As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Kansas City Fed: Prospects for 2021 Farm Income Remain Strong, But Input Costs Have Risen Considerably

In an update earlier this month from the Federal Reserve Bank of Kansas City, “Limited Demand for Farm Loans, But Strong Profits for Ag Banks,” Nathan Kauffman and Ty Kreitman stated that, “Agricultural lending at commercial banks continued to decline but showed some signs of stabilizing in the third quarter. According to Call Report data, farm debt decreased at the slowest pace in 2 years. Non-real estate debt declined at a substantially slower rate than recent quarters and farm real estate loans increased slightly for the first time since mid-2019. Performance on agricultural loans also continued to improve rapidly, leading to a five-year low in delinquency rates. With support from stronger loan performance and lower interest expense, profitability for farm lenders remained near historic highs.

Prospects for farm income in 2021 remained strong heading into year-end alongside continued strength in agricultural commodity markets.

“Elevated commodity prices have boosted revenues for producers and supported a swift improvement in agricultural credit conditions and a surge in farmland values. At the same time however, input costs have risen considerably in recent months, which is likely to increase credit needs and weigh on profit margins going forward.”

Kauffman and Kreitman noted that, “The balance of outstanding farm loans at commercial banks retracted further, but at a notably slower pace. Driven by a slight increase in farm real estate lending and a smaller decrease in non-real estate loans, total farm debt declined by the smallest percentage since 2019. After dropping by an average pace of about 5% in the previous four quarters, farm loans decreased by less than 2 percent from a year ago.”

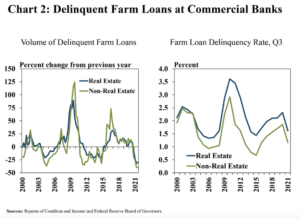

The Kansas City Fed update also pointed out that, “The volume of delinquent agricultural loans continued to decline sharply alongside improved farm finances and subdued lending activity. The volume of delinquent farm real estate and production loans continued to decline substantially, dropping by 30% and 40% from a year ago, respectively. The quick turnaround in repayment issues led to the lowest rate of delinquency on farm loans for the third quarter since 2015.”

Kauffman and Kreitman added that, “Alongside strong loan performance, the financial performance of agricultural banks remained sound. Despite continued compression of net interest margins, profitability at agricultural banks remained near record highs (Chart 4, left panel). Strong growth in assets has held down interest margins despite an increase in the amount of net interest income (Chart 4, right panel).

“Net income increased nearly 20% from a year ago, which outpaced the growth in assets and drove a strong return on assets (ROAA) and supported the ability of banks to augment capital.”