Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

WSJ: Farmers Expected to Increase Planting, But Input Costs, Weather, and Chinese Demand Bring Uncertainty

Wall Street Journal writer Kirk Maltais reported in today’s paper that, “A banner year for grain prices has U.S. farmers aiming to plant even more corn, wheat and soybeans than they did in a record 2021. But high fertilizer prices, forecasts of more wild weather and the threat that China slows its buying loom over the year ahead.

“Row crops this year soared to multiyear highs amid surging global demand and inflation, and farmers are expected to increase planting to attempt to capitalize on 2021’s momentum.

Research firm IHS Markit this month forecast that farmers will plant roughly 230 million acres of soybeans, wheat and corn in 2022, up 2 million acres from the past year’s record-busting levels.

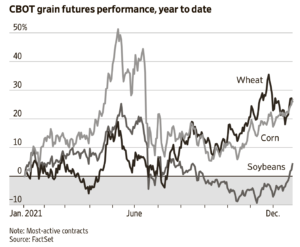

“Analysts project that grain prices in 2022 will back off, as global supplies catch up to demand. Prices have eased since reaching highs in May but remain at levels unseen in eight years. Year-to-date, corn futures trading on the Chicago Board of Trade are up 27%, and wheat futures are up 25%. Soybeans, up nearly 5% for the year, started 2021 at their highest levels since 2014.”

The Journal article noted that, “Several factors may bring more volatility to prices in 2022. Analysts and investors said geopolitics may be the biggest factor, with tensions between the U.S. and China and the buildup of Russian troops along its border with Ukraine threatening to add uncertainty to global trade.”

Mr. Maltais explained that, “China’s appetite for grains is also in question. The country’s gross domestic product is expected to slow its growth in 2022, and a real estate bubble is threatening to burst. China, the world’s leading buyer of grain exports, is forecast to import more than 135 million metric tons of corn, wheat and soybeans from around the world in the 2021/22 marketing year, the USDA says.”

Today’s Journal article added that, “The effect of the supply chain bottleneck is being especially felt with costs for fertilizer, which are up as much as triple from this time last year. Higher fertilizer prices could decrease use, reducing farm production, Fitch Solutions in a note published earlier this month.

“Strong demand and tight capacity in freight markets is also expected to persist next year, offering little hope for farmers’ input costs easing before the next planting season.”