea has made farmers fear for their livelihoods. In South Korea, it meant truck drivers couldn’t start their engines.

“Urea is an important type of agricultural fertilizer, so rising prices could ultimately mean higher costs at dinner tables around the world. The United Nations Food and Agriculture Organization’s index of food prices is already at its highest level since 2011. The coronavirus pandemic has caused huge numbers of people to face hunger, and increased food prices could cause even more to have trouble meeting basic dietary needs. Prices of two other widely used plant foods are skyrocketing as well.”

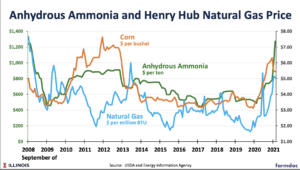

Mr. Zhong explained that, “One big reason for surging fertilizer prices is surging prices of coal and natural gas. The urea in your urine is produced in the liver. The industrial kind is made through a century-old process that turns natural gas or gas derived from coal into ammonia, which is then used to synthesize urea.”

While discussing factors that have lead to higher prices, the Times article stated that, “China and Russia, two of the biggest producers, have restricted exports to ensure supplies for their own farmers. In China’s case, an energy crunch led some areas to ration electricity, which forced fertilizer factories to slash production.

“Hurricane Ida drove several large chemical plants to suspend operations when it tore through the U.S. Gulf Coast in August. Western sanctions on Belarus have hit that nation’s production of potash, the key ingredient in another fertilizer. Port delays and high freight fees — plant food is bulky stuff — have added to costs.”

The Times article added that, “China is a linchpin of the global fertilizer trade. The country accounts for about a tenth of the world’s urea-based fertilizer exports and a third of exports of diammonium phosphate, another type of crop nutrient, according to the World Bank.

“As prices of fuel and fertilizer began rising this year, China’s cabinet in June authorized billions of dollars in subsidies and other support for farmers. The next month, the country’s major fertilizer producers met with the state planning agency and agreed to halt exports.”

China’s leaders have been paying much more attention to food security since the pandemic began, said Darin Friedrichs of Sitonia Consulting, an advisory firm in Shanghai that focuses on Chinese agricultural markets.

“‘They were probably ahead of the curve in realizing how much this was going to disrupt global supply chains,’ Mr. Friedrichs said. ‘And in a situation like that, it’s obviously better to err on the side of trying to have more food rather than less.'”

The Times article indicated that, “More than half of China’s urea exports this year have gone to India. The Indian government subsidizes fertilizer to keep prices low, but distributing it to growers requires coordination between national and state authorities who are often at odds for partisan and other reasons.”