The frustration in the room at Commodity Classic has been palpable following a year in 2025 where strong production was again unable to overcome swelling costs and expenses. Farmers here…

Iowa Farmland Values Up 29%

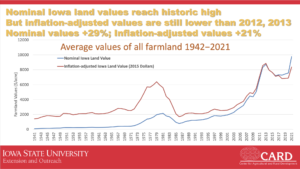

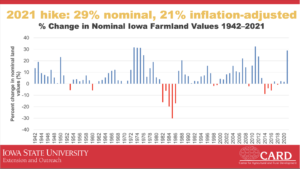

A news release Tuesday from the Center for Agricultural and Rural Development at Iowa State University and Iowa State University Extension and Outreach indicated that, “After several years of modest gains and losses, the average value of an acre of Iowa farmland skyrocketed 29% in 2021. The nominal value of an acre of farmland is now higher than at any point since Iowa State University began surveying values in 1941, and is 12% higher than the previous peak in 2013; although the current value in inflation-adjusted terms is still lower than that for 2012 and 2013.”

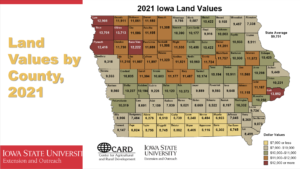

The release noted that, [Wendong Zhang, an associate professor of economics at Iowa State’s Center for Agricultural and Rural Development] leads [the] annual Land Value Survey, which found that the average statewide value of an acre of farmland is $9,751, an increase of 29%, or $2,193, since 2020. The $9,751 per acre estimate, and 29% increase in value, represents a statewide average of low-, medium-, and high-quality farmland.”

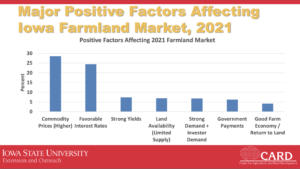

Tuesday’s update added that, “The most frequently mentioned positive factor influencing the land market was higher commodity prices. Favorable interest rates and strong yields were the second- and third- most frequently mentioned factors. Other frequently mentioned factors included limited land supply, strong demand, COVID-related government payments, and a good farm economy.

“The most frequently mentioned negative factor affecting land values was higher input costs.”

In a more detailed overview of the Survey, Dr. Zhang pointed out that, “All 99 counties reported the highest nominal land values since 1950; and, for 20 counties, the inflation-adjusted values are also record-high—even higher than the previous peak in 2013.”

“In general, the results from the 2021 Iowa State University Land Value Survey echo results from other surveys, which all showed surging farmland market trends due to higher commodity prices and low interest rates.”

The analysis of the results also pointed out that, “The majority of farmland sales, 54%, were from estate sales, followed by retired farmers at 24%. Active farmers accounted for 9% of sales, while investors accounted for 10%.”